What is bond investment?

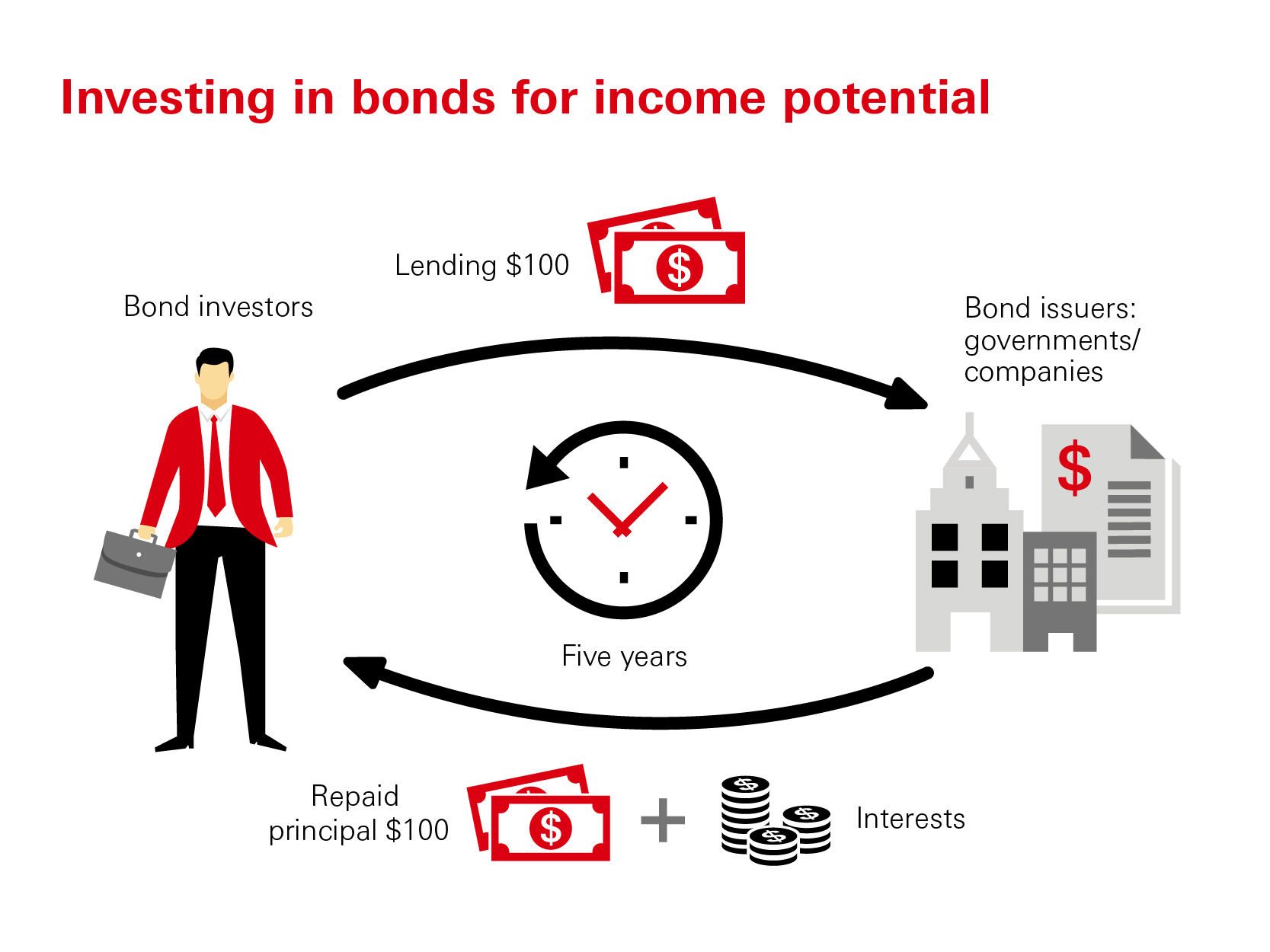

Advancing loans for regular income

Bond is a form of loans issued by governments or companies in order to raise funds. Such issuers promise to return the principal to investors (bond holders) upon an agreed date (also known as the ‘maturity date’). Before the bond is due, investors are liable to receive coupon payments regularly, which explains why bonds are also called fixed-income products.

Take a bond with a face value of USD100, coupon rate of 5 per cent and tenor of five years. Its holders can receive USD5 of coupon payment in the first four years and another USD5 plus the principal the final year. In the event of bankruptcy of the issuer, bond holders will get paid before stock investors.