Securitised Credit

Synopsis

- Collateralised Loan Obligations (CLOs) are floating rate securities, providing investors with attractive levels of income.

- CLOs are performing strongly in the current macroeconomic environment.

- Manager and Security Selection is key in this sector. We believe broadly syndicated CLOs sponsored by high-quality CLO managers offer attractive risk-adjusted returns and are our preferred investment versus mid-market loan CLOs and commercial real estate loan CLOs.

- Credit enhancement behind the senior tranches provides investors with a significant cushion against collateral losses and senior tranches are best placed to navigate any market volatility.

- Tranches allow investors to choose their level of risk, along with where they want to allocate across senior, subordinated and equity tranches.

- Demand for the asset class, as demonstrated by the strong CLO issuance during 2025, was well absorbed by the market and bodes well for the sector.

- CLOs offer a spread premium over similarly rated traditional fixed income corporates and diversification benefits given their unique cash flow profile and structure.

What is a CLO?

A CLO is a special purpose vehicle (SPV) backed by a pool of loans – typically leveraged loans that are issued to corporate entities. As of end October 2025, CLOs represent ~31% (c.USD1.2tn) of the distributed Securitised Credit market.

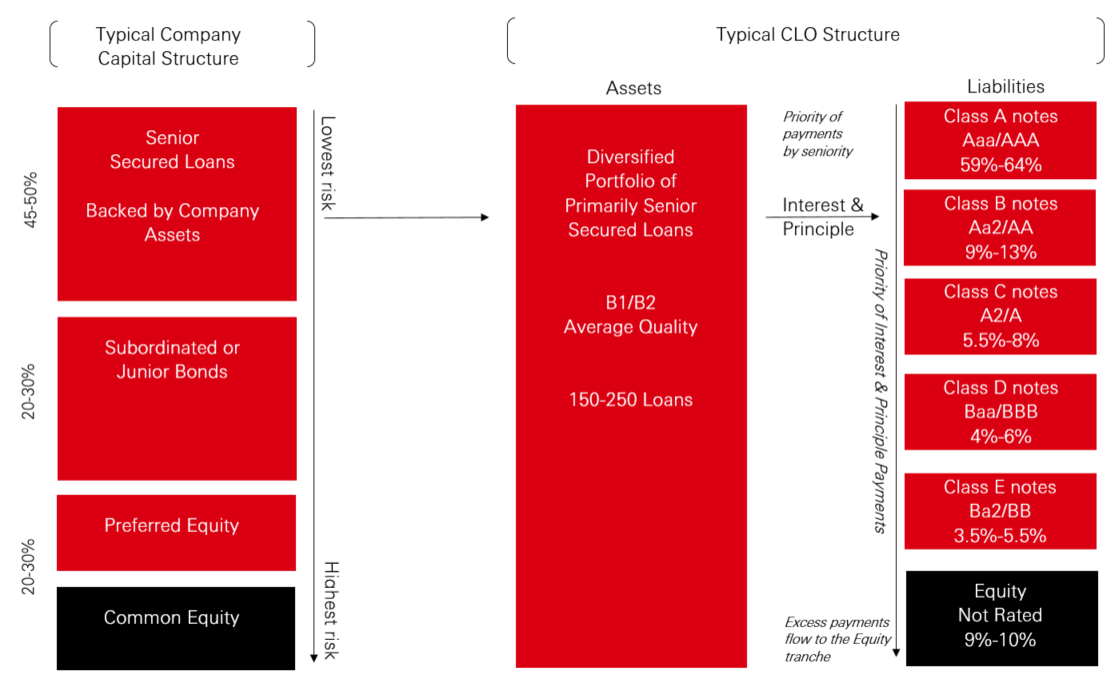

The below chart shows an illustrative structure of a CLO including the number of underlying leveraged loans to private companies, the different levels of risk comprising the CLO and the order of payments from these loans to the investors in different CLO tranches.

Typical CLO Structure

Source: HSBC Asset Management, LCD Global Review – US/Europe 2Q 2018 and LCD Loan Primer “Syndicated Loans: The Market and the Mechanics – 2017”

CLOs can offer investors diversification benefits versus equivalent rated corporate bonds due to lower correlations but also offer much more…

-

Floating rate: CLO securities pay investors a spread above a benchmark such as SOFR or EURIBOR. The spread is larger than for comparably rated corporate bonds and provide additional yield. The floating rate aspect means that elevated base rates provide attractive levels of income and, while the yield curve remains flat, significant benefit over longer duration bonds. The fact that the coupons change with rates means that this yield is paid as current running income.

-

Manager selection: Choosing the right CLO manager is fundamental to CLO investing. The CLO manager selects the different loans across various sectors that make up the CLO itself. Therefore, it is crucial that the loans selected are in the right sectors, are of high credit quality and are in full compliance with the terms/triggers and criteria of the CLO structure.

Dynamicity is also a key factor. An active CLO manager has the ability to spot warning signs in individual loans and sectors early and move the portfolio to lower risk sectors. Extracting the best opportunities allows the CLO manager to enrich risk-adjusted returns for investors.

It is our opinion that top tier institutional quality CLO managers are more likely to achieve this by selecting a diversified portfolio of high-quality loans across market sectors.

-

Tranches: Tranches create a capital structure within the CLO, allowing investors to allocate based upon their risk appetite across senior, subordinated and equity securities. Senior tranches receive principal and interest payments from the CLO first with subordinated and equity tranches receiving their payments only once the senior tranche above them has been paid. The lower tranches are also the first to absorb any losses realised within the structure.

-

Credit enhancement: The structural features of credit enhancement may provide an extra layer of protection in addition to the underlying collateral security before investors begin to suffer losses. Credit enhancement at the top tranches of the securitisation are higher now than in previous cycles. These include cash reserve funds, overcollateralisation (where the value of collateral exceeds the loan value) and excess spread (amount paid by CLO loan holders exceeds amount paid to investors).

-

Risk retention: Regulatory changes have symbiotically aligned issuer and investor interests in the CLO market, providing further protection to CLO investors. EU Risk Retention regulation forces CLO managers distributing in Europe to retain 5% of the securitisation on the CLO manager balance sheet (skin in the game).

-

Prudent management: Typically, the CLO managers take exposure to the lowest quality equity tranche of a securitisation and are restricted to a maximum of 7.5% allocation to CCC rated debt, further incentivising prudent management of the underlying assets.

Source: HSBC Asset Management, 31 October 2025. Diversification does not ensure a profit or protect against loss.

Size matters

When it comes to the CLO sector, size matters with regards to the corporates backing the loans, the CLO manager, and the syndication of the CLOs.

- Corporates: Typically, the underlying assets in CLOs we invest in are mostly Senior Secured/First Lien corporate loans (this means the CLO manager has a priority claim on the secured assets in event of a bankruptcy). These loans are all from established corporates that typically have an EBITDA greater than USD200mn. A CLO holds between 150–250 corporate loans.

- Type of CLO manager: As mentioned above, repeat-issue, top tier institutional quality CLO managers with experience in the market are most likely to outperform. Given this, it should come as no surprise that we utilise our enhanced due diligence procedure and our team’s length of time in the market to select the better performing managers. With roughly 150 CLO managers in the US CLO market, we only invest with a small selection of managers that we believe can unlock the opportunities and navigate the pitfalls in this asset class.

-

Broadly syndicated loans: CLOs at a broader level can be segregated into different types based on the underlying loan collateral. The main types are broadly syndicated loans (i.e. big loans to big companies, with many large institutions as investors behind the loan), smaller mid-market leveraged loans and commercial real estate (CRE) CLOs.

We only invest in CLOs backed by broadly syndicated loans and therefore avoid the higher credit risk associated with smaller mid-market firms and nuances involved with commercial real estate CLOs. Indeed, mid-market and CRE CLOs are already showing signs of distress. The size of the broadly syndicated loans market also facilitates sectoral diversity within the CLO portfolio, which we believe makes it the most attractive segment.

Selecting a manager with the right credit resources to make the best loan selection and manage the loan portfolio during the term of the CLO is critical: when interest rates are high (attractive coupons for investors), defaults and loan loss in the CLO might tick up because the high borrowing costs for the underlying companies.

Loan defaults are down year-to-date in both the US and Europe and are 1.53% and 0.91% respectively as of end September. Along-side our allocation to higher rated tranches (i.e. senior securities), our approach to CLO investing seems well suited to manage any potential increases in defaults as well as any possible credit deterioration within the underlying CLO collateral.

Source: HSBC Asset Management, 31 October 2025.

Why has 2025 been an important year for CLOs and what can we expect 2026 to bring?

Resilient economic data and inflation proving harder to tame for most of 2025 has delayed the Fed delivering rate cuts until recently, one in September and one in October. This has been supportive for floating rate CLOs which continue to offer attractive income from coupons.

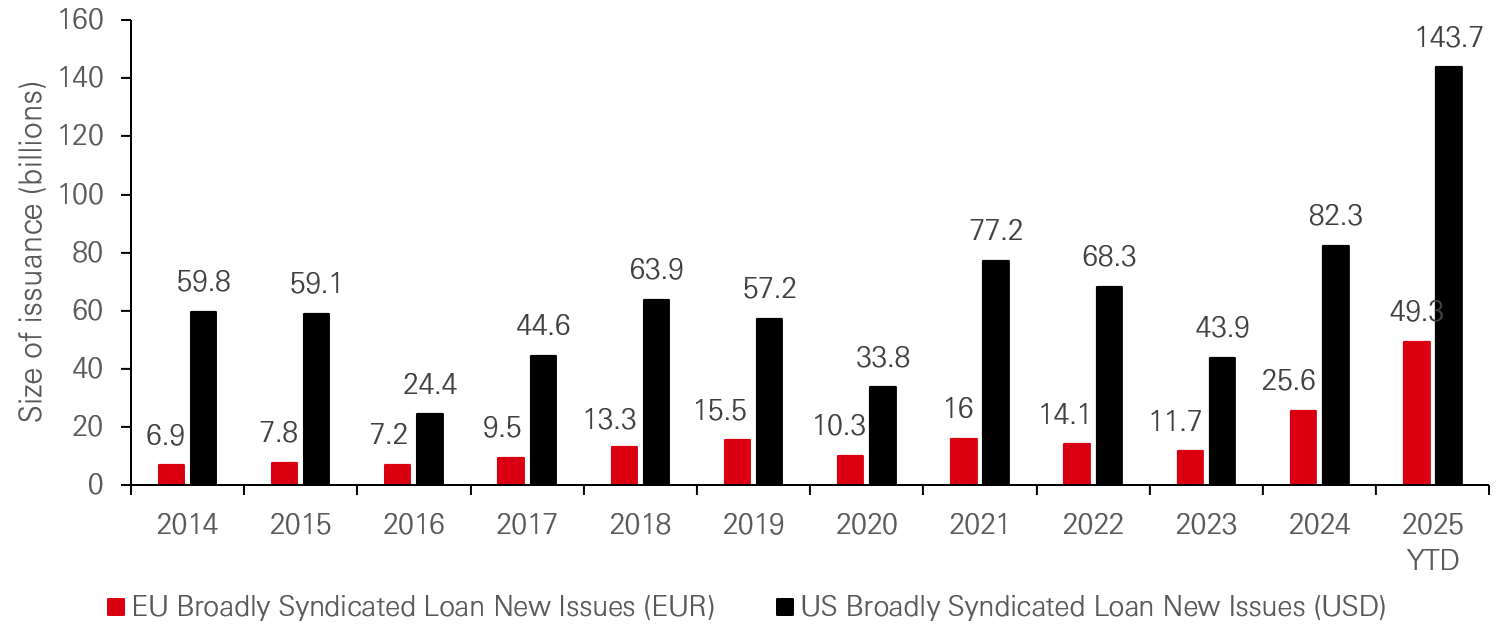

Demand for CLOs, given the market backdrop, has been sizeable and has been met with high levels of issuance. As can be seen below, 2025 Issuance has significantly outstripped historical issuance, with September reaching USD169.9bn of broadly syndicated CLO paper issuance. Demand has been outstripping supply for high quality loans.

This market demand is expected to remain strong, continuing into 2026, with institutional clients and investment banks continuing to make up the lion share of investment.

Broadly syndicated CLO loan issuance has soared to 10+ year highs

Source: HSBC Asset Management, Barclays as at 31 October 2025. The views expressed above were held at the time of preparation and are subject to change without notice. Past performance does not predict future returns.

Despite October’s news headlines of high-profile bankruptcies, we are not seeing any signs of systemic risk. Although the default rate of leveraged loans has ticked up from historically low levels in 2021, it remains well below the long run average of around 3% p.a. (as of September 2025, it was 1.53% in the US and 0.91% in Europe). Even if default rates were to increase to longer term averages, this is far from a concern, given that we continue to invest solely in broadly syndicated CLOs, with a strong focus on institutional quality, repeat-issue CLO managers (we only invest with the top 15 out of 150 managers).

As long as inflation data allows it, we would expect the Fed to continue with further interest rate cuts into and throughout 2026. Given that CLOs are floating rate instruments, this would mean a reduction in the coupon payments. However, there are four points to note that suggest returns for CLOs remain attractive even with forecasted interest rate cuts:

- CLO securities will still generate high levels of income even as interest rates are lowered to more neutral levels; it is unlikely we are going back to the “lower for longer” environment of the past decade.

- Inflation remains a lingering concern and if it remains sticky, central banks will most likely have to pause interest rate cuts, meaning that income from CLOs would remain higher.

- Spreads on CLOs will always be higher than traditional corporates due to the complexity premiums on offer when evaluating pools of loans. These provide opportunities for investors to source high quality CLOs whilst earning a spread premium.

- Falling interest rates, including the recent Fed rate cuts, could mean spread tightening in the sector, due to improved corporate fundamentals, especially with the diversified corporates which make up the high-quality CLOs we invest in.

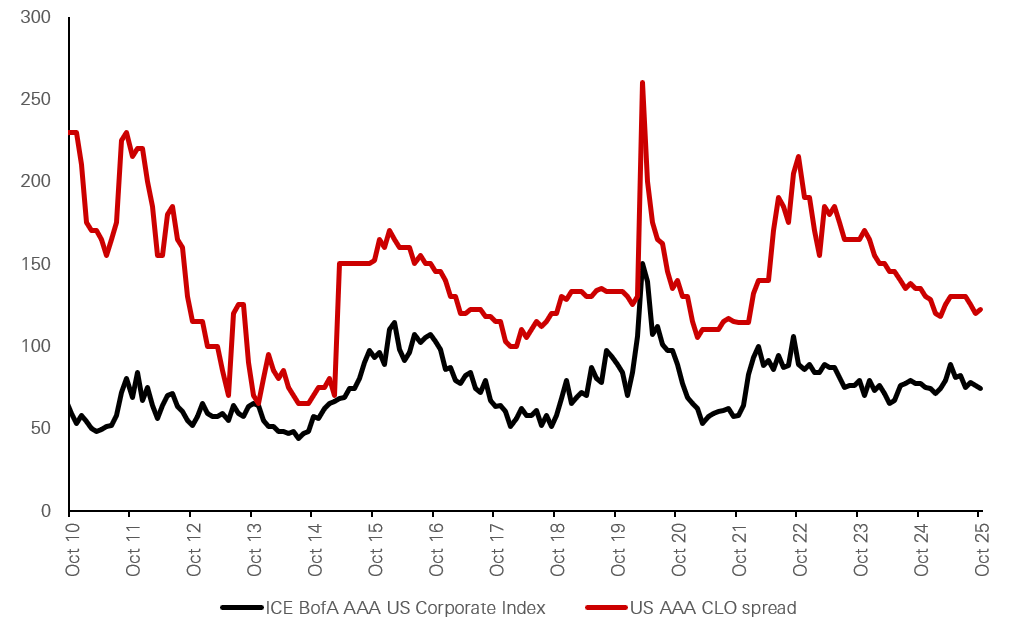

When we look at CLO spreads, they remain wide of their historic tights. The same cannot be said for traditional corporates which continue to test record tights.

What’s more is that CLOs will always provide a spread pick-up when compared to equivalent rated corporate bonds (which are at historical spread tights). One can argue from an asset allocation perspective that high quality CLOs are more attractive than high quality corporate bonds at this point in the cycle.

In fact, as can be seen below, in all instances within the below chart, AAA US CLOs offer a wider spread than AAA US corporate bonds, highlighting their attractiveness.

CLO spreads offer real premiums and can tighten further

Source: Bloomberg, JP Morgan, HSBC Asset Management, as at 31 October 2025.

Conclusion

CLOs continue to be an attractive proposition, and we believe they should be front and centre in the minds of institutional investors in this new paradigm of neutral interest rates. There is a yield pick up on offer as a result of interest rates remaining high, low correlations to traditional fixed income corporates given its unique cash flow profile and the opportunity for further returns through spread compression. However, extracting the returns and diversification benefits will hinge on manager selection which is of paramount importance. There is strong demand for the asset class as evidenced by the record levels of issuance and one could arguably have to look far and wide for a worthy alternative.

Important Information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

This document provides a high level overview of the recent economic environment. It is for marketing purposes and does not constitute investment research, investment advice nor a recommendation to any reader of this content to buy or sell investments. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.