Securitised Credit: Why a global dynamic approach can offer better value than European only

Key points

- Opportunities in Securitised Credit change regularly, so we invest dynamically in all major Securitised Credit sectors, and do so on a global basis

- This allows us to allocate to where we see the best opportunities across geographies and sectors, maximise relative value across markets and move seamlessly to where we believe the best opportunities lie

- We believe Securitised Credit investors focusing on European markets could benefit from dynamically allocating across multiple regions, specifically by including the largest market in the US

- We consider that the US market can provide better value and more attractive opportunities compared to European investments only

- Additionally, the Australian Residential Mortgage Backed Securities (RMBS) market has historically been and remains attractive on a risk-adjusted value basis, having the ability to attract a broad range of investment opportunities

- Adding US and Australian exposure to a concentrated European portfolio, would improve overall diversification and build performance resilience in the portfolio, which would result in more stable and consistent returns over time

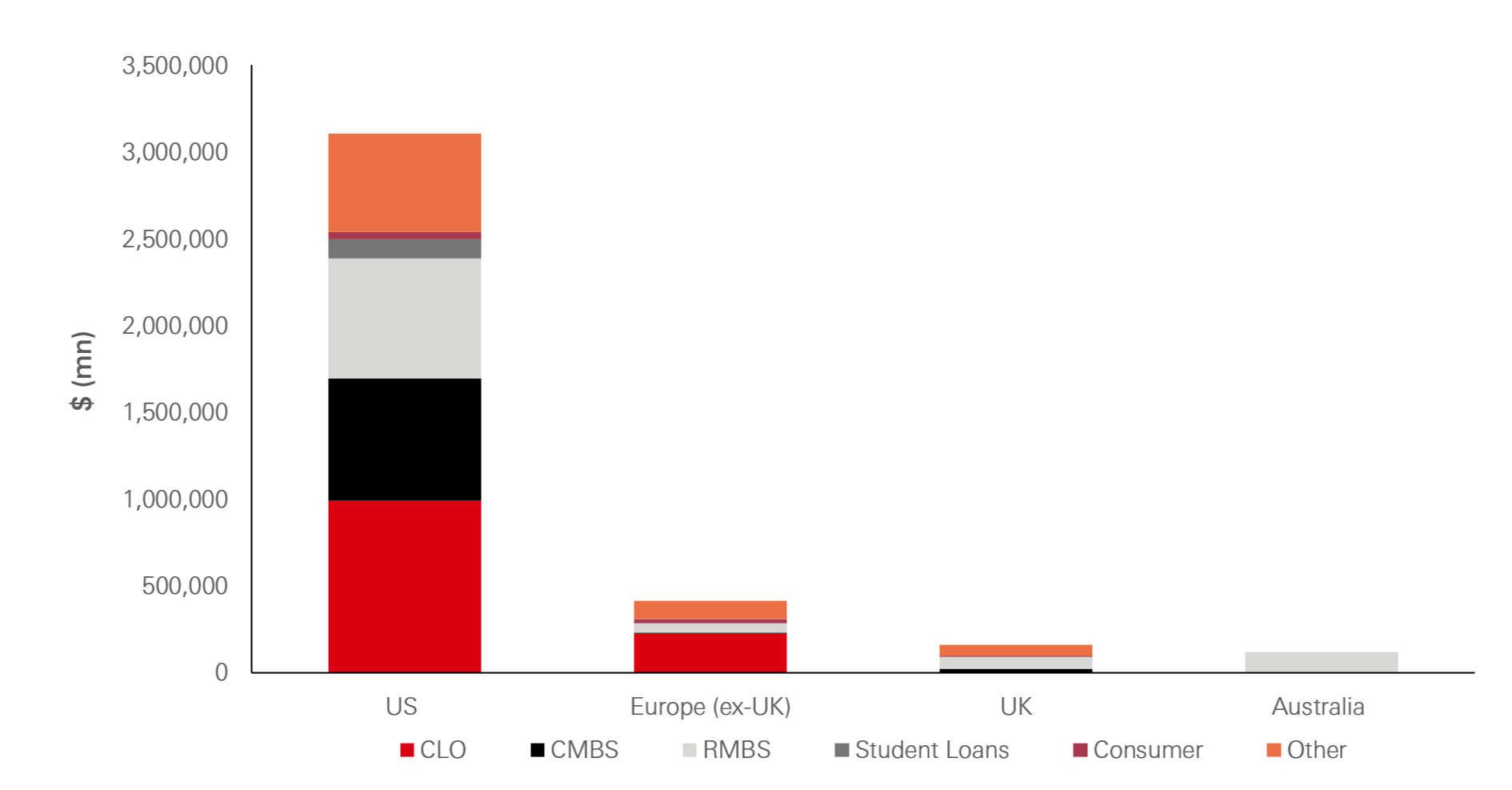

The size of the US market overshadows Europe and others

- The global Securitised Credit (distributed) market size is estimated to be USD3.8tn

- The US and Australia account for around 85 per cent of the distributed market, while Europe and the UK account for approximately 15 per cent

- The US market is more diversified than Europe with all segments having a significant weight and typically offering better liquidity

Source: HSBC Asset Management; AFME, SIFMA (data updated in March 2025 using latest available SIFMA data as at 28 February 2025); Australian Statistics Bureau; Reserve Bank of Australia and JPMorgan.

Main benefits of allocating to the US

- Improved diversification as the US comprises around 70 per cent of the global distributed securitised market (excluding China – whose market is mostly closed to international investors)

- Access to attractive US only segments such as Single Family Rentals (SFRs) and Credit Risk Transfers (CRTs)

- The US market is often seen to have more attractive valuations compared to Europe due to the European Central banks market intervention that reduces supply and has artificially depressed spreads on much of the market

Investment areas where we prefer global markets relative to Europe only

Residential Mortgage Backed Securities (RMBS)

- We prefer certain areas of the US versus the European market. In particular, we consider SFRs and CRTs to be attractive

- This sector remains attractively priced, with good credit enhancement. SFRs provide a diversified exposure to professionally managed pools of high quality homes that are likely to provide stable income, low default rates and high levels of occupancy

- Additionally, CRTs allow investors the opportunity to get paid a floating-rate coupon in exchange for selling credit protection on agency mortgage loans

- In contrast, European RMBS is typically too expensive given the risk. We would also highlight that UK RMBS remains attractive. This sector has some of the best protection in Securitised Credit, both in terms of liquidity and credit enhancement

- Equally, Australian RMBS offers attractive spreads, the asset class performed well in the last crisis and underlying mortgage quality has improved. This space offers a broad range of investment opportunities, due to issuance by large banks and active specialist lenders, which bring a steady flow of Prime and Non-Conforming RMBS deals to our portfolios

Commercial Mortgage-Backed Securities (CMBS)

- The investment case is very asset specific while fundamentals remain acceptable subject to post COVID-19 issues / direct impact

- Overall we are more positive about US versus European assets

- Importantly, we like certain areas of the US market such as single asset or single borrower (SASB) CMBS, where we are confident about the tenant, property and borrower quality and where we can avoid secondary assets and poorly performing sectors such as Retail and Hotels

- Additionally, two areas of SASB Office CMBS offer attractive investment opportunities. These are Life Sciences (requires the use of laboratory spaces and experimentation) and Data Centres (in the ever increasing digital world we are in, the storing and utilisaiton of data is crucial)

- While traditional retail has gone out of vogue and technology continues to advance, the right kind of retail such as grocery-led out of town supermarket complexes (next to retail stores) continues to see strong demand

- As retail goods are ordered online, they need to be delivered to the end consumer. Industrial warehouses which store these goods and last mile distribution/logistics CMBS is a key area that has directly benefitted

- In Europe, fundamentals are largely solid away from Retail and Hotel sectors

Collateralised Loan Obligations (CLOs):

- In the US, spreads offer significant value especially for well managed deals once extent of loan losses becomes clear. We avoid CLOs with exposure to middle-market loans

- In Europe, significant price dislocation provides recovery opportunity while we also avoid CLOs with exposure to middle-market loans

- Typically, we have preferred the US, as this market is more mature, and hence offers better liquidity and underlying loan issuer diversification

Regulation: what is the impact on investment opportunities?

Investors in Securitised Credit based in Europe most often have to comply with the EU securitisation regulations.

- There are two main issues related to investing outside of the EU:

- the risk retention must comply with the EU version (the US regulations are different)

- from 2019, EU investors must invest in assets that comply with the EU securitisation reporting standards (note that the reporting templates remain open to some interpretation)

How we approach this regulation within our Securitised Credit funds

Our Luxembourg UCITS strategies have managed around this, such that the impact is reduced.

- For CMBS, our strategy has been to invest in Single Asset, Single Borrower (SASB) CMBS to avoid exposure to Retail and Hotel sectors

- These deals are most likely to have EU risk retention and are easiest to comply with EU reporting. We have had success persuading issuers to meet these rules

- Clearly, there are some CMBS, which fail to meet the EU risk retention, or where the issuers will not produce reporting in the correct format, but we find that we are still able to create a rounded portfolio in the US that complies with EU requirements

- In terms of CLOs, we invest with institutional backed managers, who have a platform that they are keen to promote

- This leads to a higher likelihood that they will issue EU risk retention compliant deals

- We have also been able to convince select CLO managers to report in a format that will meet the EU requirements sufficiently

- Outside of a fund structure and on a segregated basis, where the mandate does not need to comply with EU securitisation regulations (risk retention and reporting), this will broaden the scope to CLO and CMBS which do not comply. However, our strategy to invest in SASB CMBS of the correct property type and institutional quality managed broadly syndicated CLOs would not change

Conclusion

Securitised Credit investors focused on European markets, would benefit from incorporating US (and other global markets) exposure to their Securitised Credit allocation for the following key reasons:

- Potentially better portfolio diversification and access to a deeper, more liquid global market

- Access to attractive US only Securitised Credit areas, unavailable in Europe such as SFRs, CRTs and Australian RMBS

- Dynamic allocation between the regions can improve the consistency of long-term returns

- Access to the global allocation experience of a well-resourced and stable team

- The team move seamlessly to where they believe the best global opportunities lie