Rethinking Liquidity Risk Management and the Investment of Cash in a Pension Fund

KEY TAKEAWAYS

- Pressure on LDI strategies in 2022 is a prompt to review and rethink cash investment approaches.

- Money Market Funds with high levels of investor concentration from individual clients, strategies, or sectors can be more challenging to manage.

- Sterling money markets can at times have supply and demand imbalances which for any investor, including Money Market Funds, needs careful management.

- We are encouraging pension investors to;

- Focus on diversification for any form of cash investment

- Understand the levels of investor concentration that exist in your cash strategy

- Consider using more than one Money Market Fund to add diversification or reduce potential risks from high investor concentration

- Review the process for how cash is invested

- Evaluate sustainably invested cash options that can be proven to achieve credible outcomes

- Consider other cash options including tailored investment mandates

Introduction

The frequency of market and economic events impacting the money markets has increased since the Global Financial Crisis, and what was perhaps a once in a decade (or even a once in generation) event now seems to occur with much greater regularity. In recent years this has included the initial onset of the COVID-19 pandemic in 2020 and the resulting demand-driven shock to markets around the world, the invasion of Ukraine in March 2022, and in the UK the volatile market reaction to the short-lived “mini-budget” in September 2022. Even more recently, the collapse of Silicon Valley Bank in the US and the sudden takeovers of First Republic Bank and Credit Suisse, as well as the sudden takeovers of Credit Suisse by UBS in March and April 2023 are reminders of how fragile sentiment can be. As well as being more frequent, each crisis can stimulate ever greater sensitivities to risks in all corners of the market, which can amplify this fragility – it’s never been truer to say that markets are all about confidence, after all.

These types of events can have a direct impact on the money markets, whether that is driving investors on the demand side to have urgent cash calls, or conversely to hold higher levels of cash as a buffer, or whether it is driving market sentiment towards issuers and counterparties. In this paper we will focus in particular on the impact of the 2022 UK mini-budget for Sterling cash investments and Liability Driven Investment (LDI) strategies where money market funds (MMFs) are widely used, but with reference to broader markets and considerations for liquidity risk management that apply in many other areas.

Sterling market volatility creating LDI cash challenges

The UK Government’s mini budget on 23rd September 2022 and the resulting Sterling market volatility threw a spotlight on how cash is managed within LDI programs. This included:

- A steep increase in the Sterling yield curve impacting the mark-to-market valuations of longer-dated money market securities

- Margin calls within LDI programs initially leading to large cash-calls, including significant redemptions from a number of MMFs affiliated with LDI programs

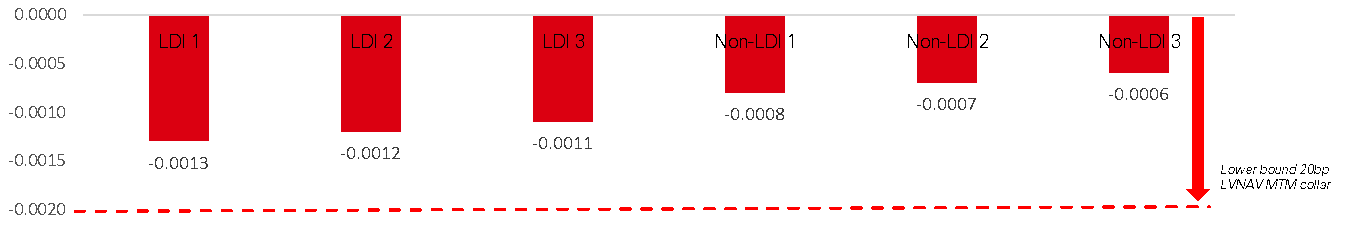

In practical terms, this led to these LDI-affiliated MMFs witnessing downward pressure on mark-to market Net Asset Values (NAVs), moving in some cases close to the lower end of the 20bp regulatory collar for “Low Volatility NAV” MMFs in Europe (which represent the majority of the Sterling MMF industry). The consequence of a MTM NAV moving outside of the collar is the fund can no longer retain a stable dealing NAV and moves to being a Variable NAV fund.*

*Short-Term LVNAV MMFs under EU regulations are permitted to operate with a constant £1 dealing NAV, as long as the mark-to-market NAV remains within a 20bp collar either side of £1, in other words between 0.9980 and 1.0020. The consequence of a MTM NAV moving outside of this collar is that the fund must allow the dealing NAV to float and fully reflect market valuations, and effectively become a Variable NAV fund.

There was significant flow volatility from these affiliated MMFs in a short period of time, as the cash needs and positions were adjusted within the LDI programs – this resulted in generally much higher levels of daily outflows (and subsequent inflows) in LDI MMFs than for many non-LDI MMFs.

The following observations are the result of analysis of 3 large LDI-affiliated and 3 non-LDI affiliated Sterling LVNAV MMFs.

We present anonymized data from 23rd September to 21st October 2022. Whilst this is not intended to provide analysis of the full Sterling MMF universe, it is designed to illustrate some of the impacts on a select number of funds for comparative purposes. The non-LDI funds are selected as being amongst the largest funds that we believe have no or limited LDI cash. We also excluded those we believe are largely aligned to insurance or internal assets as this can also be a driver at times of large flow dynamics.

Observation 1: LDI-affiliated Sterling MMFs saw notably higher mark-to-market NAV movements vs the 20bp regulatory collar

Source: HSBC Asset Management, iMoneyNet, Crane Data, Bloomberg, asset managers’ public websites, 21st October 2022. Sterling Short-Term LVNAV MMFs only.

The LDI-affiliated MMFs in this analysis demonstrated greater downward pressure on their mark-to-market (MTM) NAVs than the other MMFs in the analysis. Mark-to-market NAVs can move for a variety of reasons including fund flows, movements in credit spreads, or movements in the yield curve (as in September 2022); it is normal for them to be above or below par, which is how European MMF regulations are designed. However, the levels witnessed here were low by historic levels. The steep and rapid increase in the Sterling yield curve impacted all MTM NAVs. Although it is important to point out that all LVNAV MMFs, including those held within LDI programs, maintained NAVs within the 20bp lower bound regulatory collar, as they have done since LVNAV funds were first introduced. Nonetheless MMFs affiliated to large LDI or insurance programs which suffered large outflows were generally among the most impacted.

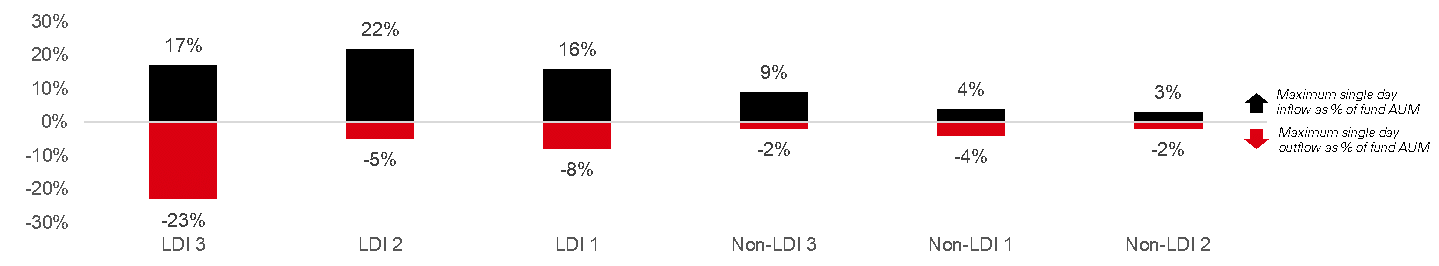

Observation 2: LDI-affiliated Sterling MMFs also saw notably higher levels of flow volatility during this period

Source: HSBC Asset Management, iMoneyNet, Crane Data, Bloomberg, asset managers’ public websites, 21st October 2022. Sterling Short-Term LVNAV MMFs only.

The impact on the assets under management of these LDI-affiliated MMFs developed in two waves;

- Firstly, there were high levels of outflows in a short period of time, as LDI strategies had large margin calls due to the dramatic rise in the Sterling yield curve . The largest outflow we observed in a single day from an LDI-affiliated MMF was a 23% drop – this is a considerable change in AUM on one day that would require careful handling by the investment manager.

- Subsequently there were high levels of inflows in a short period of time as positions were rebalanced. The largest inflow we observed in a single day was 22%, which would also require careful management.

In the case of the large size of sudden outflows and inflows, these were considerably more significant than the flows seen in the non LDI-affiliated funds in our analysis; in general these had relatively normal levels of flows at the time and were not impacted in the same way, as can be seen clearly in the chart.

We believe this serves as an example of the risks of a MMF having a high level of investor concentration. Whilst specific to LDI in our analysis, it is a broader issue that can exist whether that is over-concentration from an individual client or at a sector level (including large internal or captive investors).

Potential for supply and demand imbalances in Sterling money markets

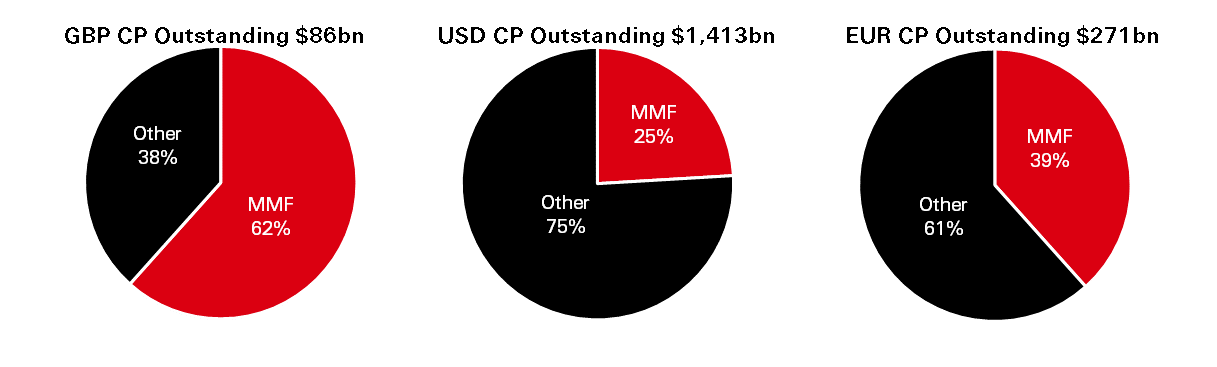

There can be a mismatch in supply and demand for short-dated Sterling money market securities, with a large direct and indirect investor base looking for assets (across pensions, insurance and other institutional investors, as well as money market funds). Whilst no official data exists on total supply across money market instruments, we have looked at a sample of publicly available Commercial Paper data to illustrate the relative scale of MMFs in purchasing Sterling securities vs US Dollar and Euro. This data was collated in October 2022.

Observation 3: MMFs are the most significant investors in Sterling money market securities

Source: HSBC Asset Management, Bank for International Settlements, Bank of England, European Central Bank, CMD Portal, Crane Data, iMoneyNet, ICI, as at end October 2022. Used for illustrative purposes only, not all source data is comprehensive. CP outstanding refers to A1/P1 paper with maximum maturity of 397 days (where possible to calculate). MMF holdings refers to EU Short-Term “Prime” MMFs, US onshore “Prime” MMFs, and select EUR Standard MMFs that are distributed internationally.

We can see from this analysis that MMFs are dominant investors in Sterling money market securities, holding a much larger proportion of outstanding paper (>60% in our analysis) when compared to USD and EUR markets. In turn, this dominance could lead to periods where Sterling markets are less liquid than USD or EUR. It is worth noting that, whilst not part of our analysis, there is also limited supply of Sterling Government securities such as short-dated UK T-Bills when compared to EUR and especially compared to the significant scale of T-Bills in USD.

We believe there can be additional challenges managing Sterling MMFs that are especially large and that have concentrated and sometimes captive investors or investor types (e.g. LDI or insurance cash), given this potential for relative illiquidity in Sterling money markets.

The importance of Liquidity Risk Management in MMFs

With the risks of having too high levels of client concentration as well as a supply and demand imbalance as discussed in the last sections, MMF managers need to pay close attention to Liquidity risk management policies and tools. This is appropriate for all MMF currencies but has even greater importance for Sterling MMFs given these dynamics.

A robust approach to liquidity risk management covers both the liquidity of the assets of the fund and the make-up of the investor base of the fund. By way of example, our approach includes the following focus areas;

Investors in MMFs should understand and scrutinise their individual managers’ approach to these areas; not all funds manage these risks in the same way. At HSBC we manage our funds’ liabilities by looking at individual shareholders and shareholder types, including setting a target maximum individual shareholder concentration of 5% and this is managed by the portfolio management team rather than the sales team, to avoid any conflict of interest.

And the importance of diversifying your investments

A factor that is distinct, whilst related to, liquidity risk management is the importance of diversification in an investment portfolio, and this is true of cash investment as an asset class. Diversification helps to manage risk by spreading investments across a number of issuers and counterparties, and the resulting impact if one of those counterparties gets into difficulty. An investment vehicle such as a MMF typically has diversification at its heart, and is the very counterpoint of “putting all your eggs in one basket”. Our MMFs, by way of illustration, might typically hold securities from as many as 50 or 60 different issuers.

We have always trumpeted the importance of diversification, but recent crises including the failure of Silicon Valley Bank in March 2023, have served as further real-life examples of the potential consequences of not being sufficiently diversified. For some investors this has been a timely reminder of the risks and a wake-up call to revisit their current investment policies and approaches.

For a pension fund it is also worth considering diversification across MMFs themselves, noting that different MMF managers have different approaches and drivers when it comes to investment policies and liquidity risk management. As noted earlier, MMFs with a high concentration of single investor types and/or captive clients can be potentially impacted when those clients need their cash at the same time. Many LDI programs would typically use a default MMF (often the in-house option) , and we believe there could be benefits in using more than that default option.

The growing importance of managing ESG risks for Pension investors

In this paper we have considered the impact of market events on cash investments for pension schemes, and highlighted some of the questions this raises for liquidity risk management and diversification. Whilst not a factor in these recent market events, it is also relevant to reference the growing importance of managing ESG risks for professional investors including pension funds. When it comes to cash investing, it can be a challenge to navigate to an approach that truly meets an investor’s broader sustainability objectives. There has been rapid growth in new solutions that are marketed as “sustainable” to meet an increased demand from investors, meaning it is important to evaluate that there is a material difference between these and pre-existing solutions.

Therein lies a risk in relying solely on the sustainability label of a solution (e.g. calling a fund “ESG”) as well as the risk of overreliance on which Article under SFDR the manager chooses to follow . Just as we encourage investors to look beyond MMF ratings to understand a manager’s investment philosophy and investment process, so too we encourage investors to undertake full due-diligence on a manager’s approach to sustainable investing – we always say “look under the bonnet”.

For a MMF to be credible in helping to meet your sustainability objectives, it should thoroughly apply ESG to its investment process;

- We argue that an ESG MMF should go far beyond simply evaluating ESG performance in the credit process (otherwise known as “ESG Integration”) - something that at HSBC is applied across all asset classes as a baseline and is not in itself sufficient for a fund to be considered sustainably invested.

- We also argue that an ESG MMF should go beyond sector screening, which removes issuers from the investable universe based on controversial activities or the sectors in which they operate. Whilst this may sound compelling, for a MMF it has little meaningful impact in the investable universe where the majority of issuers are typically financial institutions, sovereigns and government agencies. There are a vanishingly small number of issuers from industries typically excluded by these screens (nuclear arms production or thermal coal production, for instance).

We apply the above approaches as a baseline to our MMFs. For a MMF to be labelled “ESG” we believe they should go materially further; in the case of HSBC we follow a Best-in-Class strategy to ESG investing with a process that incorporates ESG factors and identifies the highest scoring ESG performers in the money market universe. The worst performing issuers across these factors are excluded from our investable universe, eliminating a significant proportion. Alongside this, we run a formal engagement strategy with issuers both within and outside of our investable universe that is focused on climate change and is designed to address factors relevant for banks which dominate issuance in the money markets globally. These criteria together result in the inclusion of issuers that are considered better equipped to manage ESG risks.

Conclusion: a checklist for rethinking cash investing in a pension fund

In this paper we have used the market disruption following the UK mini-budget in 2022 as a focus for our analysis, although we note that the observations also apply more broadly to illustrate some of the risks and challenges that exist for all cash investors. In our conclusion, we offer up a checklist of areas that pension funds and their Trustees could consider, and which we believe can help ensure cash investment policies and processes are as robust as possible;

- Diversification is paramount; it has always been critical to diversify cash but recent market events serve as a timely reminder to ensure this is applied universally and robustly.

- Consider using more than one MMF; for LDI programs the default or incumbent cash option may have a high level of concentration from other pension schemes which can put pressure on the MMF if there are large outflows at the same time.

- Expanding the number of MMFs used, including those with less concentration risk from LDI or other captive cash, supports diversification.

- Look at the process for how cash is invested; subscriptions to and redemptions from MMFs are easily instructed, even if outside of a default LDI option

- cash managers can place trades directly

- in many cases custodians have solutions to sweep cash from custody accounts to and from different MMFs.

- Consider non-Sterling MMFs; if there is risk appetite to hedge, to reduce exposure to Sterling volatility and potential illiquidity.

- Review sustainably invested options for cash; credible ESG-specific MMFs or mandates to support a broader approach to sustainable investing

- Consider other investment options; consider tailored investment mandates;

- can precisely match the investment restrictions and requirements of the pension fund (including ESG investment criteria).

- could include non-GBP currencies, if there is risk appetite to hedge, to reduce reliance on GBP liquidity

- reduces reliance on MMFs, and not directly impacted by the flows of other investors in the way a pooled fund is.

HSBC is well positioned to support any of these alternatives;

- One of the largest AAA-rated MMF providers in Europe with pooled funds and mandates in Sterling and a variety of currencies.

- We have a robust and clear investment process and philosophy, including policies targeting a maximum typical client concentration level of 5% of fund AUM which we believe is especially important in Sterling with the challenging dynamics in play.

- We have a very diversified investors base with no large internal investor, or large insurance or LDI programs that dominate our funds.

- We also offer ESG-specific MMFs and mandates which go beyond ESG integration and invest in issuers that we have identified as being demonstrably better at addressing ESG risks than other issuers in the investable universe.