Investment Weekly

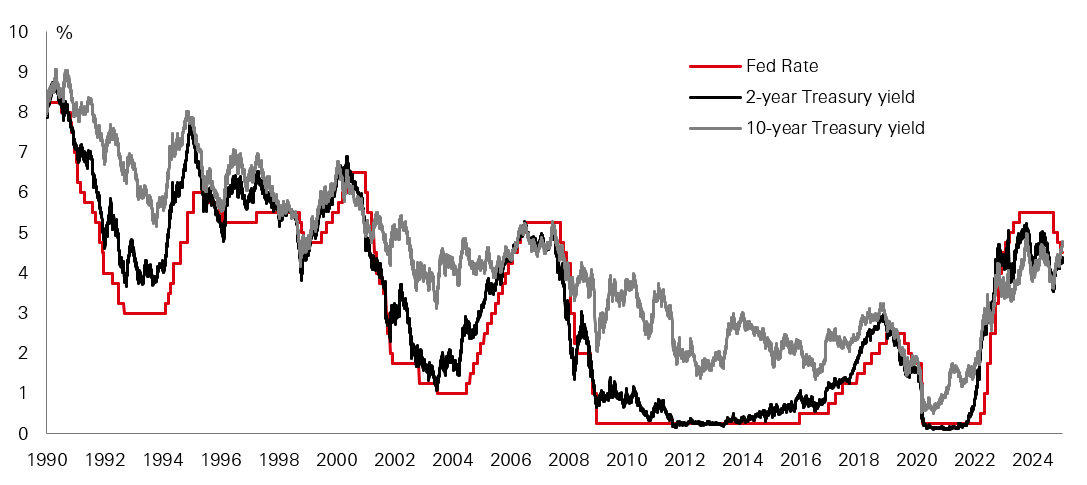

Chart of the week – Reverse conundrum

With developed market government bonds losing significant ground in recent months, central bank policymakers face the potential of a “reverse conundrum”. Unlike the conundrum of stubbornly-low long bond yields in the face of multiple Fed hikes in the mid-2000s, today’s “reverse conundrum” is this process flipped around… despite Fed cuts, bond yields are on the rise. Could this signal a new economic and market regime – and what would that mean for investors?

More from this week:

Market Spotlight

- Opportunities in European listed real estate

Lens on…

- Credit quality

- US momentum

- Brazilian headwinds