Frontier Markets

Key takeaways

- Frontier Markets have large, young populations and low labour costs, representing significant potential for growth in productivity and output

- Supply chain diversification has created opportunities for integration into global supply chains and export markets, demonstrated by a move of manufacturing hubs into Frontier Markets

- Frontier Markets have become more business-friendly through easing regulations and barriers to trade, opening up economic opportunities

- Digitisation is spurring integration of the informal economy within Frontier countries, leading to greater financial inclusion and efficiency

What are Frontier Markets?

Despite including some of the world's most populous and fastest growing economies, Frontier Markets remain relatively under-researched, undervalued, and under-owned. We believe that they offer an array of attributes in which some investors may see emerging opportunity.

So, what are Frontier Markets?

Frontier Markets are typically countries at earlier stages of capital markets maturity. The term originated from the International Finance Corporation (IFC) as a designation for smaller, less liquid emerging markets back in 1992, with Vietnam, Egypt, and Romania being a few present-day examples. Some wealthy countries are also considered Frontier due to their smaller size and/or trading restrictions, such as Iceland and countries within the Gulf Cooperation Council (GCC).

Global index provider, MSCI, defines Frontier Markets as equity markets not included in the MSCI Emerging Markets Index, that:

- demonstrate a relative openness to and accessibility for foreign investors;

- are generally not considered part of the developed markets universe;

- and are not undergoing a period of extreme economic (e.g., hyperinflation) or political instability (e.g., civil war)

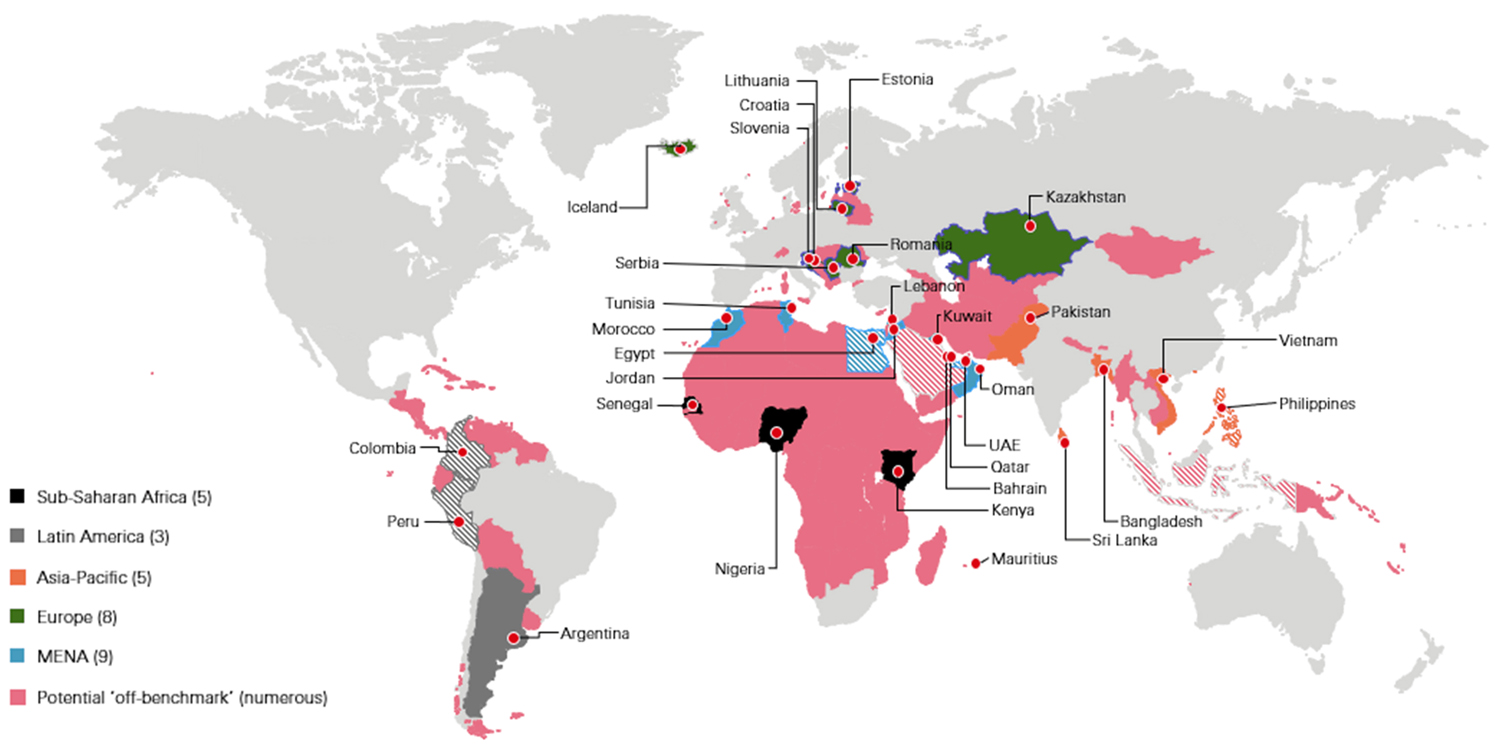

At HSBC Asset Management, we characterise Frontier Markets using a custom reference index which currently includes the 30 countries illustrated below. However, we also consider numerous "off-benchmark" geographies alongside 9 countries which we refer to as "crossover countries" – these are emerging markets small enough to be often excluded by emerging market fund managers and sometimes exhibiting Frontier-like characteristics.

Nine "crossover countries" highlighted with a crosshatch include: Colombia, Egypt, Kuwait, Peru, Philippines, Qatar, UAE, Saudi Arabia and Indonesia.

Source: HSBC Asset Management, December 2022

In recent decades, correlations and returns for Emerging and Developed Markets have been on a path of convergence. In contrast, the internal dynamics and domestic outlooks in Frontier Markets play a more significant role than global market drivers which can mean they are able to develop independently to the wider global economy – conditions that can be conducive to uncorrelated returns. It is also worth noting that Frontier Markets are currently under-represented across most investment portfolios and could represent a source of diversification for long-term growth and income.

Where we see opportunity

There are a number of attributes that make a thought-provoking case for Frontier Markets. We aim to capture alpha across the investment universe by investing in the following themes:

Consumers

A young, large, growing population provides a “demographic dividend.”

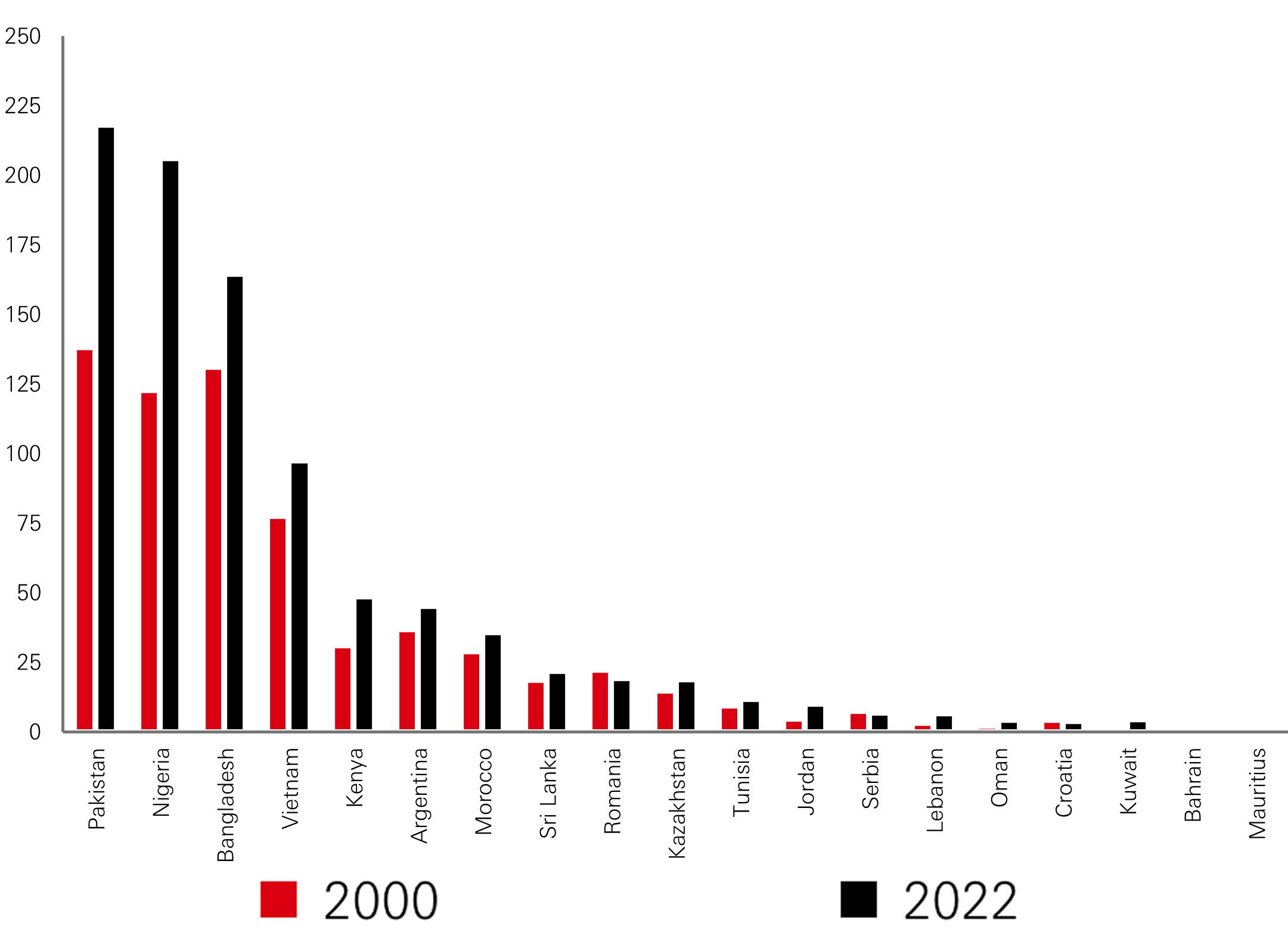

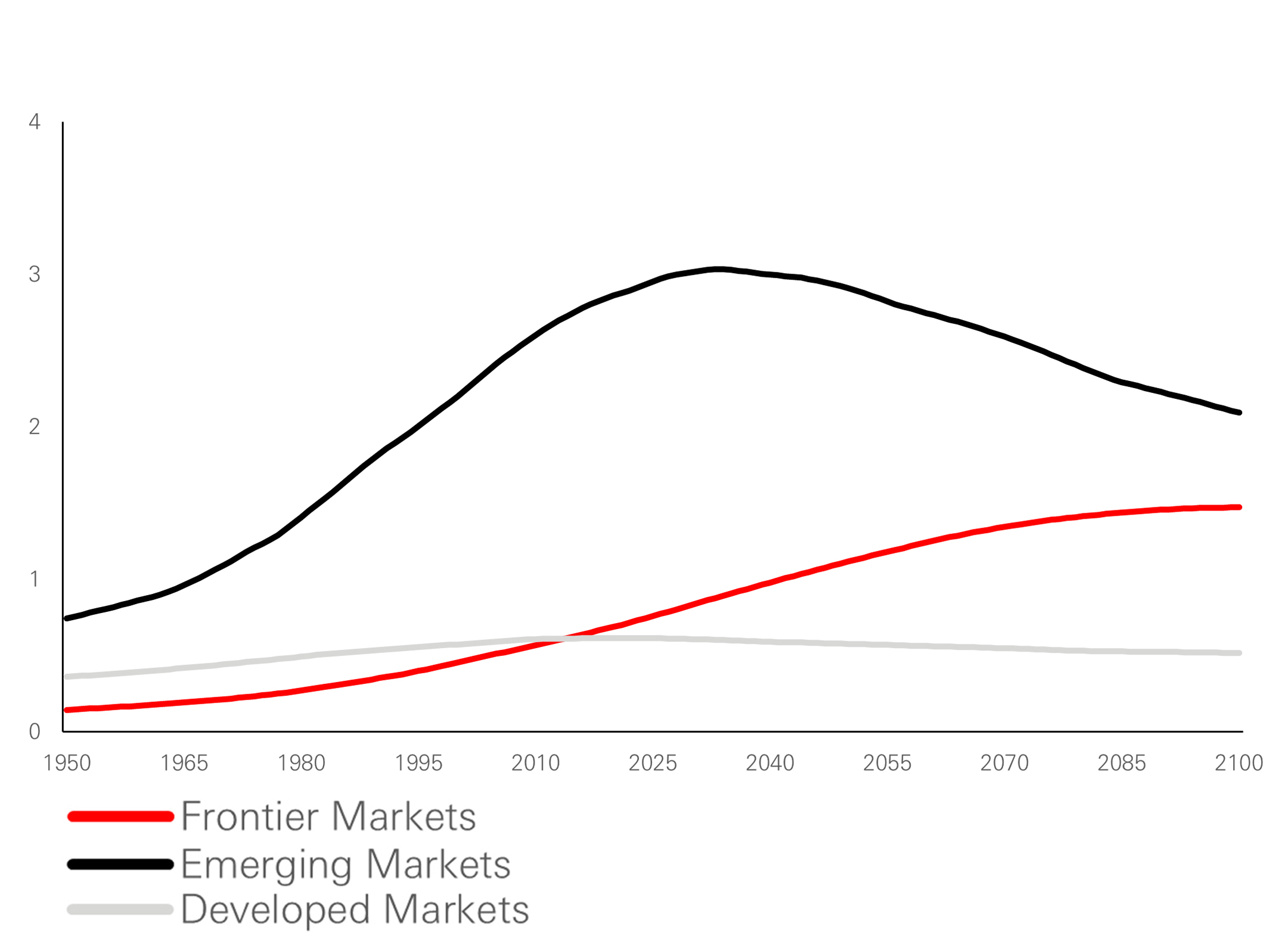

Frontier countries are by no means small, being home to close to 1bn people. They are also home to large, young populations, and low labour costs which are among the key drivers for long-term economic growth, a feature providing a “demographic dividend”. This abundance of growing, young working age populations is in stark contrast with the general slowdown of population growth across developed markets, an issue that is also beginning to impact Emerging Markets – for example, in China.

We are also seeing a rise in the middle classes, bolstering consumer expenditure and, in turn, economic growth as wealth and disposable income increases. This can also foster increasing digitalisation and may drive productivity improvements. Another interesting takeaway is that Frontier companies tend to be less indebted which sets strong foundations for investors1.

|

Growing populations2 |

Working age population3 |

- Source: Bloomberg 2022

- Source: International Monetary Fund, World Economic Outlook Database estimates, October 2020

- Developed Markets based on MSCI World. Source: United Nations Department of Economic and Social Affairs, Population Division (2015), HSBC Research, February 2018. Based on the median fertility rate assumptions. Aggregate of countries comprised in respective MSCI indices.

Supply chain diversification and nearshoring opportunities

Supply chain diversification and nearshoring are themes of disruption we are seeing across Frontier Markets, each bring swathes of potential benefits. By locating different stages of production in neighbouring economies, it is possible to take advantage of lower costs, economies of scale and higher productivity. Some examples of this include Vietnam, Bangladesh, and Kenya, who offer relatively low wage costs, competitive productivity, and large working-age populations.

Another example is Morocco’s automotive sector which has become a case study of nearshoring over the last few years. By gradually positioning itself as a regional hub for the industry, the North African country has seen an influx of international brands setting up manufacturing bases that take advantage of local economics to supply European markets.

We are also seeing a plethora of opportunity across Eastern Europe. Slovenia and Romania, for example, have been making progress towards becoming key manufacturing hubs for the EU. The charts below illustrate the recent growth of their export markets and, being two of the richer emerging European countries, they are well positioned to capitalise on this momentum and become a local first mover in the nearshoring theme.

A positive outcome of these developments could be rising incomes, growing the levels of disposable income for the middle classes, and tailwinds for the broader economy with all sectors being buoyed by increased spending.

|

Slovenia Exports |

Romania Exports |

Frontier markets have become more business friendly

We have seen a number of Frontier economies ease legislation, lower barriers and open themselves up to facilitate a friendly business environment for foreign investment.

The chart below looks to illustrate the changing environment. A positive change in the distance to Frontier Score implies improving regulatory environment, as measured by the World Bank’s Ease of Doing Business survey across factors such as starting a business, getting electricity, paying taxes, getting credit, etc.

Regulatory performance

Change in distance to frontier1 score, 2015-2020

- The "Distance to Frontier" score helps assess the absolute level of regulatory performance over time. It measures the distance of each economy to the "frontier", which represents the best performance observed on each of the indicators across all economies in the Doing Business sample since 2005.

Liberalisation

When Vietnam enacted their first liberalisation in 2009, the informational efficiency of their markets was improved, paving the way for easier participation for foreign investors. There has been a notable movement of foreign companies to Vietnam, to avoid the risks arising from the US economic sanctions against China. Growth has been visible in industries with high production costs, especially in the electronics industry - Samsung is a prominent example.

More recently, this has been particularly prevalent across Gulf Cooperation Council members. One example is the UAE government lifting corporate ownership restrictions – previously capped at 49 per cent, full foreign ownership of UAE-based companies is now permitted. Alongside moves to privatise state assets, bolster industrial growth, and support the start-up ecosystem, this is likely to contribute to the country's sustained economic growth and development in 2023 and beyond. Qatar has also recently liberalised their markets in a similar fashion.

Saudi Arabia (crossover) also presents an exciting case for liberalisation as we see meaningful steps taken towards a general opening-up. This brings with it a wealth of opportunity when it comes to diversifying investment in the Emerging Markets space.

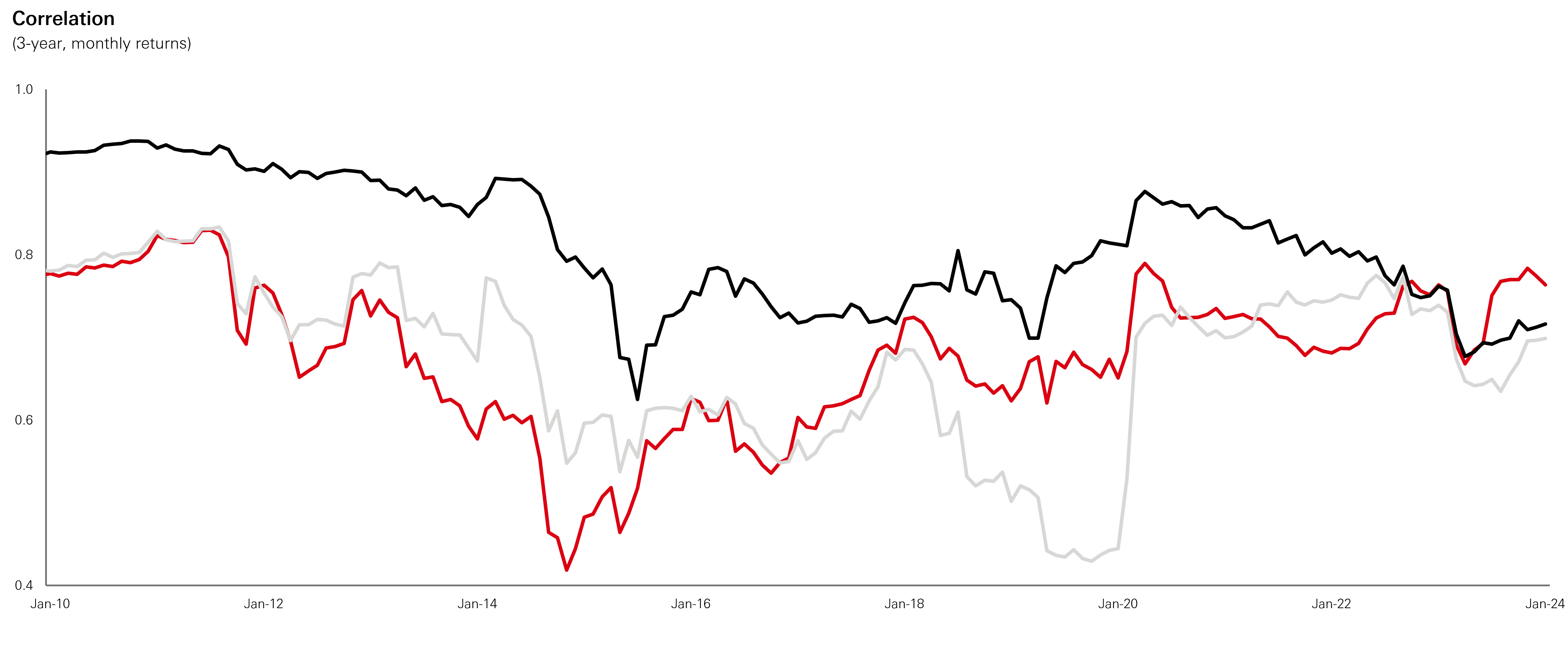

Correlations

Low correlation with other asset classes should provide diversification benefits

Source: HSBC Asset Management, Bloomberg, as of 31 January 2024. Frontier Markets: MSCI Frontier Markets Daily TR Net USD; Emerging Markets: MSCI Emerging Markets Daily TR Net USD; Developed Markets: MSCI World Daily TR Net USD.

Frontier Markets may offer a way to expand diversification within a portfolio. This has been a more challenging aspect of portfolio management in recent years as Emerging and Developed Markets correlations have risen.

In contrast, correlations between Frontier and both Developed and Emerging Markets have only been modest which could represent an opportunity for global investors. Despite typically being smaller, less developed, and more volatile on an individual name basis, by pooling countries together we end up with a different story. One reason for this is the lack of foreign investors (<20 per cent across most markets).

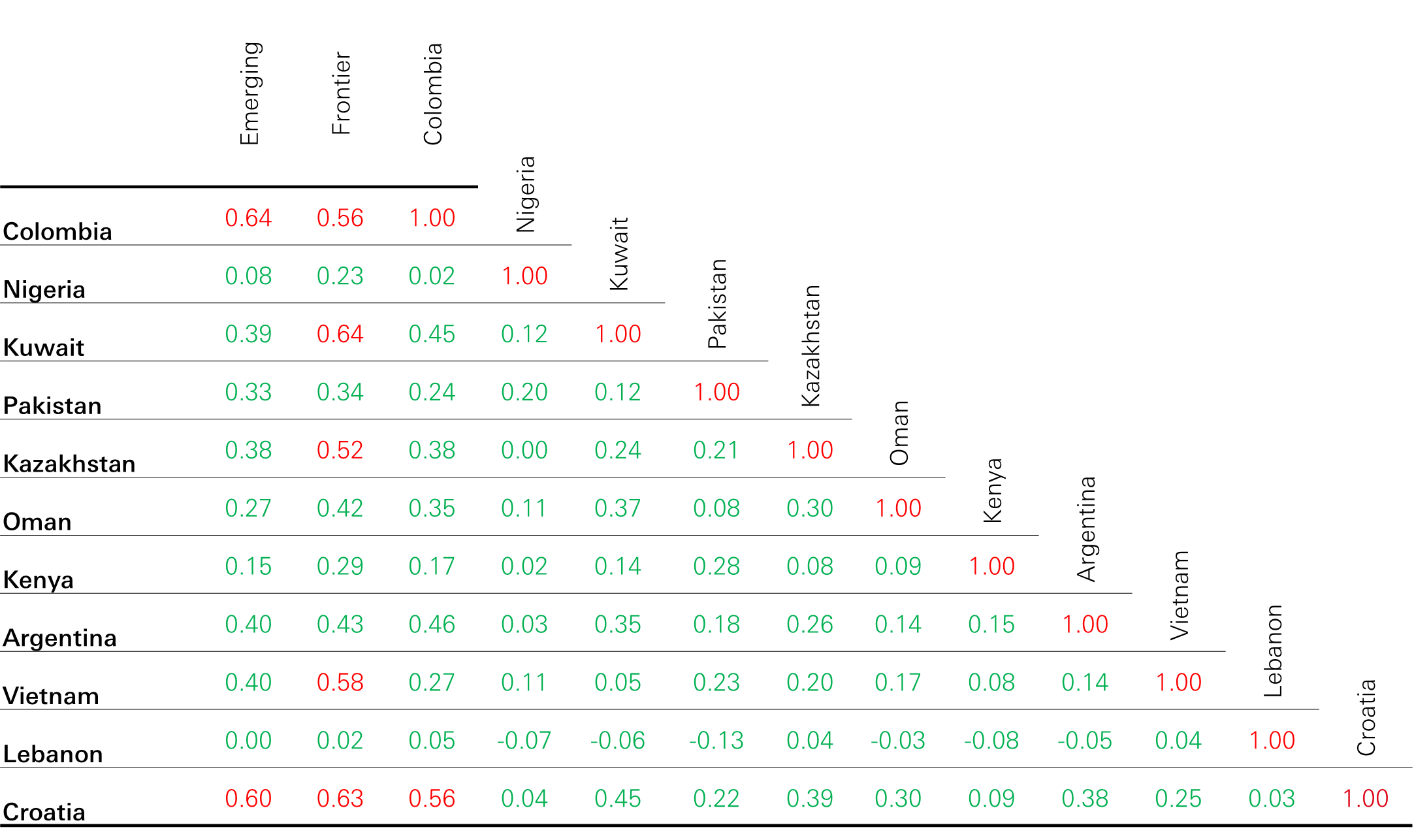

Intra-country Correlation Matrix

5-year weekly returns

Green indicates a correlation between -0.49 and +0.49

Red indicates a correlation higher or lower than +/-0.50

Another is that stock prices are generally dominated by local investors focussed on local issues, and this helps drive correlations down. The intra-correlations within these markets are remarkably low. By distributing your investments within Frontier countries, for example across Kazakhstan and Kuwait, you are diversifying effectively (0.24, see the correlation table below). These markets do not meaningfully move together.

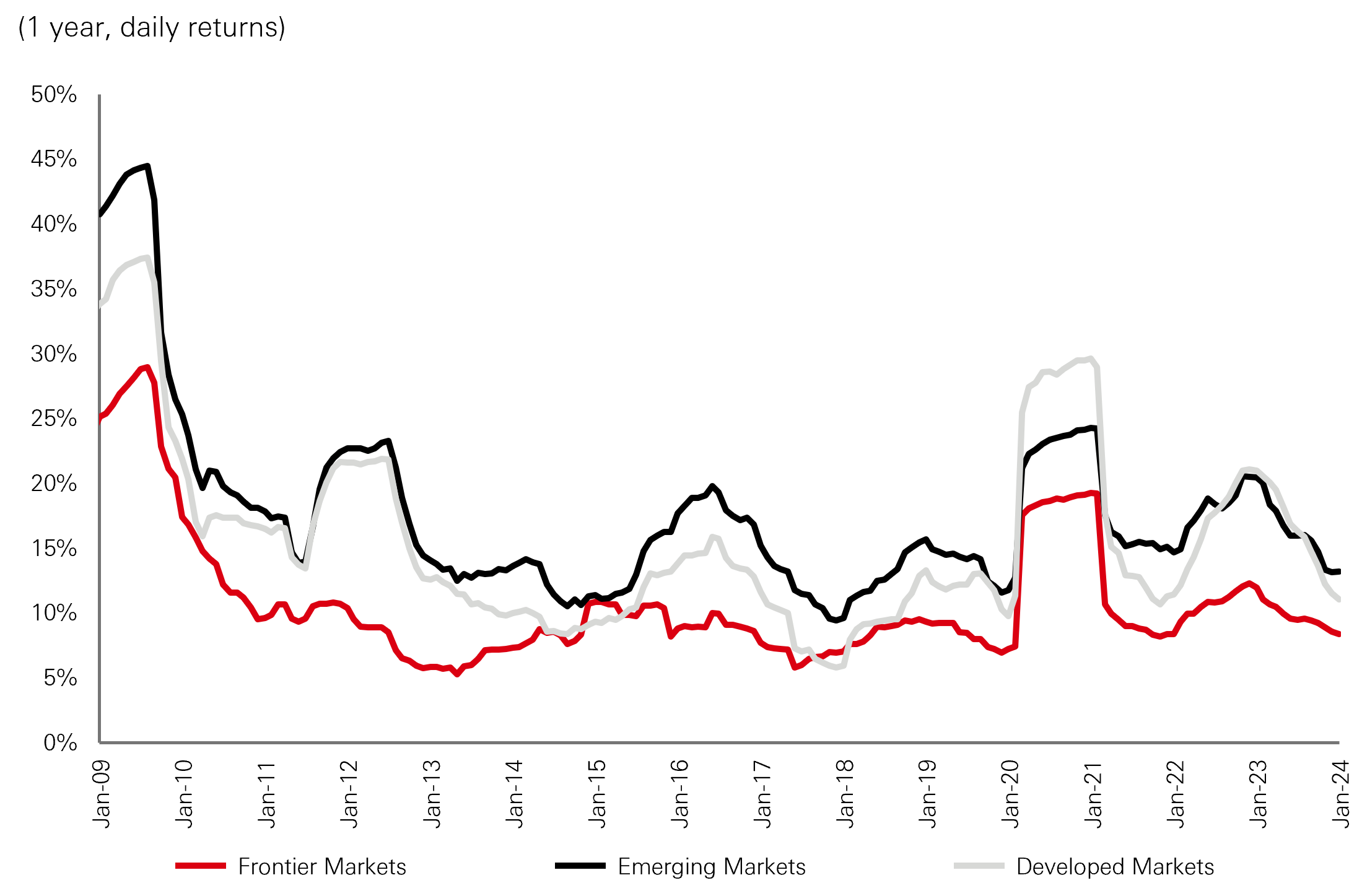

Volatility

Low intra-country correlation within frontier markets has resulted in volatility lower than emerging markets historically.

These weak relationships help feed into the risk dynamic, as measured by volatility, for Frontier Markets. Represented in the chart overleaf in red, they are lower than both Emerging and Developed Markets. This is a common misconception and helps make the case for complementing existing Emerging Markets exposures with allocations to Frontiers. Even a small amount in a portfolio could dampen overall portfolio volatility and help drive risk adjusted returns.

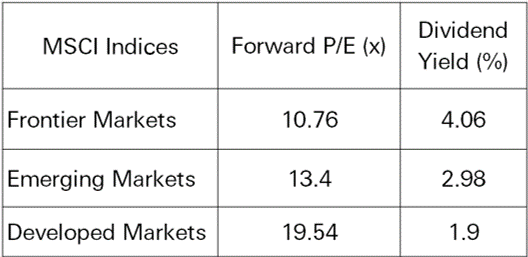

Valuations and income

FM offering superior earnings growth at a reasonable PE ratio.

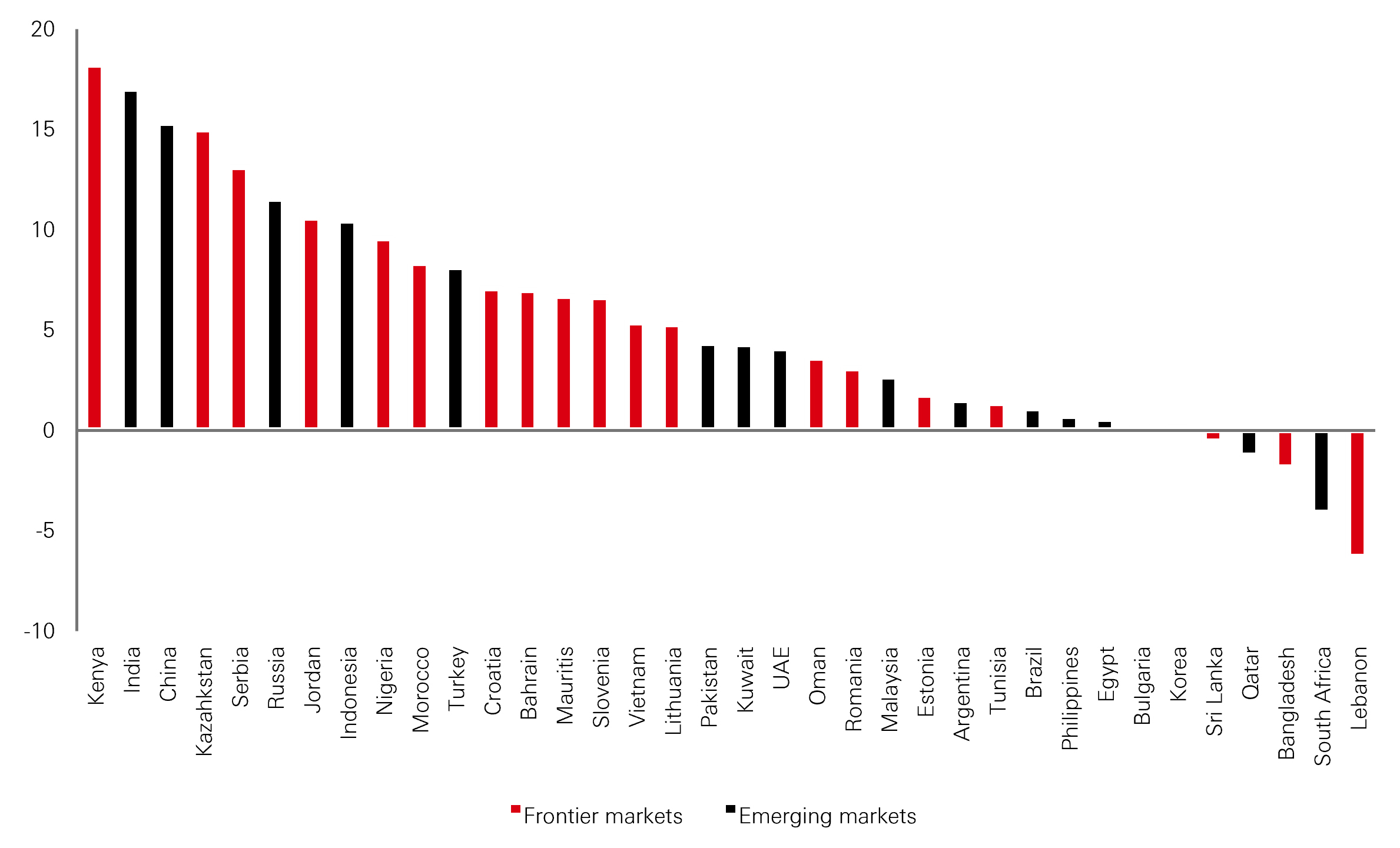

Frontier Markets are trading at attractive valuation levels, at a discount greater than historical levels to Developed and Emerging Markets. It is also a discount to its own historical average valuation with a Price to Earnings ratio of about 12.5x (current P/E is approximately 10x – see the table below). Earnings growth is expected to remain strong in 2023 at 10.2 per cent compared to -3.5 per cent for Emerging Markets1. They also offer more income with higher dividend yields. Below we compare Frontier Markets’ superior earnings growth at a reasonable P/E ratio and superior dividend yield to Emerging and Developed Markets.

1Bloomberg Estimates, MSCI, January 2024

Source: MSCI, as at 31 January 2024 Frontier Markets: MSCI Frontier Markets Daily TR Net USD; Emerging Markets: MSCI Emerging Markets Daily TR Net USD; Developed Markets: MSCI World Daily TR Net USD

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future.

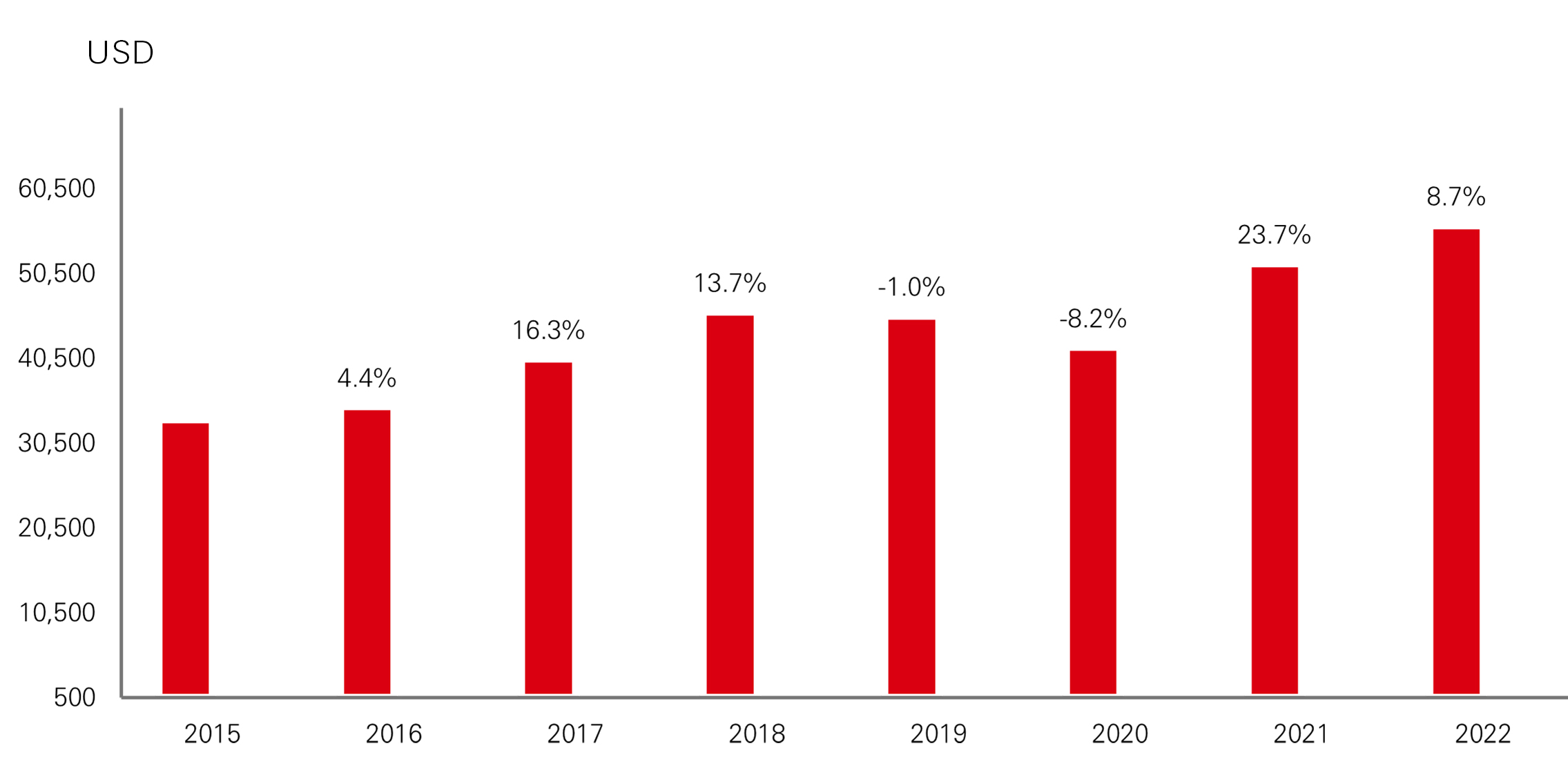

Increased capital markets activity opportunities

A booming market for IPOs is perhaps the most direct and tangible indicator of an economy where new companies are confident about their prospects. We have been seeing a gradual increase in the number of IPOs, growing the universe of listed equities across Frontier geographies, with recent examples in Romania, the UAE, and wider MENA region1. We may see swathes of benefits following the public funding, including corporate growth, increased governance, more competition and, ideally, job creation.

1. Ernst & Young Global IPO Trends 2023

A liquidity challenge?

As this segment of the market includes less developed capital markets and smaller participants, some investors have reasonable doubts about the difficulties of getting in and out of positions and the associated costs. Across the entire Frontier Markets investment opportunity, liquidity is certainly more constrained as a rule of thumb, but this is where active management can play a key role by managing liquidity effectively across a portfolio.

At HSBC Asset Management, for example, our Frontiers Team take an active approach to this, with screening and Frontiers investment due diligence. By focusing on the more liquid names, it’s possible to provide deeper coverage into individual stock profiles and manage a more liquid portfolio, ultimately adding significant value to the effectiveness of the opportunity.

Summary

Frontier Markets make a dynamic, potentially rewarding yet under-owned asset class. With excellent diversification benefits, a complimentary set of risk-return characteristics, and yield potential, we think that Frontier Markets can make a welcome addition to Emerging Markets allocations in global portfolios. Moreover, we think with stock selection and liquidity managed on an active basis, the Frontier Markets proposition becomes all the more attractive.

The investment case

The case for Frontier Markets funds

- Attractive valuations. Frontier Markets are trading at a large discount to their emerging market peers, and offer higher earnings growth and higher dividend yields

- Diversification benefits. Frontier Markets have a low correlation with other asset classes, and lower volatility than Emerging Markets

- Superior earnings growth. Driven by structural change, Frontier Markets earnings growth is expected to remain strong in 2024