Real Estate APAC

Dedicated Asia Pacific direct Real Estate investment manager

What’s new

Who we are

Our Real Estate APAC team provides investors access to value-add and core-plus investment approaches, leveraging our long track record and presence in the region.

|

|

|

|

Source: HSBC AM, as of 30th June 2025

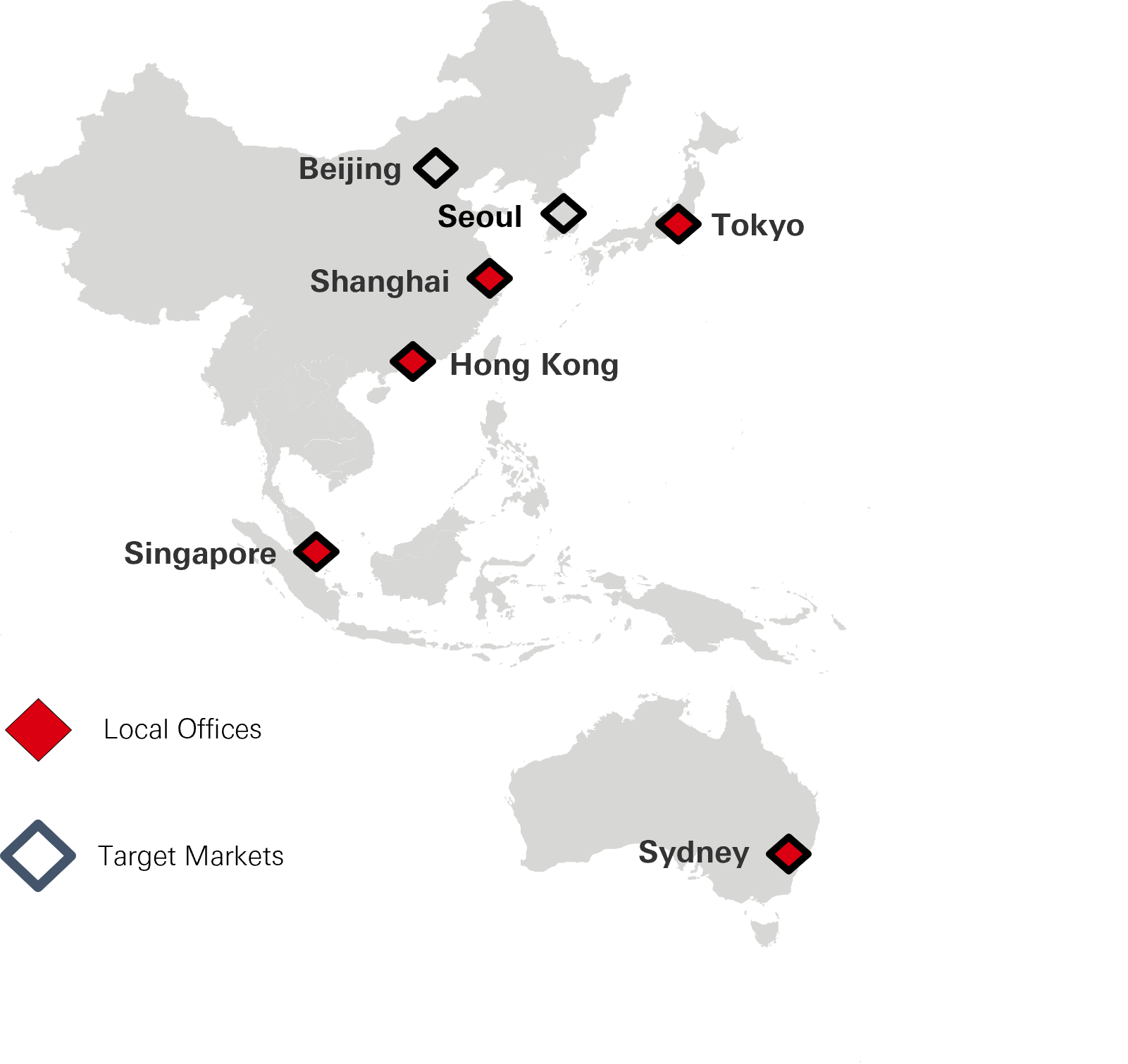

We target the most mature, institutionalised, liquid and transparent markets in the Asia Pacific Region

Our Investment Approach

|

Invest

|

Optimise

|

Realise

|

What we do

Our Portfolio

Our team currently manages over 20 properties in the region – representative properties include:

Experienced Investment Team

|

|

|

Leadership

25 investment professionals locally based across APAC

Peter Wittendorp, CEFA Head of Real Estate, APAC 30 years of real estate experience |

Berend Poppe, CFA Head of China 20 years real estate experience |

George Kang Head of Singapore 20 years real estate experience |

Nick Kearns, CFA Head of Hong Kong 20 years real estate experience |

Takashi Hamajima Head of Japan 20 years real estate experience |

Key Risks

Important Information

Investors in alternatives products should bear in mind that these products can be highly speculative and may not be suitable for all clients. Investors should ensure they understand the features of the products and fund strategies and the risks involved before deciding whether or not to invest in such products. Such investments are generally intended for investors who are willing to bear the risks associated with such investments, which can include: loss of all or a substantial portion of the investment, lack of liquidity in that there may be no secondary market for the fund and none may be expected to develop; volatility of returns; prohibitions and/or material restrictions on transferring interests in the fund; absence of information regarding valuations and pricing; delays in tax reporting; key man and adviser risk; limited or no transparency to underlying investments; limited or no regulatory oversight and less regulation and higher fees than mutual funds.

Please note that alternatives related investments are generally illiquid, long term investments that do not display the liquid or transparency characteristics often found in other investments (e.g. listed securities). It can take time for money to be invested and for investments to produce returns after initial losses. As such alternatives related investments should be considered as a very high risk investment and are only suitable as part of a diversified portfolio. Before making such investments, prospective investors should carefully consider the risks set forth in the relevant investment documents.

The contents of this document have not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”) or any regulatory authority in Hong Kong. You are advised to exercise caution in relation to any relevant offer. If you are in any doubt about the contents of the relevant investment documents you should consult your accountant, legal or professional adviser or financial adviser. The relevant product is not authorized under Section 104 of the Securities and Futures Ordinance of Hong Kong (“Ordinance”) by the SFC Accordingly, the distribution of any relevant Private Placement Memorandum, and the placement of interests or units in Hong Kong, is restricted. Any relevant Private Placement Memorandum may only be distributed, circulated or issued to persons who are professional investors under the Ordinance and any rules made under the Ordinance or as otherwise permitted by the Ordinance.

HSBC Asset Management is the brand name for the asset management business of HSBC Group. The above communication is distributed in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management (Hong Kong) Limited.

Formulate Strategic Asset Plan (SAP), ensuring a real estate asset is developed and / or managed to optimise long-term performance

Formulate Strategic Asset Plan (SAP), ensuring a real estate asset is developed and / or managed to optimise long-term performance