What is an index fund?

An index fund is a type of mutual fund that aims to track the performance of a stated financial market index by building a portfolio that invests in all or part of the constituent stocks (or constituent bonds) of that particular index.

|

|

|

|

|

For whom?

If you are optimistic about an asset class or market, but are unfamiliar with security or company selection, or are worried that your risk is too concentrated, index funds will come in handy as a relatively simple and low cost method for achieving diversification benefits.

Benefits of index funds

Two-minute videos on index funds

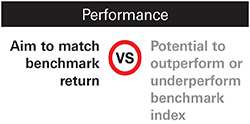

How are index funds different from actively managed funds?

|

|

||

|

|

|

|

Both types of funds have their own merits. While index funds may be smart options for your core portfolio, actively managed funds can be valuable complements for capturing additional potential returns of certain segments of the market, and together they form a more comprehensive and diversified portfolio.

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.