Indian equities – spotting opportunities amidst global uncertainties

Key takeaways

- India’s economy is facing cyclical headwinds in the medium term, though looking ahead, we anticipate a sequential recovery in economic growth, supported by monetary easing, consumption-boosting policy measures, and a resurgence in infrastructure spending. Though India is relatively better placed, we believe, recent tariff announcements are likely to weigh on growth recovery.

- With the recent correction in Indian equities, the risk-reward profile for large-cap stocks has become favourable. Valuations of large-cap stocks and the broader market are now closer to their long-term averages

- Our overall outlook on Indian equities remains constructive with earnings growth in the medium term estimated in the 12-15 per cent range

- Despite significant foreign net outflows year-to-date, domestic investors remain active buyers. Domestic mutual funds’ ownership share in Indian equities reached new highs in March 2025, and retail investment flows have remained resilient

- India's long-term structural themes, including advanced manufacturing, investment in infrastructure, rising discretionary spending, and digitalisation, will augur well for economic growth and newer opportunities for investors

- In the HSBC India equity strategy, we maintain a preference for large cap stocks with robust earnings growth. We find the earnings and valuations combination more attractive for financials, real estate, and consumer sectors. We have turned positive on the consumer sector as we expect tailwinds from policy shift at the government and central bank levels to benefit consumers

Cyclical headwinds in the medium term following post-pandemic outperformance

After a period of significant growth following the pandemic, India experienced an unexpectedly sharp cyclical slowdown in FY2025. The current growth forecast stands at 6.3 per cent for FY2025, following a high base of 9.2 per cent in FY2024. This slowdown occurred amid post-COVID normalisation of demand and a cautious policy stance to maintain macroeconomic stability. Factors contributing to the slowdown included the fading of pent-up urban demand, a moderation in government spending on infrastructure due to national elections, a high base of growth, tight monetary policy, and slower credit growth. Additionally, trade tariffs and other global geopolitical uncertainties further dampened business and consumer sentiment.

Looking ahead, we anticipate a sequential recovery in growth, supported by monetary easing, consumption-boosting policy measures, and a resurgence in infrastructure spending. While India's structural growth drivers remain robust, achieving growth above the long-term trend will require further domestic reforms to revive the private sector's capex cycle and enhance the competitiveness of Indian manufacturing in global trade. Though the current slowdown is cyclical, its duration remains uncertain given the unpredictable global business environment.

Slowing growth, earnings downgrades, and relatively high valuations have led to a reasonable correction in India's equity markets, presenting a valuable opportunity for long-term investors. Investors seeking exposure to one of the world's fastest-growing major economies, characterised by favorable demographics, economic policies, and geopolitical positioning, may find this to be an opportune time. Additionally, Indian equities have historically shown low correlation with global, US, and Chinese equities, offering much-needed diversification benefits.1

Earnings outlook remains robust even as equity valuations get a reality check

Despite the economic slowdown, India remains one of the world's fastest-growing major economies, with a projected 6.5 per cent GDP growth for FY2026 and FY2027—double the world's average.2 This growth is fueled by a young workforce, a thriving entrepreneurial ecosystem, an expanding middle class, and ongoing structural reforms to improve economic efficiency and the business environment. While geopolitical risks exist, India's domestically oriented economy is less vulnerable to external factors. Foreign direct investment (FDI) from the Asia region and lower import tariffs could further support growth and reforms.

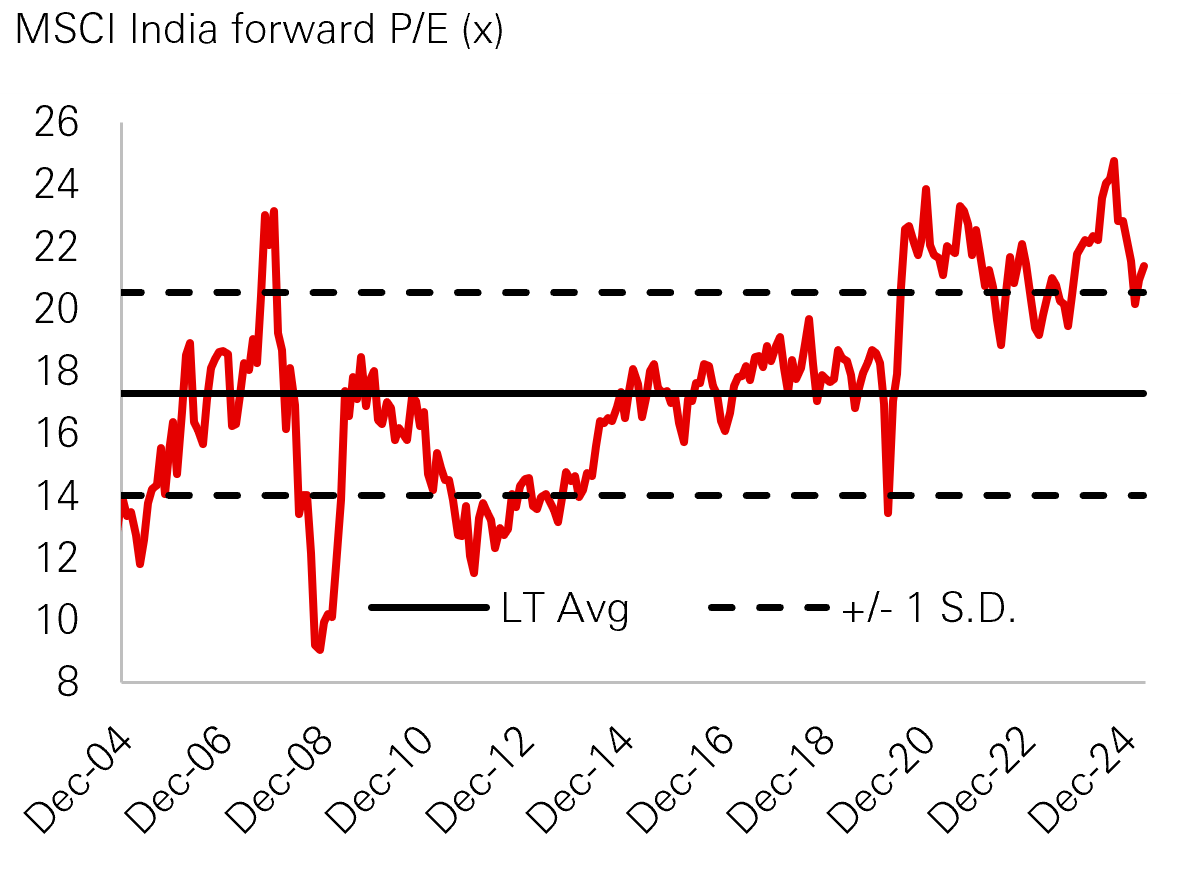

India equity valuations have moderated to a one year forward price-to-earnings (PE) ratio of 21.4x in March from a peak of 25x in September 2024 (Fig. 1). Our overall outlook on Indian equities remains constructive as earnings growth in medium term is estimated to be in the 12-15 per cent range.

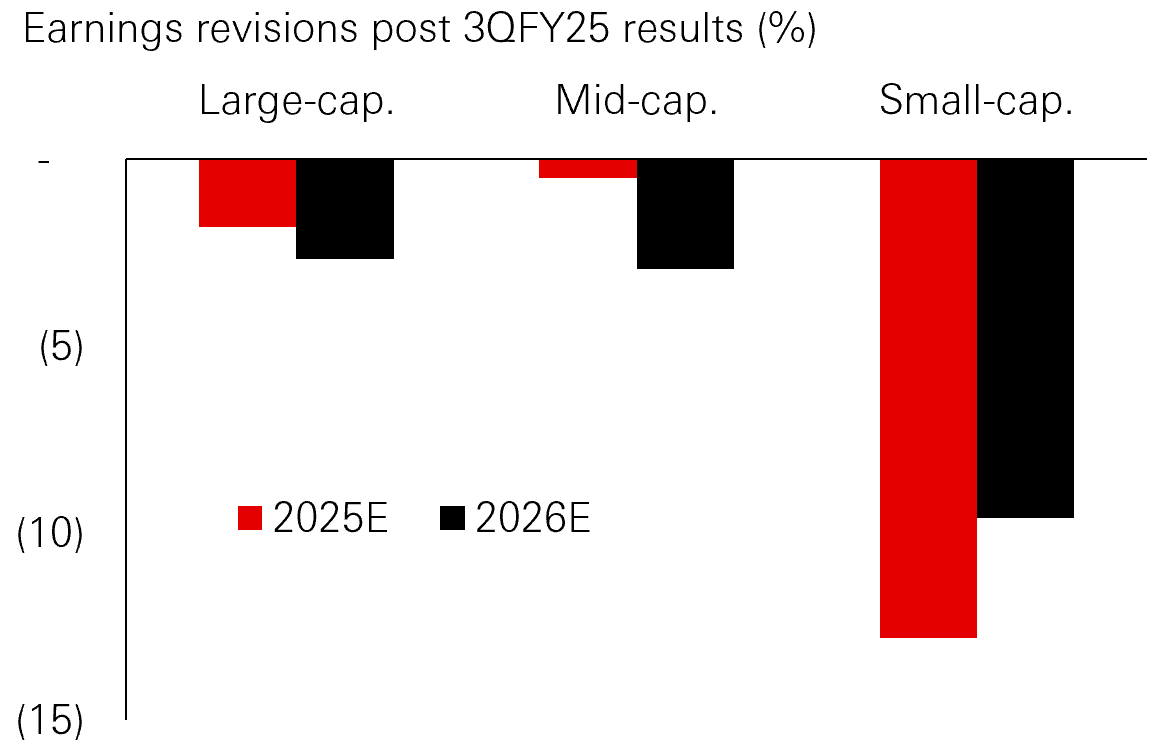

The earnings contraction has been more pronounced for small and mid-cap companies, where expectations were high. Since 3QFY25, earnings downgrades for these companies have accelerated more sharply than for large-cap companies (Fig. 2).

Source: MSCI, Goldman Sachs, 28 February 2025.

Source: Bloomberg, Kotak Institutional Equities, data as of February 2025

Earnings outlook remains robust even as equity valuations get a reality check (continued)

While downgrades were broad-based, the impact varied across sectors. Small-cap sectors such as media and internet software saw significant downgrades as they struggled to maintain growth. In contrast, large-cap sectors including banks, insurance, and healthcare showed resilience due to diversified revenue streams and their inherently defensive nature.

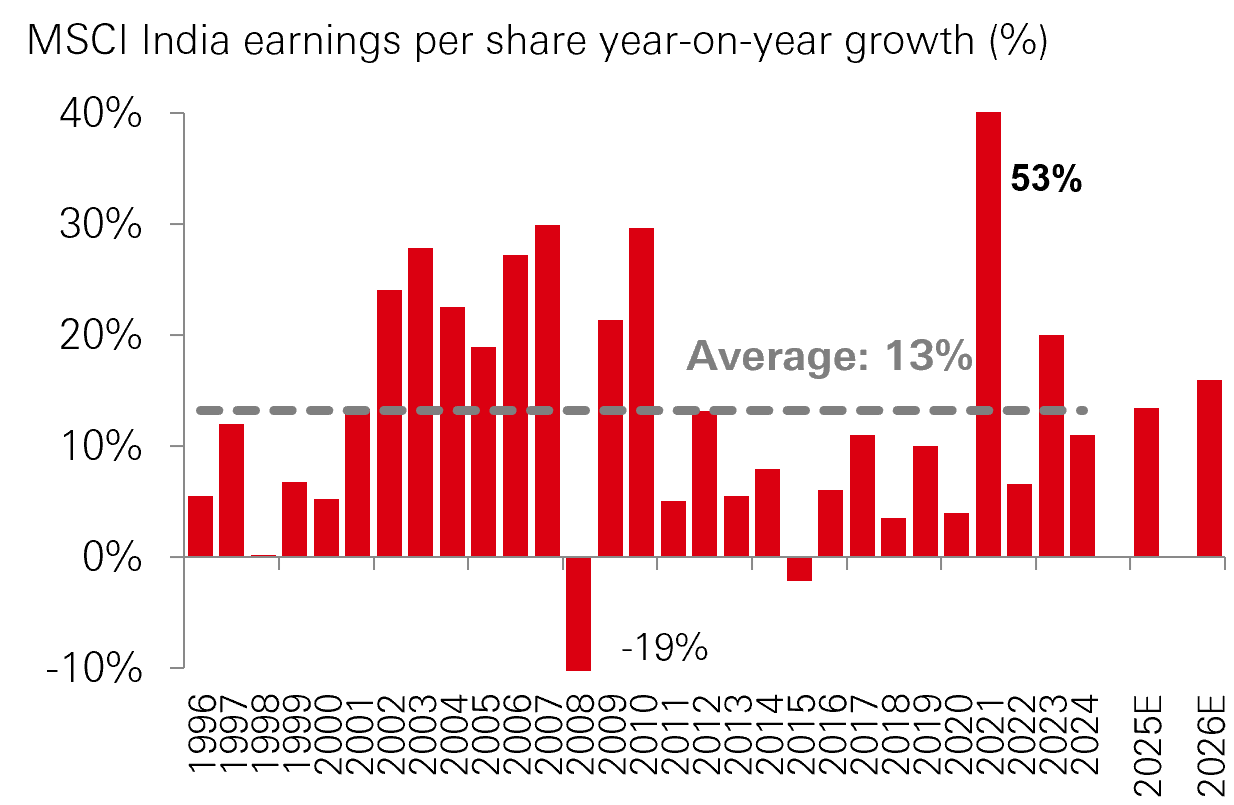

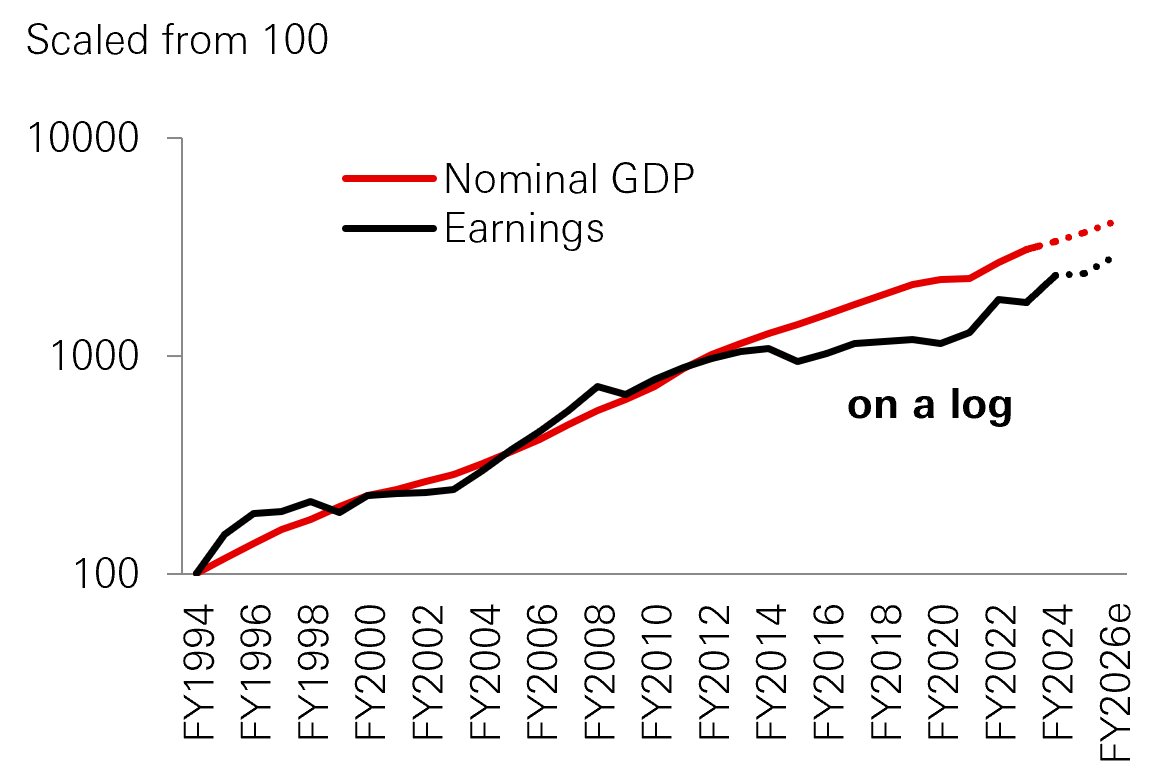

Although India’s earnings growth has slowed compared with expectations, consensus growth projections for 2025 and 2026 are at 14 per cent and 15 per cent (Fig. 3) respectively, albeit with some risk of downward revisions. Over the past two decades, India’s earnings growth has outpaced that of the US, China, and other emerging markets.3 Looking ahead, India is expected to achieve double-digit annual earnings growth in the medium term, supported by both structural and cyclical factors. Historically, there has been a strong correlation between nominal GDP growth and corporate earnings in India (Fig. 4), though there are periods of lead and lag and currently we are in a phase where earnings are likely playing catch-up with the trend in nominal GDP growth, making us more confident about medium term earnings trajectory.

Source: Goldman Sachs, February 2025

Source: CEIC, RIMES, MSCI, Morgan Stanley Research, data as of February 2025

Potential impact of US tariffs

There is significant uncertainty surrounding the impact of the US administration’s “reciprocal” tariff announcements made on 2nd April – a week after this announcement, on 9th April, the US declared a 90-day suspension of the “reciprocal” tariffs for most countries. Key developments to watch include which economies might negotiate deals to lower tariffs, potential policy easing to counteract growth risks (e.g., monetary easing), and the possibility of relatively positive outcomes for certain countries, including India, where efforts to reduce trade barriers and enhance the ease of doing business could be expedited.

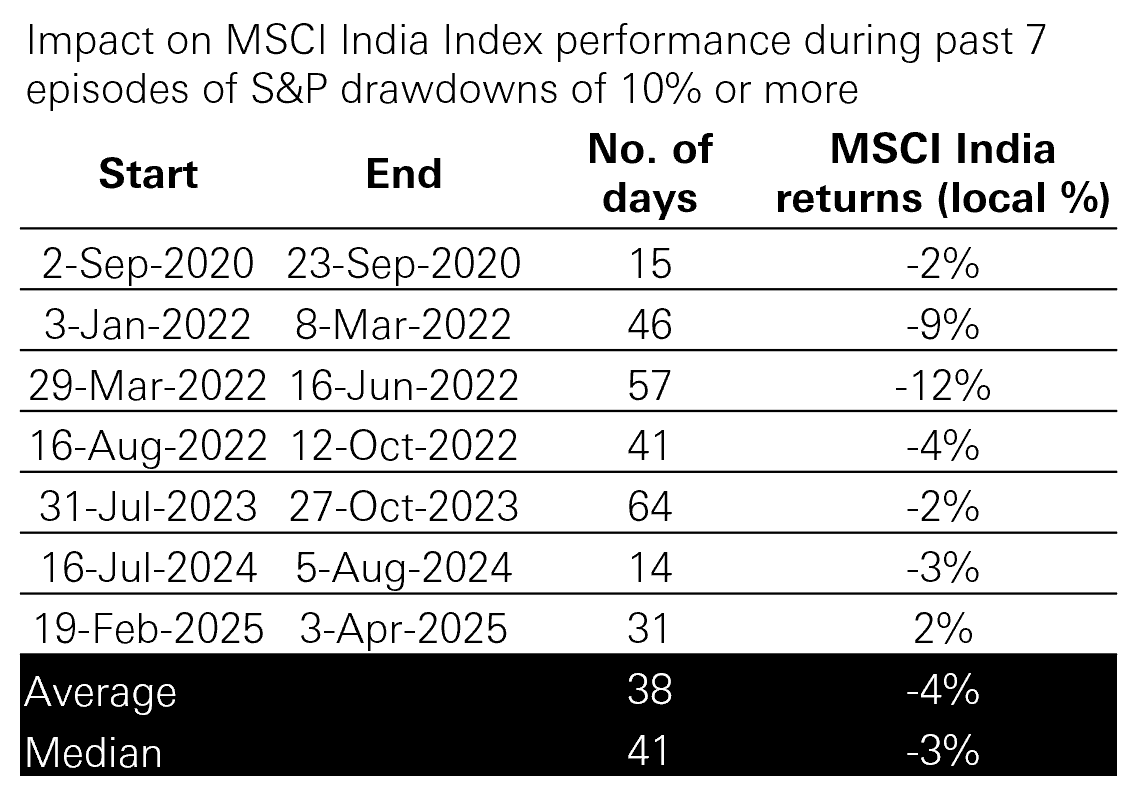

Recent news about Apple's plan to relocate its iPhone manufacturing base to India4 supports our view that the country could potentially benefit from shifts in global trade dynamics in the longer term. Amidst the volatility, it should be noted that Indian equities have shown resilience during periods of US equity drawdowns (Fig. 5). In our HSBC India equity strategy, we had previously lightened our exposure in healthcare due to tariff risks while these stocks have since corrected – we are looking to add back to the pharmaceutical space. Our strategy is underweight IT services as of end March – despite no tariffs being imposed on the IT services sector, slower global growth should have an impact. We continue to be overweight on consumer discretionary and staples with main exposure in FMCG and beverages, which we believe are relatively better positioned amidst the tariff headlines.

Local refers to local currency. Source: Goldman Sachs, April 2025.

Recent market sell-off presents opportunities

With the recent market correction, the risk-reward profile for large-cap stocks has become favourable. Valuations for large-cap stocks and the broader market are now closer to their long-term averages.

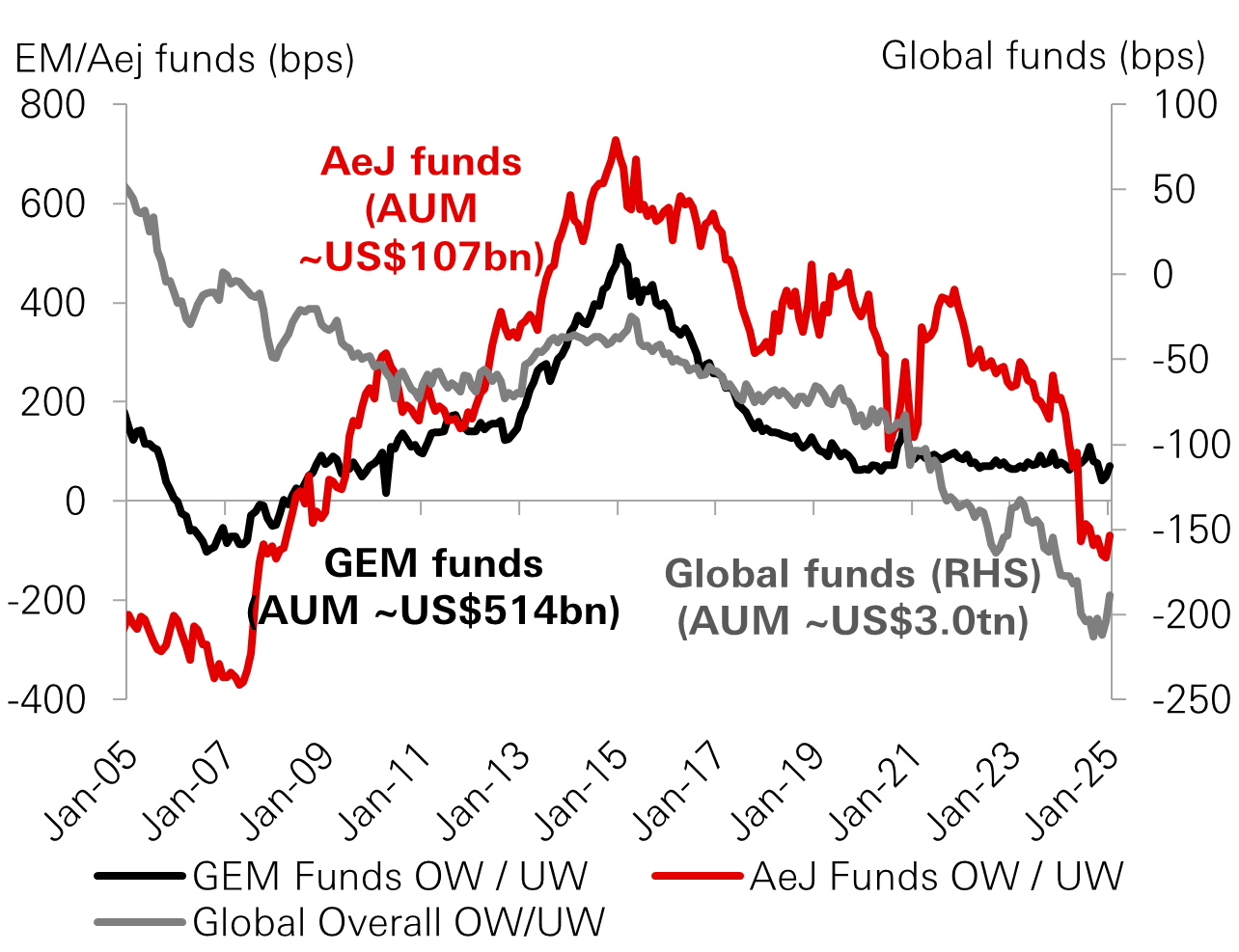

Despite significant foreign net outflows of USD 13 billion year-to-date, domestic investors remain active buyers. Domestic mutual funds' share in Indian equities reached new highs in March 2025, and retail investment flows have remained resilient as the financialisation of domestic savings – the transition from physical assets such as gold and real estate to equities and mutual funds – continues. Since March 2025, foreign investors have gradually returned to the market. However, India remains underrepresented in global and emerging market portfolios (Fig. 6). Foreign institutional investor ownership of the Indian equity market is at a 10-year low, indicating potential for substantial foreign inflows if ownership levels return to the 10-year average.5

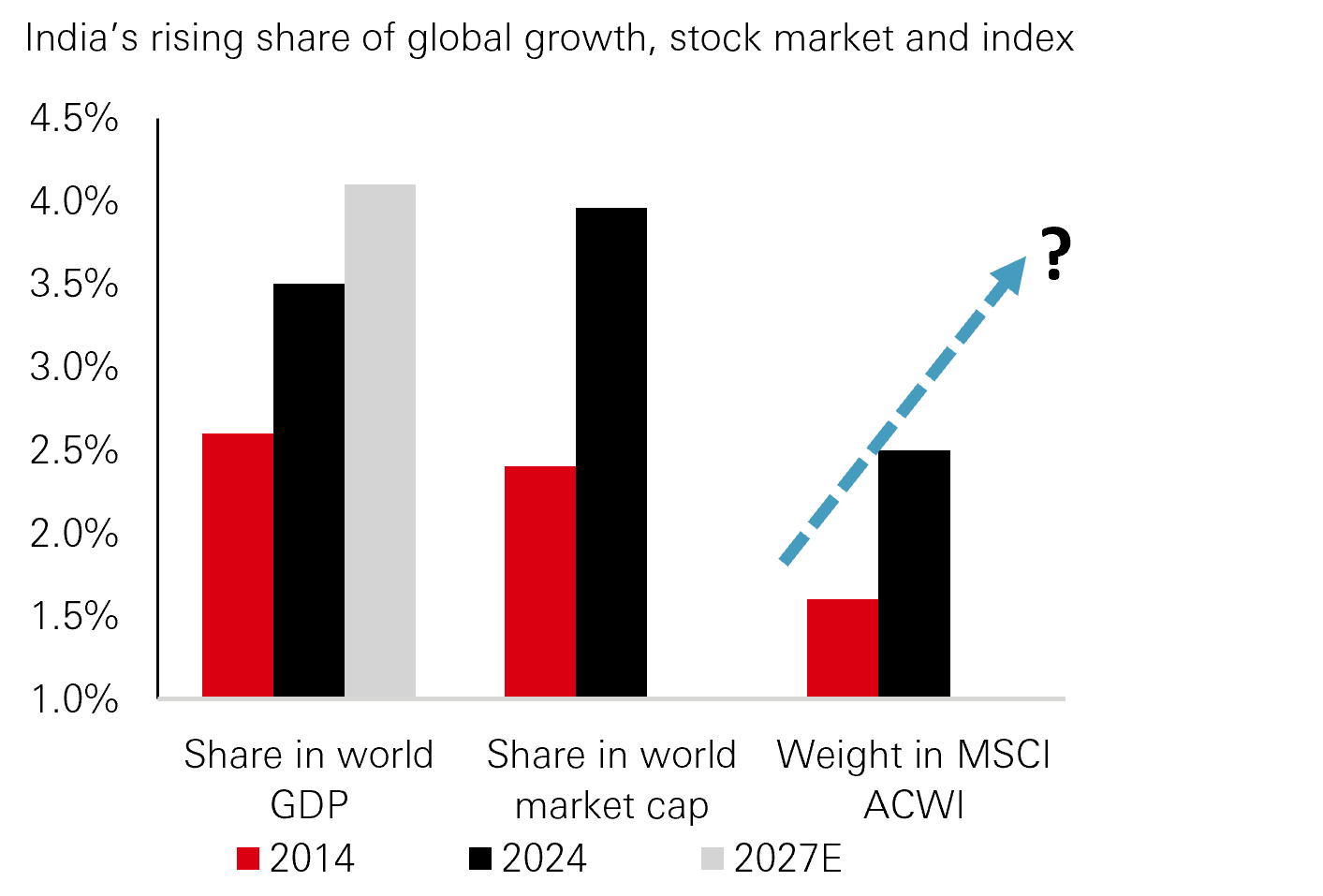

For asset allocators, Indian equity’s low correlation with other major markets is particularly appealing in an increasingly interconnected and unpredictable global economy – correlation with developed market equities was only 0.24 over the last two years.6 The recent market correction provides a strategic opportunity to acquire high-quality stocks at discounted prices, while also gaining exposure to India's growing economic influence. Along with India’s increasing share in world GDP, Indian equities’ rising representation in global equity indices also points to a growing need to allocate to the asset class (Fig. 7). Embracing this period of volatility as a window of opportunity may potentially lead to longer term rewards. Adding Indian equities to global portfolios can provide diversification benefits and potential portfolio stability.

Overall mutual funds AUM = US$3.7tn; Global funds include global & global ex-USA funds.

Aej refers to Asia ex Japan. GEM refers to global emerging markets. Source: Goldman Sachs, February 2025

Source: Morgan Stanley estimates, HSBC Asset Management, data as of February 2025

HSBC Indian Equity strategy

The HSBC Indian Equity strategy employs a well-defined bottom-up investment process to identify companies with sound and resilient business models that are available at reasonable valuations. This approach involves evaluating companies based on their durable competitive advantages, stable earnings, potential for free cash flow generation, and returns on capital that exceed their cost of capital. Management quality, positive environmental factors, and the regulatory environment are also important considerations. Various valuation methods are utilised, depending on the nature of the business and the sectors.

In the HSBC India equity strategy, we maintain a preference for large cap stocks with robust earnings growth. We find the earnings and valuations combination more attractive for financials, real estate, and consumer sectors. We have turned positive on the consumer sector as we expect tailwinds from policy shift at the government and central bank levels to benefit consumers.

Long-term structural themes

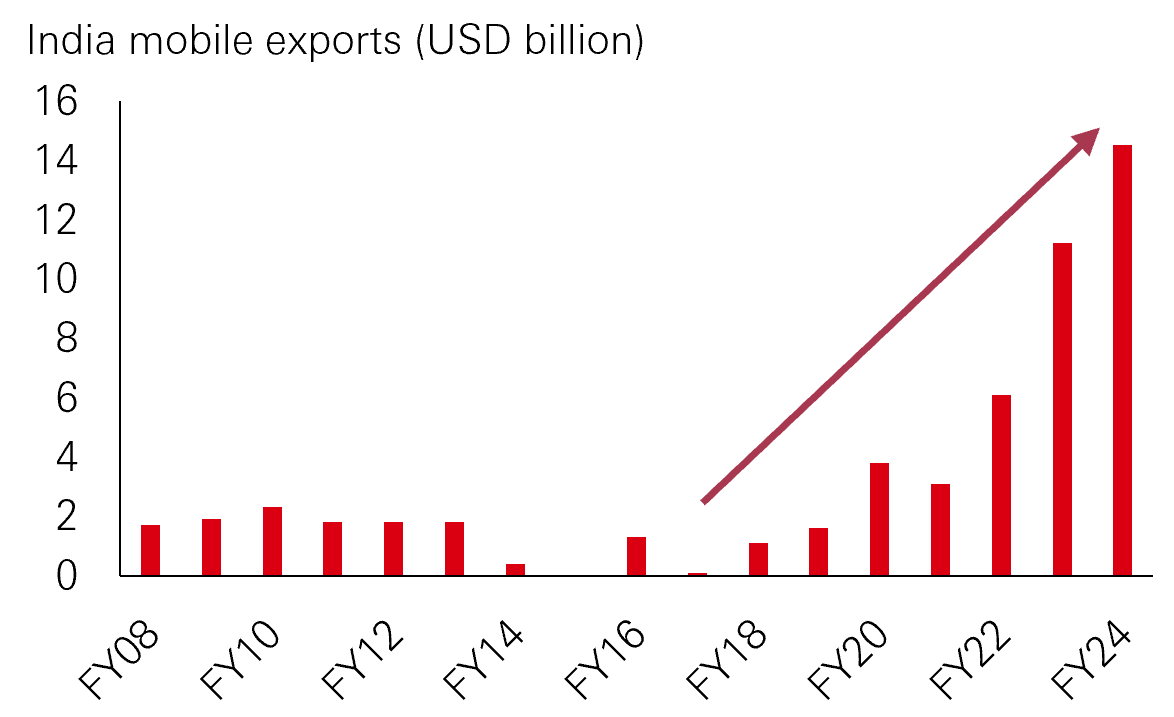

Manufacturing in India: India's manufacturing sector is poised for significant growth, fueled by a combination of favorable government policies and global supply chain realignments. Initiatives such as the "Make in India" campaign and the Production-Linked Incentive (PLI) scheme are attracting both domestic and foreign investments. These policies are designed to enhance the country's manufacturing capabilities, boost productivity, and create jobs. Additionally, as global companies diversify their supply chains to reduce dependency on a single country, India emerges as a compelling alternative. This shift positions India as a key player in the global manufacturing landscape.

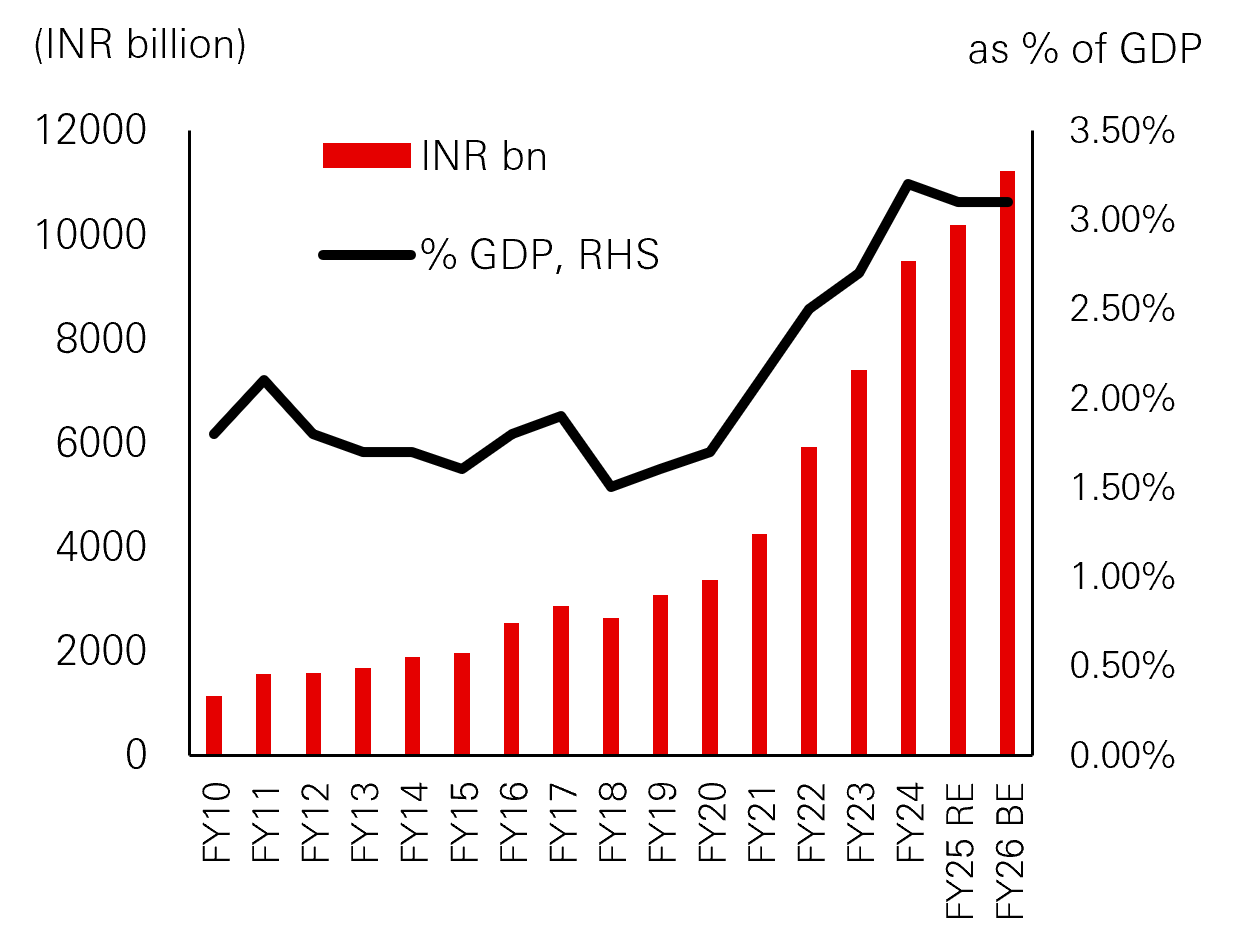

Infrastructure: India is undergoing a transformative phase with significant government investments in infrastructure. Massive projects in transportation, energy, and urban development are at the forefront of this modernization drive. The development of highways, railways, and ports is set to improve connectivity and reduce logistical costs, thereby enhancing overall economic efficiency. In the last Union Budget, the government’s capital expenditure has been sustained at 3.1 per cent of GDP (Fig. 9) in the FY26 budget while fiscal deficit has been reined in at 4.4 per cent of GDP.7

Discretionary spending: India's rising consumer confidence and increasing spending power are propelling growth in various sectors, particularly retail, travel, and luxury goods. As the middle class expands and disposable incomes rise, consumers are more willing to spend on non-essential items and experiences – India’s GDP per capita is expected to reach USD5,000 by 2030, according to Morgan Stanley’s estimates. India has now emerged as the second largest ecommerce market in the world in terms of number of online shoppers.8 It is also now the second largest smart phone market in the world.

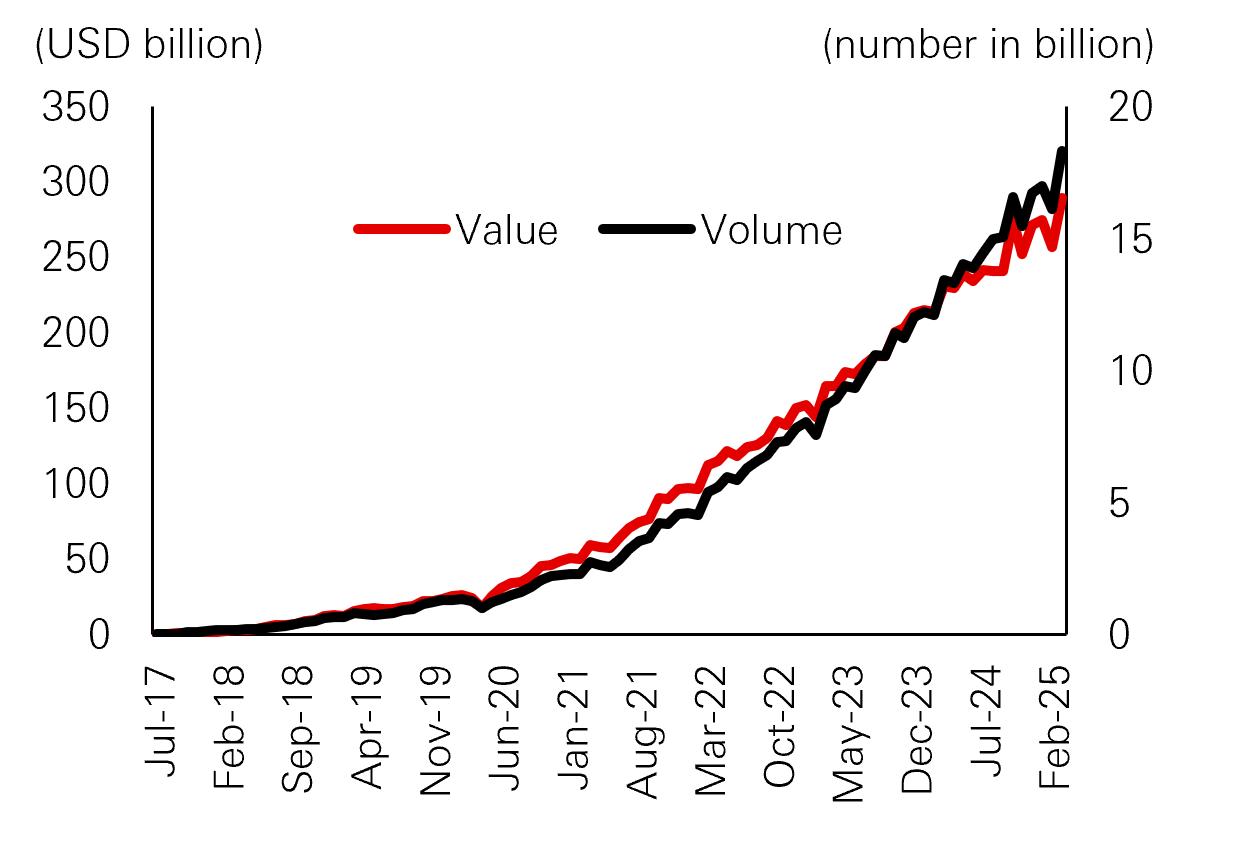

Digitalisation: Digitalisation is transforming the economy and opening up new avenues for investment in technology and innovation. Expanding internet access, particularly in rural areas, is bridging the digital divide and bringing millions of people online. The proliferation of digital payments, spurred by initiatives such as the Unified Payments Interface (UPI), has revolutionised the way transactions are conducted (Fig. 10). E-governance initiatives are enhancing transparency and efficiency in public services. These efforts are not only fostering a more inclusive and connected society but also creating a fertile ground for tech startups and innovation. Investors are increasingly eyeing opportunities in sectors such as fintech, e-commerce, and digital services, making India a hotspot for technological advancement.

Source: Jefferies estimates and analysis, September 2024

Source: Union Budget, data as of February 2025

Source: NPCI, data as of March 2025. The value of UPI transactions was converted using the spot rate of 85.58 on April 3.

Note 1: Source is Bloomberg, MSCI, March 2025.

Note 2: Source is IMF, January 2025.

Note 3: Source is MSCI, Bloomberg, February 2025.

Note 4: Wall Street Journal, April 2025.

Note 5: Based on foreign institutional investor ownership of NSE500. Source is Citi as of December 2024.

Note 6: Based on daily correlation between MSCI India Net USD Total Return Index and MSCI World between March 2023 to March 2025. Source is MSCI, Bloomberg, March 2025.

Note 7: India Union Budget, February 2025.

Note 8: Bain & Co, March 2025.

Source: Bloomberg, HSBC Asset Management, April 2025.

This commentary has been produced by HSBC Asset Management to provide a high level overview of the recent economic and financial market environment, and is for information purposes only. The views expressed were held at the time of preparation; are subject to change without notice and may not reflect the views expressed in other HSBC Group communications or strategies. This marketing communication does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. The content has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. You should be aware that the value of any investment can go down as well as up and investors may not get back the amount originally invested. Furthermore, any investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in established markets. Any performance information shown refers to the past and should not be seen as an indication of future returns. You should always consider seeking professional advice when thinking about undertaking any form of investment. This communication has not been reviewed by the Securities and Futures Commission.

Past performance does not predict future returns. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. Diversification does not ensure a profit or protect against loss. For illustrative purposes only.

Important information

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Global Asset Management Global Investment Strategy Unit at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

We accept no responsibility for the accuracy and/or completeness of any third party information obtained from sources we believe to be reliable but which have not been independently verified.

Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document has not been reviewed by the Securities and Futures Commission.

HSBC Global Asset Management is the brand name for the asset management business of HSBC Group. The above communication is distributed in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited.

Copyright © HSBC Global Asset Management (Hong Kong) Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management (Hong Kong) Limited.

Content ID: D043448; Expiry date: 31.12.2025