Asia’s resilience amid global uncertainties

Key takeaways

- Although Asian economies continue to face external growth headwinds, the region’s improved external macro fundamentals and prudent policymaking help mitigate external vulnerabilities

- For China, its policy responses to US trade tensions aim for long-term resilience and growth, while India’s low goods exports to GDP share and strength in the services trade make the country relatively well positioned to deal with global trade disruptions

- Within the financial markets in the region, Chinese equities are supported by ongoing domestic policy support and breakthroughs in artificial intelligence (AI) in the country. The asset class is also attractively valued both historically and relatively, with steep discounts versus developed and emerging markets

- Meanwhile, the Indian equity market is set to benefit from the Reserve Bank of India’s easing cycle, with positive implications for the financial, real estate and consumer sectors. Long-term investment themes also remain solid, including the country’s key role in global manufacturing, rising discretionary spending, and digitalisation initiatives

- At the same time, the India fixed income market is bolstered by a number of strong cyclical, technical and secular factors. It offers diversification benefits to global investors as its own set of drivers are often uncorrelated with those of developed markets

Source: HSBC Asset Management, May 2025

Asia macro: at the forefront of global trade shifts

Asian economies face external growth headwinds from global trade policy shifts, geopolitical uncertainties, and rising financial market volatility. However, the region’s improved external macro fundamentals help reduce external vulnerabilities. This is aided by a prudent policy mix of countercyclical stimulus to support growth and long-term strategies to strengthen macro resilience and financial stability. Asia will likely continue to benefit from strong global AI demand, which is driving demand for data centres across the region. The reshaping of global trade in a multipolar world presents potential long-term gains for Asia by diversifying trade relationships and implementing reforms to lower trade barriers, boost productivity and competitiveness, and unlock the full potential of domestic markets.

Risks and silver linings from the global trade reorder

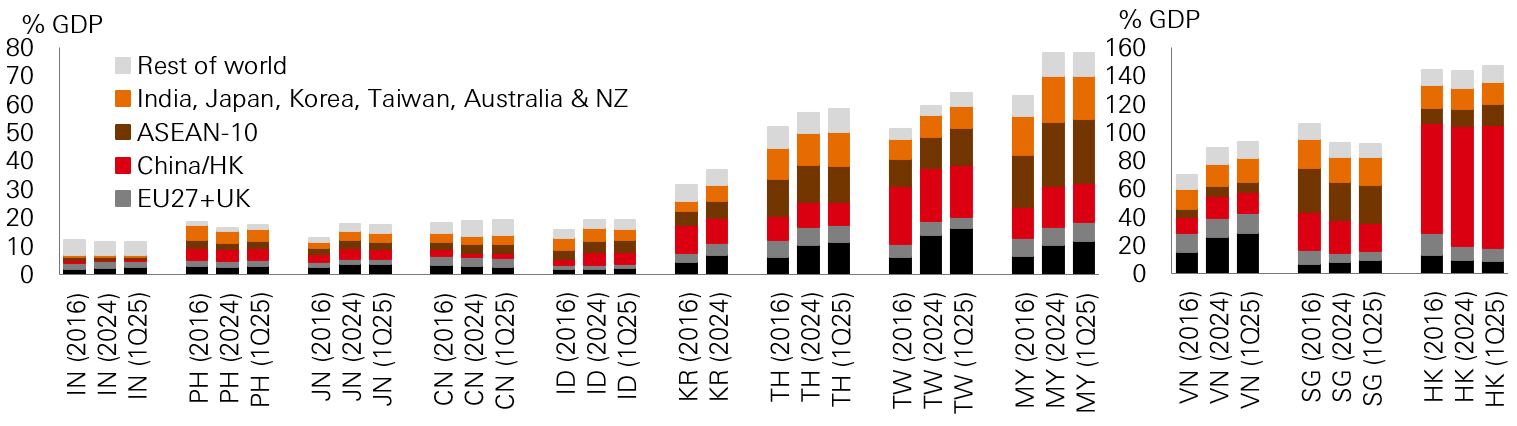

Global trade tensions and potential supply-chain disruptions are likely to have diverging effects on Asian economies, largely based on each economy’s reliance on US and global trade (Fig. 1) and the complexity of its exports. Trade negotiations with the US are progressing at varying speeds, given the complexity of issues at hand. Front-loading of shipments to the US and re-routing of exports from China have driven strong Asian exports in recent months, giving a temporary lift to overall growth. As such, sequential growth moderation is expected in H2 2025 due to payback after export front-loading, though AI demand is likely to remain a tailwind. Further, protracted external uncertainties would weigh on corporate investment and hiring plans, posing risks to capex and jobs in trade-exposed sectors.

Fig. 1: More trade-oriented economies face greater growth risks from persistent global trade uncertainty

That said, accommodative macro policies help cushion external risks. Most Asia economies have been diversifying trade and reconfiguring supply chains in recent years and are likely better positioned today to navigate evolving global trade/tariff dynamics, though the US remains a crucial market for Asian exports. There are potential silver linings in the medium to long term from the global trade reorder. Upside potentials could come from stronger regional economic cooperation and new trade opportunities through diversification of export markets, product upgrades (via technology & innovation), and new trade agreements, as well as renewed structural reform momentum to lift potential growth.

Sound external fundamentals

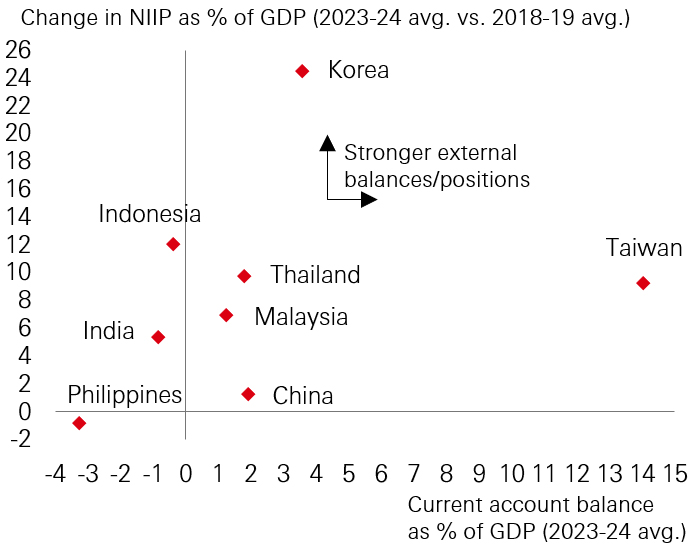

Increased global rate volatility and a higher US term premium could tighten Asia’s financial conditions, though the impact has been cushioned by a weaker USD – a trend that could continue as investors worry about US growth, high deficits, and an end of US exceptionalism. External fundamentals of many Asian economies have improved over the past few years, with smaller current account imbalances and improved foreign asset/net international investment positions (NIIP), reducing external vulnerabilities (Fig. 2). Foreign reserves provide a strong buffer against external shocks. There are potential tailwinds for Asian currencies from increased hedging of USD assets, forex conversion by exporters, and diversification flows into non-US assets, with FX a potential topic in US trade talks, though persistent global uncertainty could trigger further volatility.

Fig. 2: Improved external fundamentals

Source: CEIC, HSBC Asset Management, May 2025

Prudent policy supports aid macro resilience

A weaker USD eases the FX stability concerns and external constraint on policy rate cuts by Asian central banks. We see the scope for further monetary easing, given growth concerns, benign inflation, and high real rates and slower credit growth in many parts of the region. Tariff uncertainty could act as a demand shock and be disinflationary for Asian economies, as lower oil prices have helped disinflation and terms-of-trade gains for oil importers. Fiscal policy space varies as the Covid-19 pandemic left many economies with higher debt and less room for budget maneuvers. That said, overall manageable debt levels and fiscal prudence in Asia provide some fiscal space to increase and/or recalibrate spending. Policymakers are likely to remain agile, focusing on building resilience and lifting growth.

China’s policy put and long-term strategy

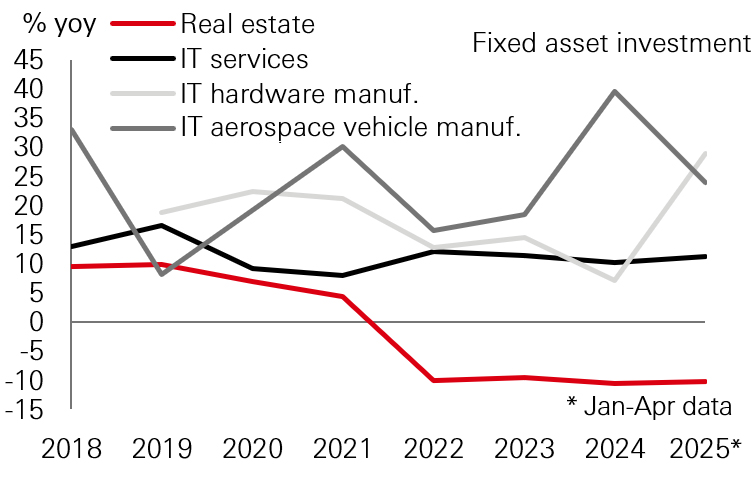

Activity data have held up so far, but the economic imbalance remains evident with industrial activities and exports showing stronger growth than domestic consumption. Retail sales of goods not included in the trade-in program have been subdued. Property activity weakness persists, as technology & innovative and new economy sectors (including services consumption) continue to show relative strength/resilience (Fig. 3).

Fig 3: Diverging investment trends

Source: CEIC, HSBC Asset Management, May 2025

The substantial US-China tariff de-escalation offers a temporary reprieve, having alleviated downside risks for the Chinese economy and reduced the urgency for imminent new stimulus. However, uncertainties linger over the US-China relationship. Policymakers may withhold additional major fiscal stimulus beyond annual budgets, baring any evidence of notable growth slowdown or re-escalation of trade tensions. That said, an uneven cyclical recovery and deflationary pressures stemming from persistent economic imbalances, excess capacity in some industries and the property downturn suggest that further targeted policy support is likely. We expect the PBoC to maintain a data-dependent approach with a preference for targeted easing over broad measures.

China’s policy responses to US trade tensions also aim for long-term resilience and growth, with an emphasis on supply-chain resilience through enforcing self-sufficiency in high-tech/strategic industries and expanding regional alliances/global partnerships, alongside a structural focus on boosting domestic consumption. Accelerating AI adoption and tech innovation will help raise productivity growth in the coming years (see more on page 4).

Cyclical recovery and structural opportunities in India

We believe India is relatively well positioned to deal with global trade disruptions given its low goods exports to GDP share and strength in services trade. India stands to gain from global supply chain diversification, given its large labour force and consumer base, improving infrastructure, and “ease of business” economic reforms, particularly as the country implements policy changes to lower trade barriers, relax the FDI policy, reduce regulatory impediments, lower logistics costs and boost labour productivity. India has struck a trade agreement with the UK after three years of negotiations. The deal will boost bilateral trade and strengthen the strategic partnership, set the path for India's deeper integration in the global supply chains, and it also signals India’s “open for business” policy approach. It may also help to set the broad contours of a potential deal with the US and EU later.

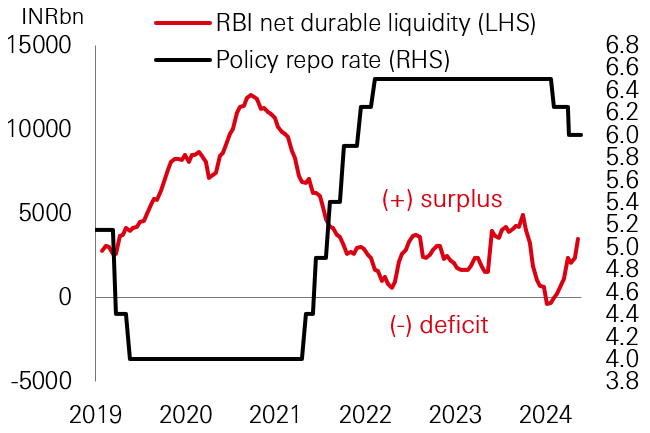

Fig. 4: Monetary easing to support growth

Source: CEIC, HSBC Asset Management, May 2025.

Macro data points to an ongoing modest, albeit uneven, cyclical growth recovery. Back-loaded government investment and a higher contribution of net exports (as imports contracted) drove a growth rebound in Q4FY25, supported also by steady rural consumption. Against an uncertain global backdrop, the Reserve Bank of India (RBI) has delivered policy rate cuts, liquidity infusion, and macro-prudential easing to support the economy amid easing inflation. Further monetary support will be data dependent. We expect income tax relief, rate cuts, and benign inflation to lift purchasing power, which should aid a recovery in urban demand.

Chinese equities: policy and AI as key drivers for 2025

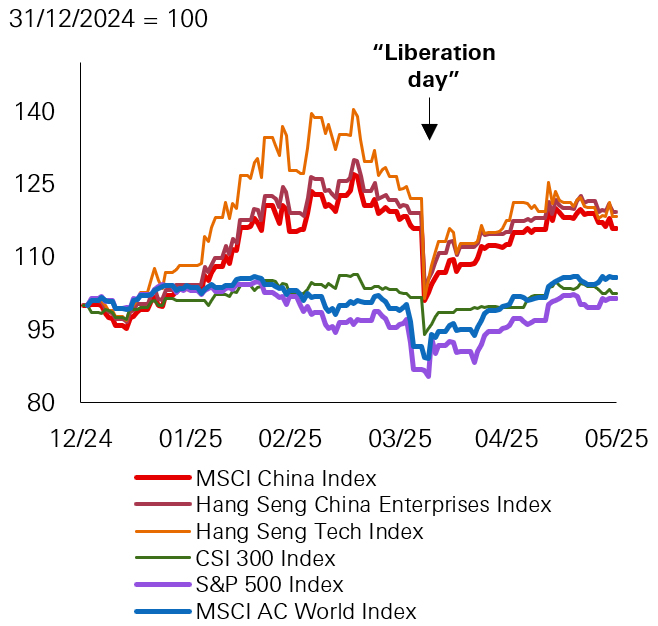

Amid global market volatility year-to-date, Chinese equities have been more resilient compared to other major markets even though China has been the key focus of the additional tariffs from US (Fig. 5). Chinese equity market drivers include domestic policy support, southbound capital flow into Hong Kong-listed equities, and breakthroughs in artificial intelligence (AI) in the country. Amongst Chinese equities, those listed offshore (e.g., Hong Kong- and US-listed Chinese companies) have outperformed onshore equities (e.g., A-shares) this year due to their higher exposure to AI and technology related themes. Overall, the de-escalation of trade tensions between the US and China in the middle of May has been positive for Chinese equities, but negotiations remain uncertain and global market volatility is expected to continue.

Fig. 5: Strong relative year-to-date performance of China equities

Indices shown are in total return USD terms.

Source: Bloomberg, MSCI, 30 May 2025

Policy support

We believe that the outlook for Chinese equities remains intact. The ongoing stimulus efforts by policymakers should mitigate adverse external shocks to the economy. Sweeping monetary policy measures were announced in May, including a 10bp reduction in the policy rate (seven-day reverse repo rate), 50bp RRR cut, and the lowering of relending rates – which supports agriculture and small and medium enterprises (SME).

Stock market stabilisation is also a key priority for policymakers, with the securities chairman pledging support for Central Huijin – a state-owned investment company – to play its role as a “quasi-stabilisation fund” through its A-share ETF purchases. Against this backdrop, companies with strong domestic presence are likely to be more favourable as they are less exposed to trade-related risks and benefit from China’s ongoing stimulus. These include consumer names, especially those tied to the service economy, internet and AI-related companies.

AI and innovation opportunities

AI advancements in the country have become major drivers, with longer term implications for earnings, valuations, and overall fundamentals of Chinese equity beneficiaries. The breakthrough of DeepSeek means Chinese companies have more room to increase corporate spending on AI infrastructure, and in the longer term, wider AI adoption could open possibilities for new business opportunities and revenue sources. At this stage, various segments in the tech sector that are likely to benefit from the expected accelerated adoption of AI include cloud platforms, application software, semiconductors, and devices. The tech sector in general is also supported by the localisation of certain products, such as AI chips, especially amid the potential further tightening of US tech exports to China.

In addition, we continue to stay positive on robotics and electric vehicles, and biotech – biotech is not impacted by tariffs and is an area that is seeing increasing venture capital investment and out-licensing deals.

Attractive valuations

Chinese equities are attractively valued both historically and relatively, with steep discounts versus developed and emerging markets (Fig. 6). Earnings revisions for Chinese equities have remained positive this year, with cooling trade tensions driving a recent pick-up. Global investor interest is on the uptrend, while Chinese equities’ low correlation with other major markets (at 0.35 vs developed markets)1 makes it a strong portfolio diversifier. Coupled with global investors’ light positioning, the attractive valuations and earnings potential could encourage more inflows and further drive the market.

Fig. 6: Chinese equities trade at a discount to developed and emerging markets

Source: Goldman Sachs Global Investment Research, April 2025.

Source: HSBC Asset Management, May 2025.

Indian equities: Seeking alpha amid easing cycle

With the Reserve Bank of India (RBI) in an easing cycle, the Indian equity market is set to benefit, with positive implications for the financial, real estate and consumer sectors. The RBI is anticipated to continue to cut this year, with the move aimed to stimulate economic growth.

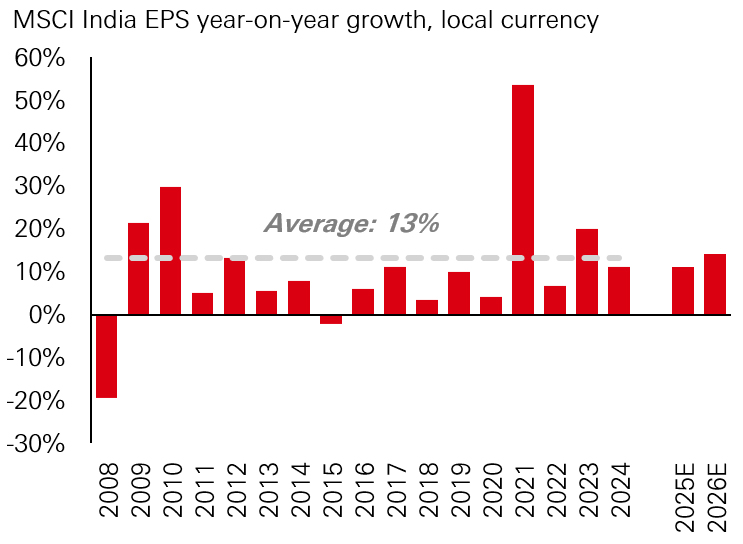

On the back of the easing cycle, earnings downgrades of Indian equities have slowed down – this follows several quarters of downward earnings revisions due to global uncertainties, domestic demand weakness, and slower credit growth. The landscape is now stabilising, with key factors such as improved consumer sentiment, policy measures by the central bank, and better-than-expected inflation data supporting the economic outlook. Indian equity earnings is expected to expand at 11 per cent in 2025 and 15 per cent in 2026 (Fig. 7). It should be noted that earnings have historically been a major driver of market returns. Meanwhile, following the recent periods of correction, relative valuations have moderated substantially, with India’s premium over Asia and emerging markets now coming closer to their medium-term averages. Returns of MSCI India and the NIFTY Index, in USD terms, have rebounded by 17.5 per cent and 16.2 per cent respectively, as of 26 May, since the 28th February trough this year.2

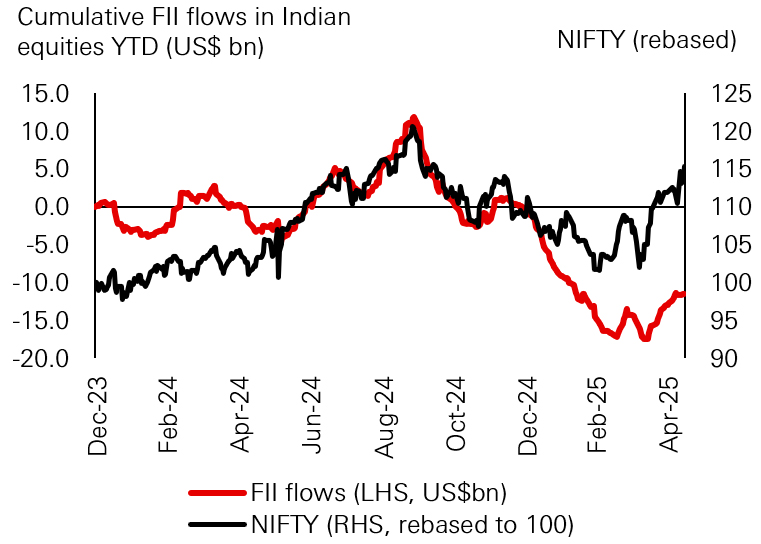

At the same time, foreign investors have turned net buyers of Indian stocks, pouring in USD 2.4bn in the last two months (Fig. 8). This appears to be a reversal of the foreign investor outflow trend that had started in October 2024 and signifies a pivotal turning point for the market. Despite global uncertainties and market volatility, many of the long-term investment themes for Indian equities remain solid – these include India’s key role in the global manufacturing landscape, its significant investment in infrastructure, rising discretionary spending among consumers, and transformative digitalisation initiatives. Renewed international investor interest underscores India's economic resilience and plays a critical role in driving market momentum.

In the midst of cross border tensions, one of the positive geopolitical developments for the market has been the India-UK trade deal announced in early May (see more on page 3). The deal can be thought of as a part of India’s broader structural reform agenda, which also goes hand in hand with the government’s focus on increasing foreign direct investment (FDI) and ease of doing business policies. Potentially, areas such as electronics, apparel, footwear, and services could benefit in the longer term.

We continue to monitor potential risks to the market, including domestic economic growth, foreign investor rotations between India and China equities resulting from potential China policies, as well as US policies – though India’s domestic orientation means its risks in this area are relatively limited versus other major markets.

Fig. 7: Earnings growth remains solid

Source: Goldman Sachs, May 2025

Fig. 8: Foreign investors returning to India

Source: Goldman Sachs, May 2025

We maintain a preference for large cap stocks with robust earnings growth, such as financials – including private sector banks, non-banking financial companies and structural domestic positions in asset management companies, real estate – supported by an upcycle in real estate demand, and healthcare – where tariff risks have been sufficiently priced in at this point. We also like consumer sectors (staples and discretionary), preferring food and beverages and household and personal product companies within consumer staples.

Source: HSBC Asset Management, May 2025

India fixed income: Benefiting from cyclical, technical and secular tailwinds

Strong supportive factors

The India fixed income market is currently being supported by a number of cyclical, technical and secular factors. First, cyclically, inflation – with April CPI coming in at 3.16 per cent – is well below the RBI target, indicating stable price pressures particularly in food prices, which should help maintain a benign rates environment. Following the recent rate cut in June, the RBI is expected to uphold a prudent policy stance and ensure sufficient liquidity in the financial system to support the economy. The central bank has also implemented various measures to boost credit flow and support the bond market, including open market operations (OMOs).

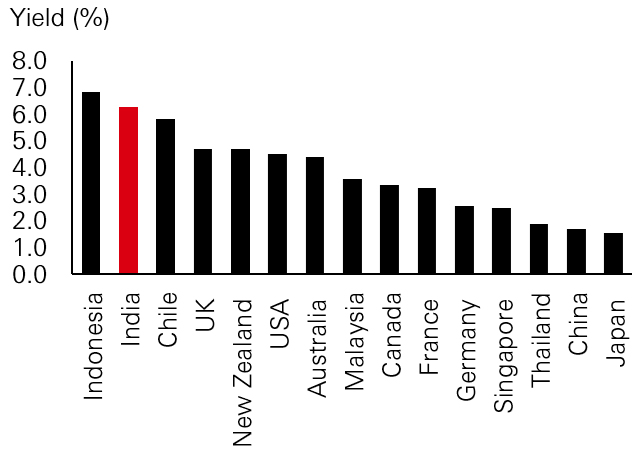

Second, on the technical front, India's fixed income market stands out for offering some of the highest yields among major economies (Fig. 9). Additionally, the bond market continues to be supported by inflows – while the JPMorgan index inclusion period has concluded, FTSE is set to start adding India bonds into its emerging market indices in September of this year. Despite the slowdown in the last few months, year-to-date foreign inflows into the Fully Accessible Route (FAR) has totaled USD 4.4bn (as of 27 May); foreign investors have bought a net total of USD 23.8bn in India bonds since the JPMorgan index inclusion announcement in September 2023.3

Fig. 9: India bonds – compelling yields

Source: Bloomberg, data as of 26 May 2025.

Third, amid the uncertainties in US trade policy, the Indian economy is distinguished by its unique growth trajectory, driven by robust domestic consumption, a diverse industrial base, and ongoing structural reforms, setting it apart from developed markets. This is positive for India bonds as they’re backed by favourable macroeconomic dynamics. For instance, the Indian rupee has shown considerable resilience in the face of global volatility, helped by the RBI’s strong foreign exchange reserves of over USD 680bn, which provides a buffer against external shocks and supports the currency's stability. In addition, India’s fiscal position has improved, with a better-than-expected fiscal deficit print, reinforcing investor confidence in the country’s macro-economic management. Further, the recent RBI dividend payout to the government, which was significantly higher than expectations, has strengthened the fiscal outlook, providing additional policy space for infrastructure and growth-oriented spending. Expectations of softer crude oil prices are likely to support the current account and the INR in the near term.

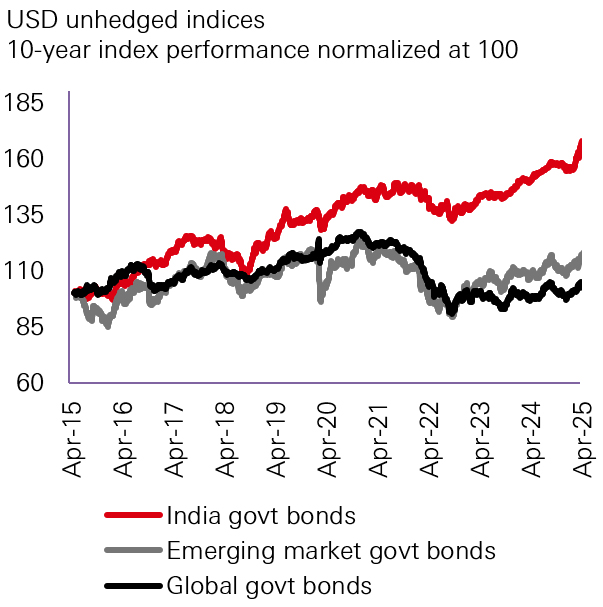

Fig. 10: India bonds: relatively solid performance

Source: RBI, Bloomberg, data as of May 2025

Continued case for diversification

India's fixed income market potentially offers diversification benefits to global investors, which is particularly valuable in times of global economic uncertainty. The market has its own set of drivers that are often uncorrelated with those of developed markets, thereby helping to reduce overall portfolio volatility and improve risk-adjusted returns (Fig. 10). The relatively low correlation with global bond markets (at only 0.13 over the last 10 years)4 strengthens the case for diversification.

We remain positive on our outlook on Indian bonds, expecting interest rates to move lower. We see opportunities in both India government bonds and INR corporate bonds. We prefer top INR supranationals, which offer reasonable carry, diversification and higher credit quality. There are also opportunities in USD bonds of Indian issuers, as they can take advantage of the high US Treasury yields. Many issuers participate in both INR corporate issuances and USD denominated bonds, enabling investors to strategically allocate between the two markets based on relative value and arbitrage opportunities.

Source: HSBC Asset Management, May 2025.

This commentary has been produced by HSBC Asset Management to provide a high level overview of the recent economic and financial market environment, and is for information purposes only. The views expressed were held at the time of preparation; are subject to change without notice and may not reflect the views expressed in other HSBC Group communications or strategies. This marketing communication does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. The content has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. You should be aware that the value of any investment can go down as well as up and investors may not get back the amount originally invested. Furthermore, any investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in established markets. Any performance information shown refers to the past and should not be seen as an indication of future returns. You should always consider seeking professional advice when thinking about undertaking any form of investment. This communication has not been reviewed by the Securities and Futures Commission.

Past performance does not predict future returns. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. Diversification does not ensure a profit or protect against loss. For illustrative purposes only.

Note: Q1 nominal GDP data is not yet available for Korea. Source: CEIC, HSBC Asset Management, May 2025

Note 1: Comparison between MSCI China and MSCI World in USD terms, using weekly returns over a 5-year period; source is Bloomberg, MSCI, as of May 2025.

Note 2: Source is Bloomberg as of 26 May 2025.

Note 3: National Securities Depositary Limited (NSDL) as of 27 May 2025.

Note 4: Using Markit ALBI India Index and FTSE World Government Bond Index, based on daily returns, over 10 years. Source is Bloomberg, May 2025.

Important information

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Global Asset Management Global Investment Strategy Unit at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

We accept no responsibility for the accuracy and/or completeness of any third party information obtained from sources we believe to be reliable but which have not been independently verified.

Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document has not been reviewed by the Securities and Futures Commission.

HSBC Global Asset Management is the brand name for the asset management business of HSBC Group. The above communication is distributed in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited.

Copyright © HSBC Global Asset Management (Hong Kong) Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management (Hong Kong) Limited.

Content ID: D046825; Expiry Date: 31.12.2025