The strength and stability in the earnings of US companies allow for better dividend income potential versus other regional markets. This helps to defend against inflation and risks brought about by higher interest rates

The strength and stability in the earnings of US companies allow for better dividend income potential versus other regional markets. This helps to defend against inflation and risks brought about by higher interest rates

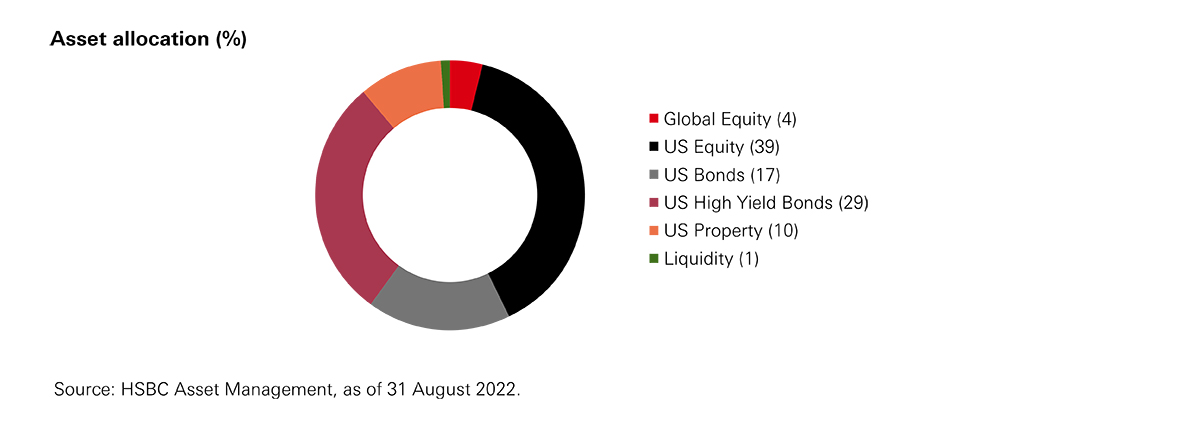

The Fund invests across asset classes and sectors in both US and non-US markets, opening up broader opportunities while managing volatility. It can also flexibly invest in contingent convertible bonds, asset backed securities, REITs and covered calls to enhance the yield potential

The Fund invests across asset classes and sectors in both US and non-US markets, opening up broader opportunities while managing volatility. It can also flexibly invest in contingent convertible bonds, asset backed securities, REITs and covered calls to enhance the yield potential

The Fund seeks to provide an appealing potential income stream. The latest annualised dividend yield of Class AM2 (as of August 2022) is 5.32%1 (dividend is not guaranteed and may be paid out of capital)

The Fund seeks to provide an appealing potential income stream. The latest annualised dividend yield of Class AM2 (as of August 2022) is 5.32%1 (dividend is not guaranteed and may be paid out of capital)

1 Source: HSBC Asset Management, data as of 31 August 2022. Dividend is not guaranteed and may be paid out of capital, which will result in capital erosion and reduction in net asset value. A positive distribution yield does not imply a positive return. Past distribution yields and payments do not represent future distribution yields and payments. Historical payments may be comprised of both distributed income and capital. The calculation method of annualised yield: ((1+ (dividend amount/ ex-dividend NAV))^12) – 1. The annualized dividend yield is calculated base on the dividend distribution on the relevant date with dividend reinvested, and may be higher or lower than the actual annual dividend yield.