Why India? A bright spot for investors

The Indian Decade

Today, no investment discussion would be complete without a look at India:

- India is now the world’s fastest growing major economy1

- It is predicted to become the third largest economy as early as 20301

- India’s equity market emerged as the fifth largest equity market in the world2

- Indian bonds will be added to major global emerging market indices in the coming year3

Analysts believe the conditions are in place for a sustained, world-leading growth cycle, as India gains power in the world order. This, many say, will be the Indian Decade.

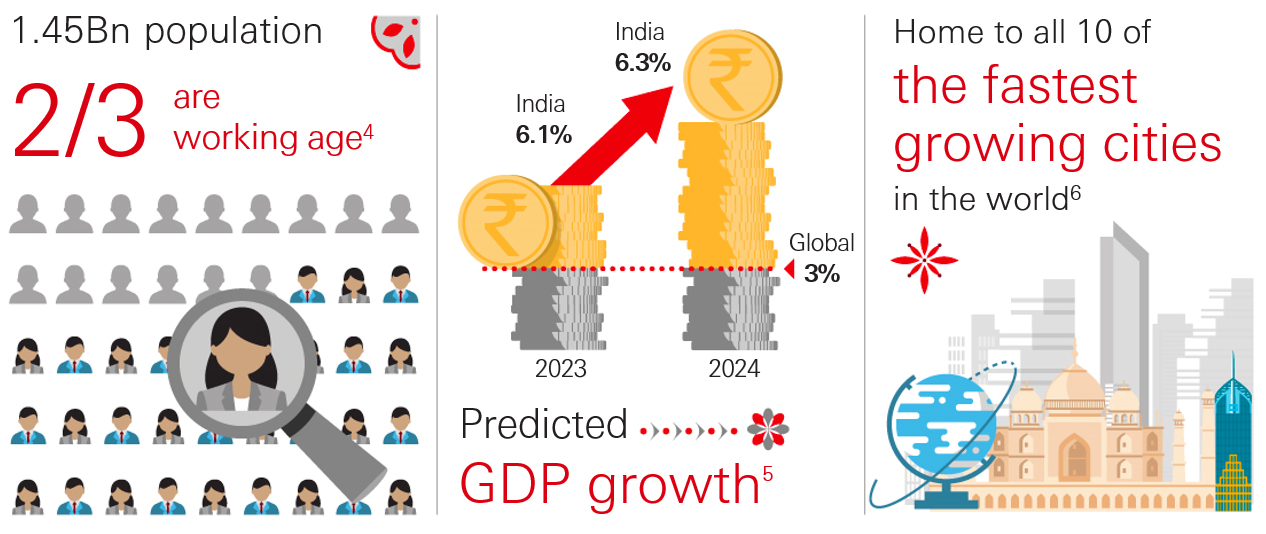

India's growth story in numbers

India’s growth story is built on number of distinctive characteristics, from inherent advantages to new drivers.

Source: 1IMF, World Economic Outlook, July 2023, 2Bloomberg, 30 June 2023, 3JPMorgan, 21 September 2023, 4United Nations Population Fund, September 2023,

5IMF database, GDP Data from July 2023 World Economic Outlook Update, 6Oxford Economics, based on current and predicted GDP 2019-2035

Past performance is not an indication of future returns. Any forecast, projection or target where provided is indicative only and is not guaranteed in anyway. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets.

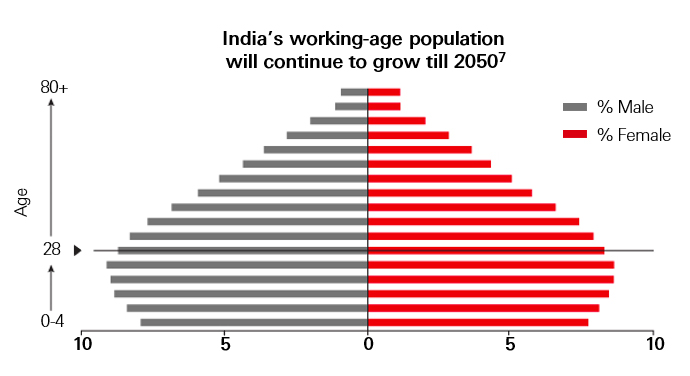

Driver no. 1 – The world’s strongest demographic dividend

Human capital

First on our list is an extremely large and youthful population.

India currently has a population of over 1.45 billion, and nearly 2/3 of them are working age.

That means India has far and away the world’s biggest workforce. While many countries face the challenges of supporting an aging population, India is a country primed for productivity.

|

|

|

Demographic dividend: the economic boost that occurs when more of the population are in the workforce than out of it.

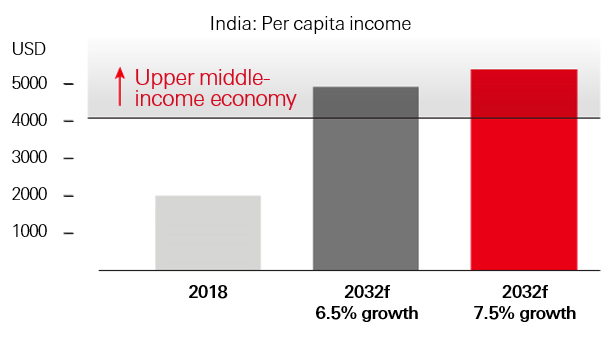

Consumer spending

That same workforce is also busy spending their hard-earned cash.

Post-pandemic consumer spending is up, driven by the young population, expanding middle class and growing number of high-net-worth individuals.

|

India is set to move to upper middle income status by 20328 |

|

|

|

|

Source: 7United Nations, HSBC Global Research, data as of May 2023, 8HSBC Global Research, data as of May 2023, 9Economic Times, May 2022, 10Statista, May 2023,

11Economic Times, August 2023

Past performance is not an indication of future returns. Any forecast, projection or target where provided is indicative only and is not guaranteed in anyway. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets.

Driver no. 2 – Economic reforms

And it’s not just young workers boosting the economy. Over the last decade, the government has launched a number of economic reforms and programmes designed to boost business.

These have contributed to a highly diverse and profitable corporate universe, and attracted billions of dollars of foreign direct investment.

|

Make in India The aim of the Make in India programme is to turn the country into a global manufacturing hub with reforms such as tax breaks and manufacturing incentives. Many MNCs looking to diversify their supply chain have already made the move to India. |

|

|

Investment in infrastructure The Indian government is channelling significant funds into improving the country’s transport links. These improvements are further boosting India’s manufacturing competitiveness, making transporting supplies and end products cheaper and faster. |

|

|

Digitalisation India is a connected nation. Driven in part by the Digital India initiative, adoption of digital technologies has been rapid. And digitalisation benefits business. In India, it is increasing economic effciency and competitiveness, creating new businesses, boosting financial inclusion and improving governance. |

|

|

Startup India Innovation and entrepreneurship are thriving in India. This is in part thanks to initiatives such as Startup India, offering budding businesses thematic funds, incubation programs, and tax benefits. |

|

|

A shift to clean energy India is renowned for its use of fossil fuels but that’s all changing with some bold energy transition plans. And those plans mean new business opportunities. The transition is expected to create investment opportunities worth over USD 720 billion by the year 2030.15 |

|

Source: 12Indian Ministry of Commerce and Industry, June 2023, 13MyGovIndia, June 2023, 14Invest India, May 2023, 15International Energy Agency (IEA), January 2022,

16India’s Ministry of Environment, Forest and Climate Change, August 2023

Driver no. 3 – Macro resilience

Globally, the economic outlook is rocky at best. And for the most part, challenges in one economy mean challenges in another.

However, India’s economy is relatively insulated from the diffcult external environment – our third critical factor in the country’s ongoing growth story.

|

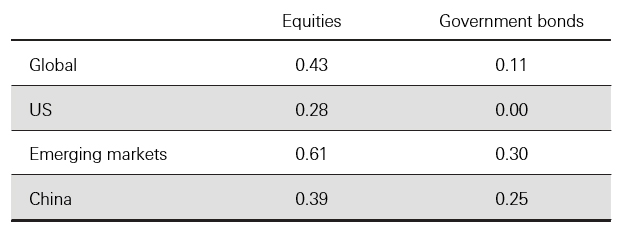

A domestically-focused market The Indian equity and fixed income markets remain relatively domestically oriented. This results in a lower correlation to broader global and emerging market sentiment. Correlation between India and other markets17

This means adding Indian assets to a global portfolio could provide important diversification benefits. |

Services exports What’s more, a surge in India's services exports is expected to further shield the economy, countering any drop in the country's merchandise exports.

|

Source: 17Bloomberg. Data are daily correlation between respective indices for the past ten years to 30 September 2023. Indices used: MSCI India Index (Indian equities), MSCI AC World (global equities), S&P 500 (US equities), MSCI Emerging Markets (emerging market equities), MSCI China (Chinese equities), Markit iBoxx ALBI India TRI Unhedged USD (India government bonds), FTSE World Government Bond Index USD (global government bonds), Bloomberg US Treasury Total Return Unhedged USD (US government bonds), JP Morgan GBI-EM Global Diversified Composite Unhedged USD (emerging market government bonds), and FTSE Chinese Government Bond USD Index (China government bonds). Past performance is not an indication of future returns, 18The World Bank and World Trade Organization, July 2023.

Why now?

In today’s climate of global uncertainties, diversification is critical.

And the Indian economy’s unique combination of economic drivers make it a top destination.

In a world starved of growth, global investors should not overlook the opportunities offered by India.