HSBC Global Funds ICAV – Index Fund Series

Important Information

- HSBC Global Funds ICAV - US Equity Index Fund invests in equity securities which are constituents of S&P 500 Net Total Return Index (“the Index”). The Fund may also invest in an equity security in advance of the equity security becoming an Index constituent. The securities in which the Fund invests will be listed or traded on Recognised Markets in the US. The Fund will adopt a full replication strategy by aiming to hold all of the stocks included in the Index in the same proportions in which they are included in the Index. The Fund is subject to the concentration risks of investing in a single market and/or substantial investments in securities issued by a single issuer.

- HSBC Global Funds ICAV - Global Equity Index Fund invests mainly in equity securities which are constituents of MSCI World Net Total Return Index (“the Index”) and equity security in advance of the equity security becoming an Index constituent. If the overall portfolio matches the characteristics of the Index, the Fund may also invest in non-Index constituents.

- HSBC Global Funds ICAV - Global Aggregate Bond Index Fund invests mainly in constituents of Bloomberg Barclays Global Aggregate Bond Index (total return hedged to USD): bonds, Asset Backed Securities (“ABS”), Mortgage Backed Securities (“MBS”), Commercial Mortgage Backed Securities (“CMBS”) and Covered Bonds all of which may be callable.

- HSBC Global Funds ICAV - Global Corporate Bond Index Fund invests mainly in corporate bonds, ABS and MBS all of which are constituents of Bloomberg Barclays Global Aggregate Corporate Bond Index (total return hedged to USD) and may be callable.

- HSBC Global Funds ICAV - Global Emerging Market Government Bond Index Fund invests fixed income securities which are constituents in JP Morgan EMBI Global Diversified Index (total return) (the “Index”), certain securities in the portfolio are not Index constituent securities is permitted. The Fund is subject to the risks of investing in emerging markets.

- HSBC Global Funds ICAV - China Government Local Bond Index Fund invests fixed income securities which are constituents in Bloomberg Barclays China Treasury and Policy Bank 9% Capped Bond Index (total return) (the “Index”), certain securities in the portfolio are not Index constituent securities is permitted. The Fund is subject to the risks of investing in emerging markets, and may involve substantial index concentration risk, new index risk, risks associated with CIBM and Bond Connect, mainland China tax and currency risks, mainland china market risks.

- For HSBC Global Funds ICAV - Global Aggregate Bond Index Fund and Global Corporate Bond Index Fund, if the overall portfolio matches the characteristics of the Indexes, the Funds may also invest in non-Index constituents, included non-Investment grade bonds which may be callable. ABS, MBS, CMBS, unrated bonds, and non-investment grade bonds which are callable bonds may subject to additional risks and volatility. The Funds are also subject to the risks of investing in emerging markets.

- The above Funds are passively managed index funds. Unlike “actively managed” unit trusts and mutual funds, the manager will not have the discretion to adapt to market changes due to the inherent investment nature of the Funds. A fall in their tracking indexes (“the Indexes”) will result in a similar fall in the net asset value of the Funds.

- Changes in the net asset value of the above Funds are unlikely to exactly replicate changes in the Indexes. The Funds’ returns may therefore deviate from those of the Indexes (known as “tracking error”) due to practical limitations as well as fees and expenses, amongst other reasons. Whilst the Funds will seek to minimize tracking error, there is no guarantee or assurance of exact replication of the Indexes.

- Because the above Funds’ base currency, investments and classes may be denominated in different currencies, investors may be affected adversely by exchange controls and exchange rate fluctuations.

- The above Funds may invest in financial derivative instruments for investment purpose which may lead to higher volatility to its net asset value.

- The above Funds’ investments may involve substantial credit, currency, volatility, liquidity, tax, interest rate, sovereign and political risks. Investors may suffer substantial loss of their investments in the Funds.

- Unit trusts are NOT equivalent to time deposits. Investors should not invest in the above Funds solely based on the information provided in this document and should read the offering documents of the Funds for details.

HSBC Global Funds ICAV

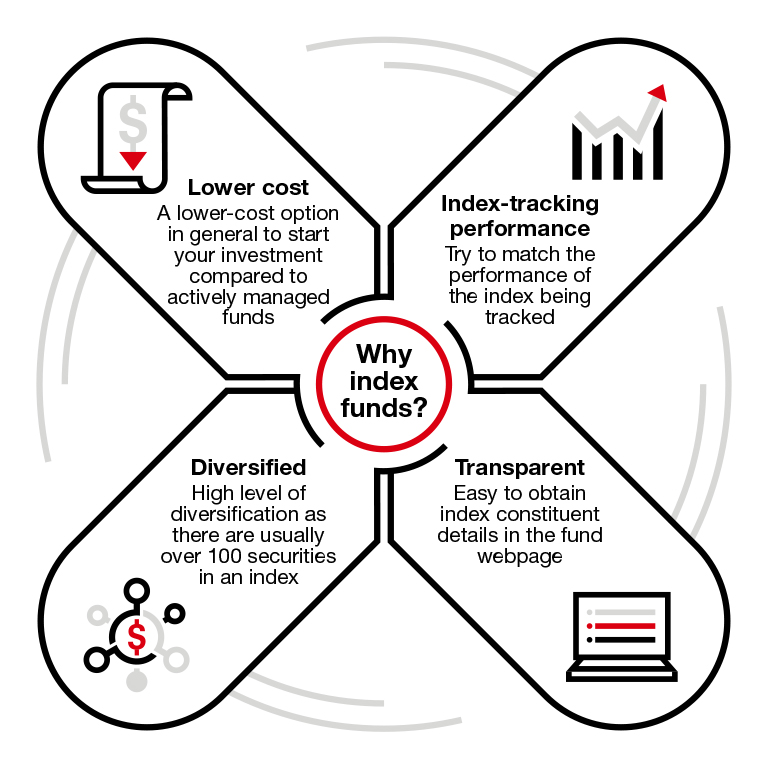

An array of index funds that help diversify your portfolio through exposure in different regions or sectors in a lower-cost way

Exclusively on HSBC FlexInvest

Why index funds?

Two-minute videos on index funds

Why these markets now?

Why China Government Local Bonds now?

-

Onshore RMB bonds lowly correlated with other fixed income assets

China’s onshore bonds have low correlation with other fixed income assets worldwide, which is conducive to income sources diversification in a turbulent market. -

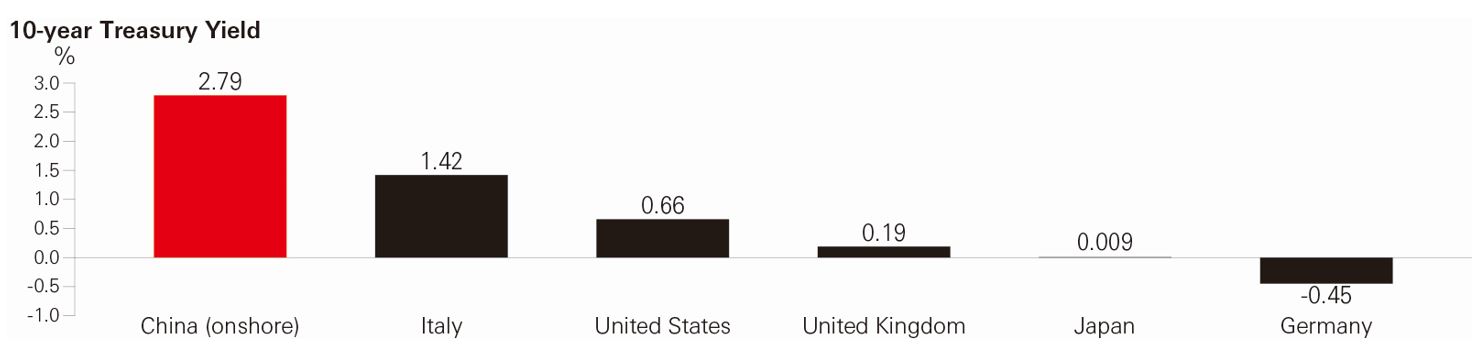

Provide attractive income in a low yield environment

The world’s major central banks have slashed their policy rates down to zero or negative, causing developed countries’ sovereign bond yields to plunge to record lows. In contrast, China’s RMB-denominated government bonds offer more attractive yield.

China’s government bond yield remains attractive to global investors

Source: Bloomberg, as of 15 June 2020. Past performance is not indicative of future performance

Why Global Aggregate Bonds now?

-

Including mortgage-backed security (MBS) to diversify portfolio’s income and risk

The MBS has a low correlation with risk assets such as equities and high-yield bonds. In a turbulent market, the MBS diversifies the portfolio’s risk and income sources. -

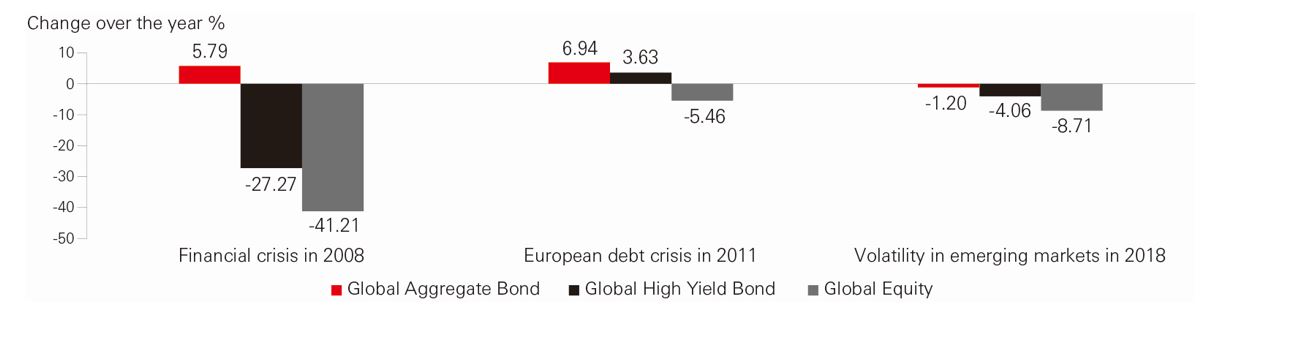

Global aggregate bonds remain steady in extreme market conditions

Historical data shows that in extreme market conditions, global aggregate bonds consistently outperformed risk assets such as equities and high-yield bonds.

Annual change of global equity and global bond indices

Source: Bloomberg, as of May 2020. Global Equity: MSCI World Index; Global High-Yield Bond: Bloomberg Barclays Global High Yield Index; Global Aggregate Bond: Bloomberg Barclays Global Aggregate Index. Past performance is not indicative of future performance

Why Global Corporate Bonds now?

-

Federal Reserve expands bond purchasing program to corporate bonds

The U.S. Federal Reserve has announced an unlimited quantitative easing program, with an expanded bond purchasing program that includes corporate bonds. -

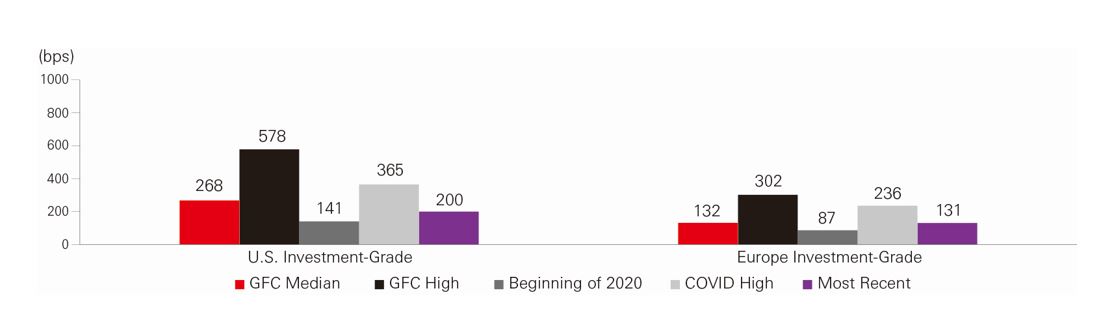

Investment grade bonds stabilised following price swings

The initial shock of the coronavirus outbreak caused the spreads of the US and Europe investment grade credits to touch a record high; but the spreads have later dropped back to the early 2020 level. It indicates that the investment grade bond market has stabilised following market turbulence.

Investment grade corporate bond spreads

Source: S&P Global Rating, as of 9 June, 2020

Why Global Emerging Market Government Bonds now?

-

Emerging market government bonds provide attractive income

Central banks of developed markets have launched sizable quantitative easing programs to bolster their economies, causing their government bond yields to fall. In contrast, emerging market government bonds can offer investors a more attractive income. -

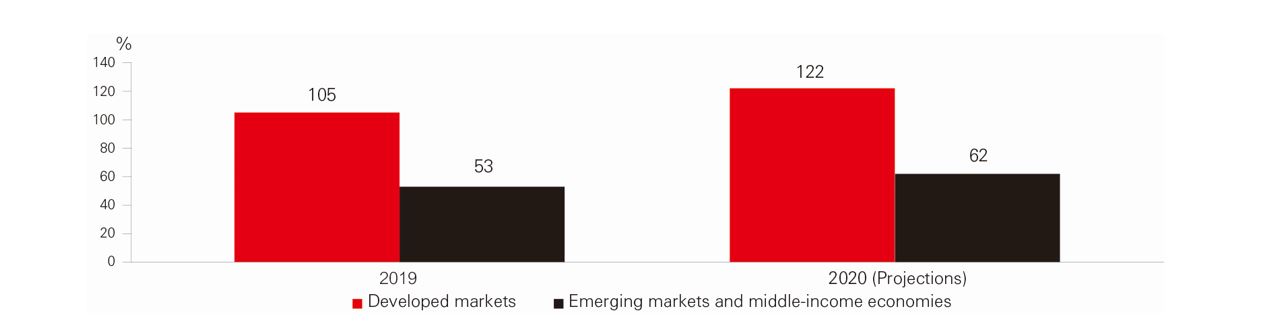

Emerging market has lower debt level than developed market

The gross public debt-to-GDP ratio in emerging market economies is substantially lower than the developed markets, indicating the emerging market’s relatively healthy credit fundamentals.

Emerging market’s lower public debt-to-GDP ratio

Source: International Monetary Fund (IMF), as of April 2020. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management Limited accepts no liability for any failure to meet such forecast, projection or target

Why Global Equities now?

-

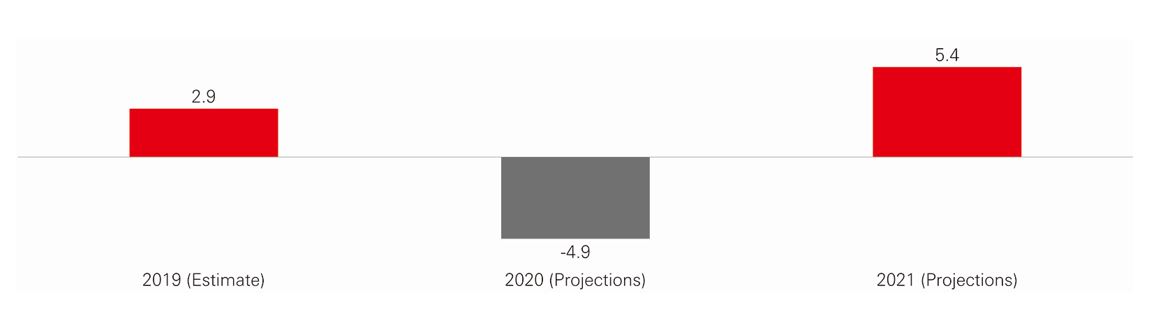

Global economy will likely see a strong rebound in 2021

Although the global economy is expected to shrink this year due to the coronavirus pandemic, if the disease can be contained in the second half of the year, the world’s economic activities will likely recover, as the forecast for next year predicts a 5.4%* economic growth. -

Governments increased spending to mitigate economic fallout

Governments worldwide have ramped up fiscal expenditure substantially to offset the pandemic’s impact on the real economy. The total global fiscal support currently stood at USD11 trillion.

Forecast for next year’s global economy predicts a strong rebound

Source: International Monetary Fund (IMF), as of June 2020. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management Limited accepts no liability for any failure to meet such forecast, projection or target

Why US Equities now?

-

Large-scale stimulus package shores up the U.S. economy

The US government has enacted sizable monetary and fiscal stimulus measures, which will bolster the country’s pandemic-stricken economy. -

A quick rebound from bear market

The coronavirus pandemic has plunged the US stocks into the bear market, but the market rebounded in a quicker turnaround than the 2008 Global Financial Crisis.

MSCI US performance

2008 Post Lehman / 2020

Sources: Bloomberg, HSBC Global Asset Management, as of 15 June 2020. For Illustrative purpose only

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.