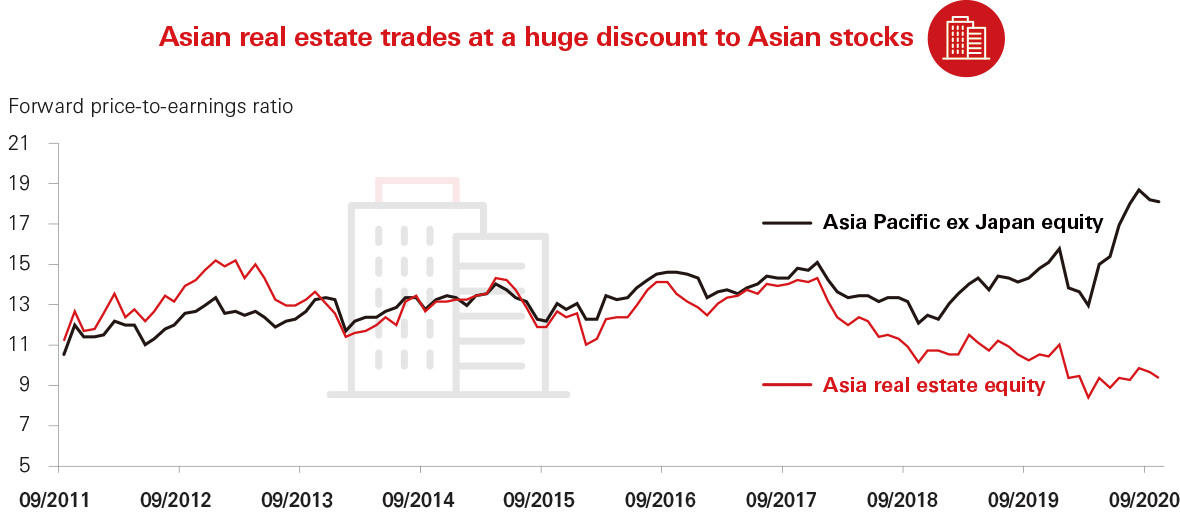

Asian equities are attractively valued and offer a source of potential growth and dividend income amid the global low-inflation and low-rate environment

Asian equities are attractively valued and offer a source of potential growth and dividend income amid the global low-inflation and low-rate environment

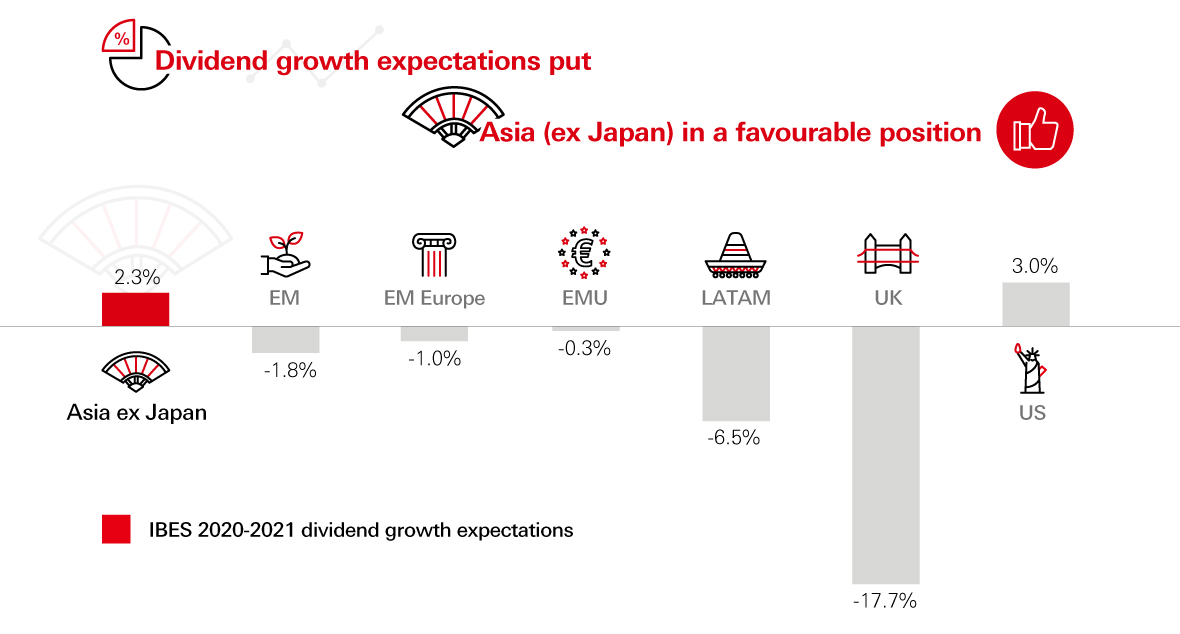

Dividend growth expectations for Asian equities remain relatively resilient amidst big cuts in other emerging markets and Europe

Dividend growth expectations for Asian equities remain relatively resilient amidst big cuts in other emerging markets and Europe

Source: HSBC Global Asset Management, Bloomberg, as of September 2020. Data is based on Asian equity dividend expectations for the respective markets. For illustrative purpose only. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management accepts no liability for any failure to meet such forecast, projection or target.