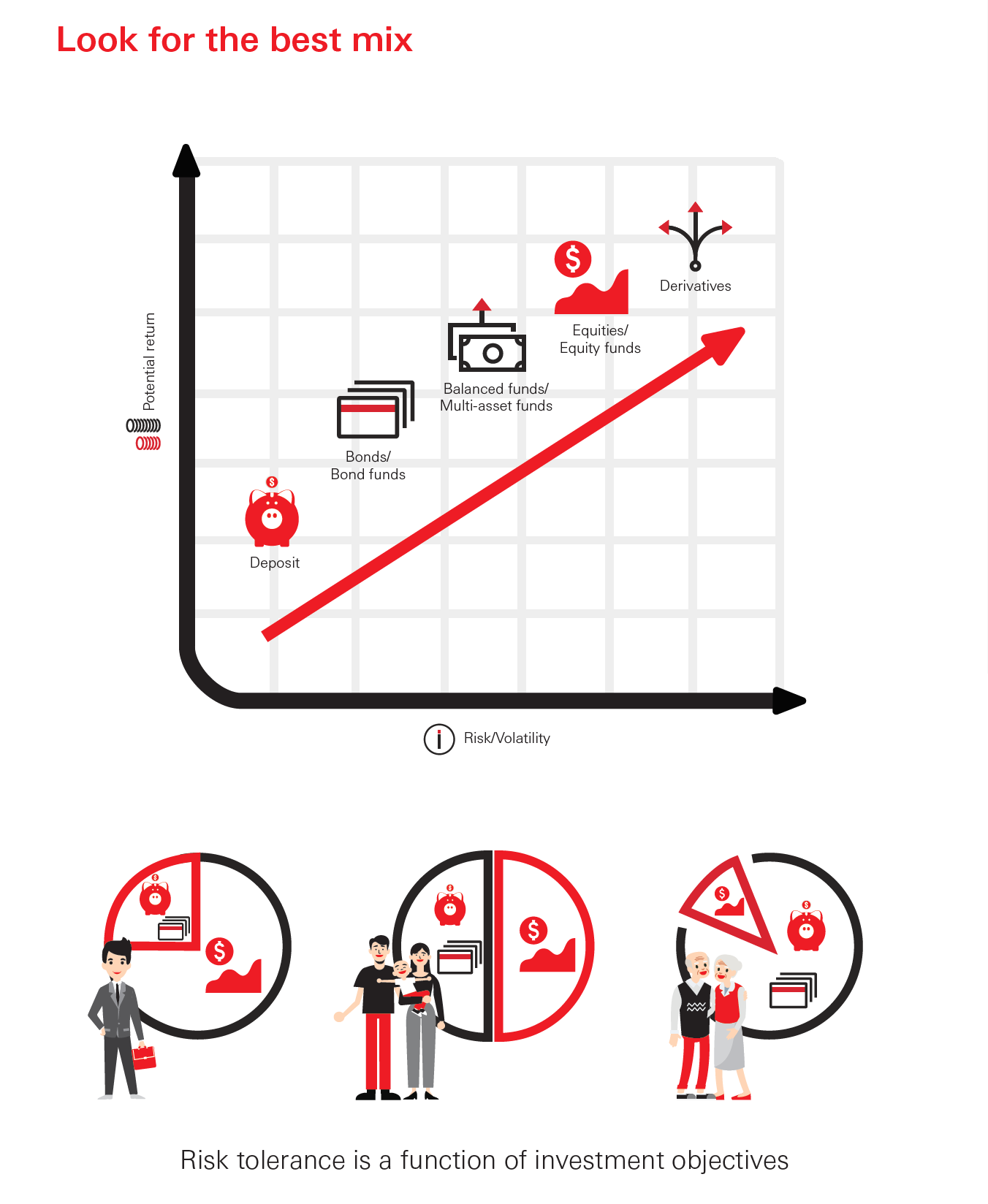

Step 1: Assess your risk tolerance

Conservative? Balanced? Aggressive? Which approach suits you?

Making the first step right is crucial to the long road of investments. Of the five steps, the first is to assess your risk tolerance and decide the most suitable asset allocation for yourself.

Different people have different attitudes towards investment. Some are not willing to take any risks or withstand losses, and therefore would rather forgo potentially higher returns. Some are willing to take some risks but tend to avoid huge volatility. Some are willing to take risks in exchange for returns that outperform the markets.

How to gauge one’s risk tolerance? Look at your investment horizon. Put it simply, the longer your investment life, the higher the risk you can take because you can afford the time to last a cycle, which helps smooth out short-term volatility. For instance, a young person just starts working, who is still far from retirement, can take more risk.

On the contrary, the shorter the investment period, the lower the risk one can take. Assuming you are going to retire next year, and not receiving any regular income, you just do not have the time to recover all losses if your investments take a nosedive all of a sudden.

Besides, your risk tolerance is dependent on your life goals. Ask yourself if you need to set aside funds for your children’s education? Are you going to buy a property in the near future? These factors will have an impact on your cashflow. After all, we all need to reserve some cash at all times just in case there are emergencies.