Rebalance your portfolio: restore the original allocation

Date: September 2020

Rebalance your portfolio: restore the original allocation

In the investing journey, investors should start o by constructing a portfolio that accommodates their investment objectives and risk profiles. However, setting up the initial asset allocation is merely a starting point. It is equally important to regularly rebalance the portfolio to ensure the asset weightings are consistent. Overlooking the need to rebalance the portfolio can prevent investors from achieving their long-term investment goals.

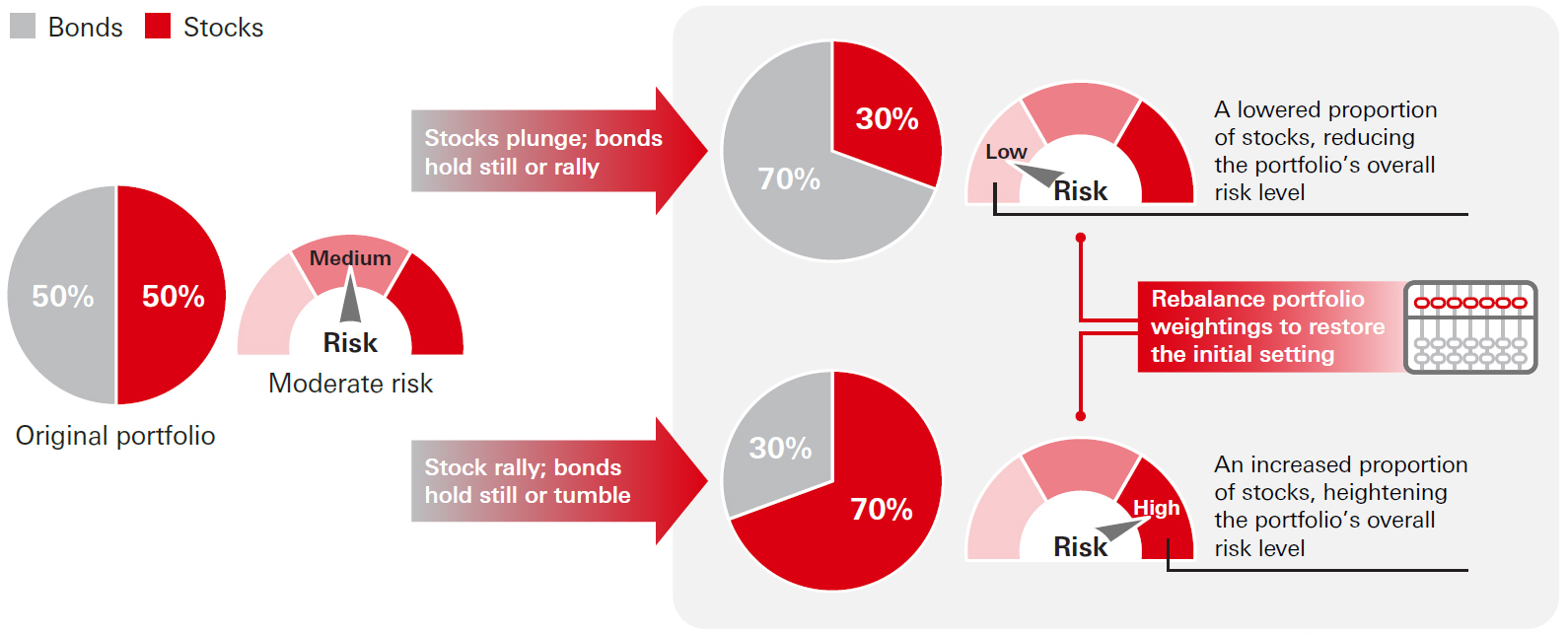

Market changes shift portfolio away from initial objective

In an investment portfolio, the relative weights of different asset classes may change due to market fluctuations, which lead to a shifted asset allocation that deviates from the original target. In this case, rebalancing the portfolio will mean restoring the weightings of portfolio assets to the original designed levels.

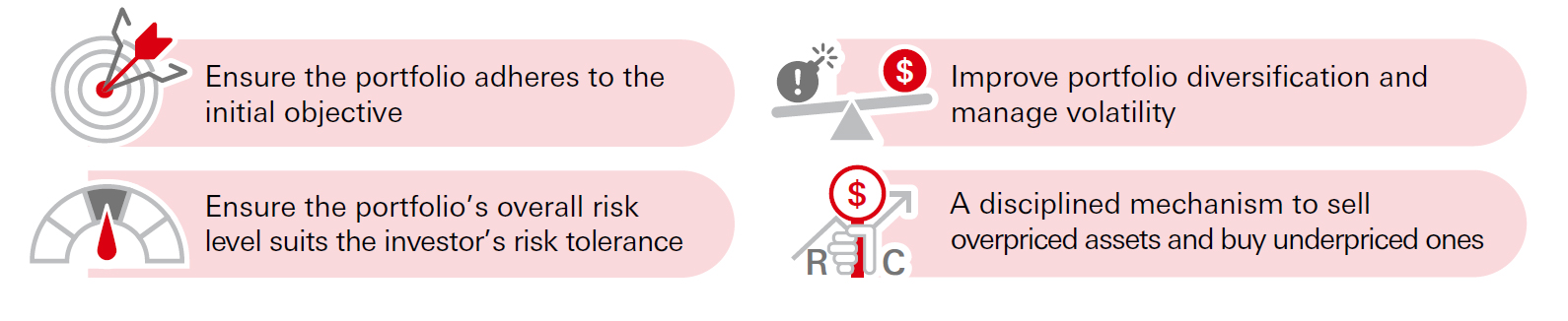

Portfolio rebalancing: four major advantages

Each asset class has its distinct risk characteristics (e.g., equities usually involve higher risk and potential returns than bonds). Hence, when a portfolio’s asset weightings deviate from the original arrangement, the portfolio’s overall risk profile will change accordingly. By restoring the asset allocation to the initial setting, there are four major advantages:

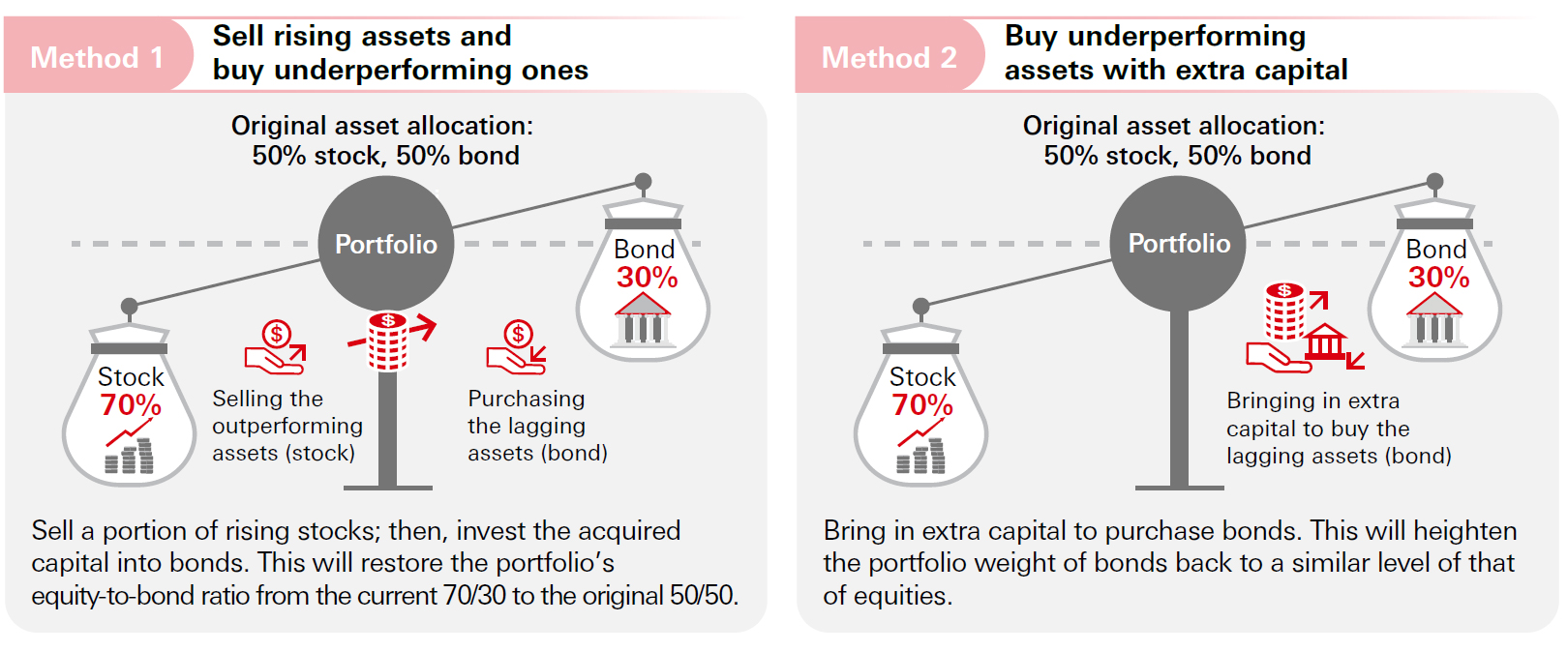

Two ways to get portfolio back on track

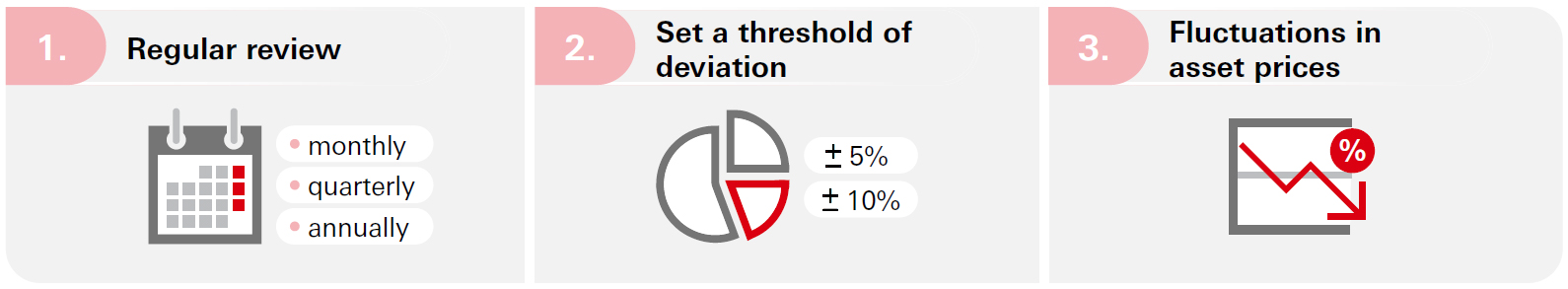

Is there a good timing to rebalance portfolio?

There isn’t a definitive good timing for rebalancing the portfolio. Investors can consider regularly reassessing their asset allocation. Alternatively, they can set a threshold of deviation, and rebalance the portfolio when the asset weighting deviates by a percentage that exceeds the threshold. Some other investors choose to rebalance their portfolios after significant market swings and sharp fluctuations in asset prices.

Hassle-free rebalancing that saves money and time

Managing and rebalancing the portfolio on your own help ensure a consistent asset weighting, but they also involve extra time and transaction costs. To avoid the tedious procedures and trading costs, investors can consider investing in multi-asset funds with a regular rebalancing mechanism that suit their investment objectives.

Disclaimer

This document is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management (Hong Kong) Limited (“AMHK”) accepts no liability for any failure to meet such forecast, projection or target. AMHK has based this document on information obtained from sources it reasonably believes to be reliable. However, AMHK does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document has not been reviewed by the Securities and Futures Commission.

Copyright © HSBC Global Asset Management (Hong Kong) Limited 2021. All rights reserved. This document is issued by HSBC Global Asset Management (Hong Kong) Limited.

y

y  y

y