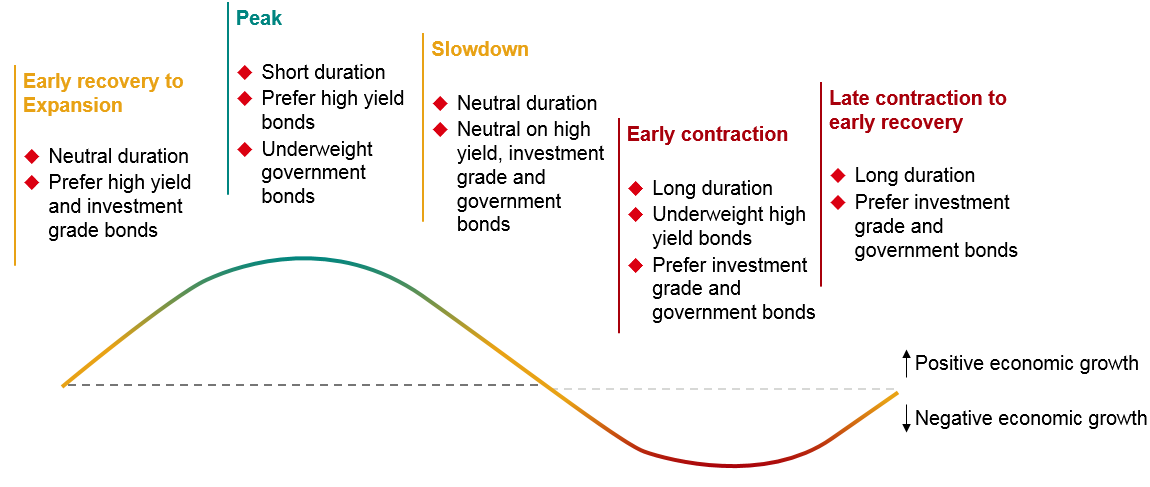

Fixed income strategies throughout an economic cycle

Date: April 2019

|

|

Source: HSBC Global Asset Management, April 2019. For illustrative purposes only. This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

y

y