Covered call strategy: Enhances income from stocks

Covered call strategy: Enhances income from stocks

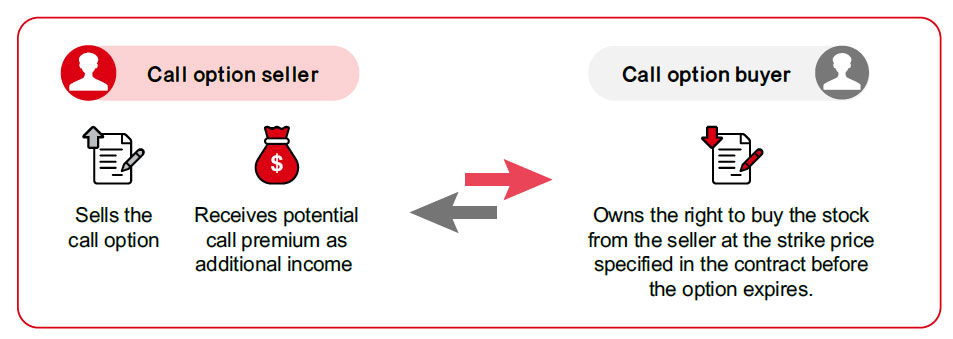

Covered call writing is one of the strategies to enhance potential income from stocks. With this strategy, fund managers broaden the income source for the funds. The idea is like this: by holding the stocks and selling the call options on the same assets, potential call premium can be received as an additional income.

How does a call option work?

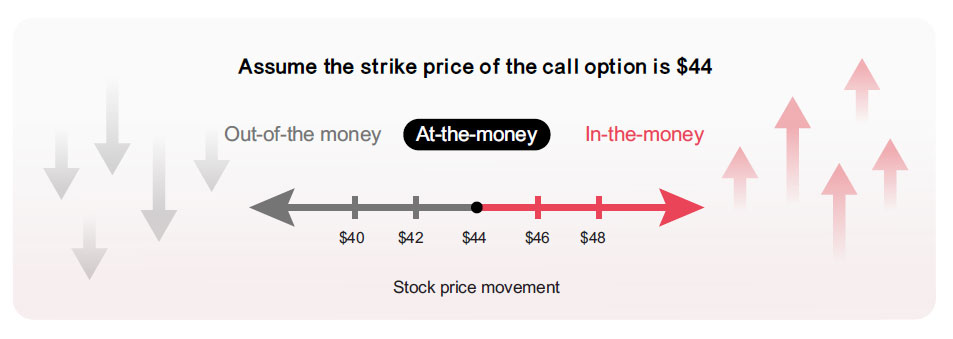

Call option outcomes

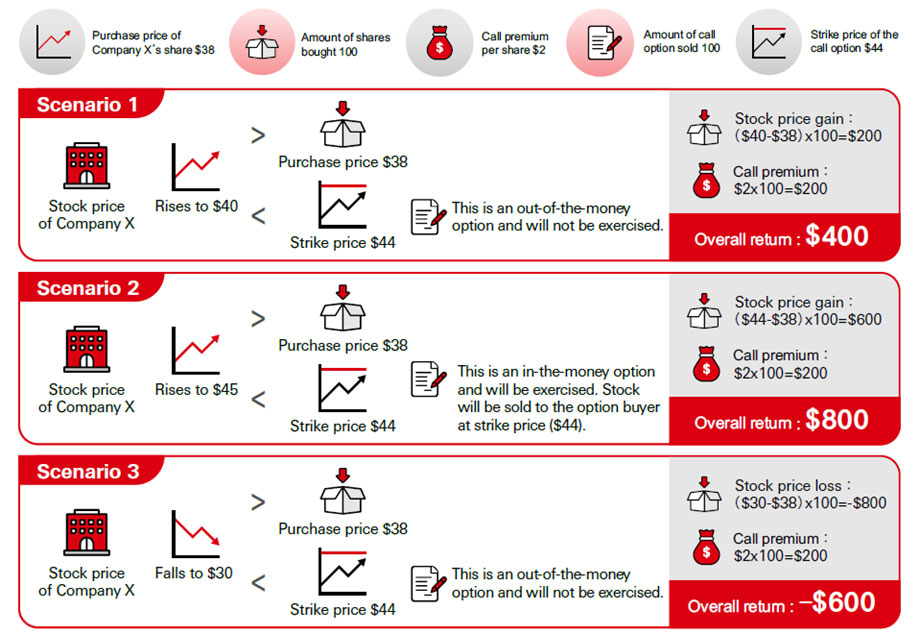

Three scenarios of the covered call option strategy

Source: HSBC Global Asset Management. The above examples are based on assumption of holding all other factors constant actual situation may differ from the above cases. For illustrative purposes only and not guaranteed in any way. Writing covered call options gives the option purchasers the right, but not the obligation, to purchase the referenced equities in the future at a pre-determined price (“strike price”). Writing covered call options limits the potential capital growth of the referenced equities to the strike price thereby limiting the overall potential return. Beyond the collected option premium, writing covered call options does not limit downside risk and investor will remain fully exposed to the risk that the referenced equities substantially fall in value.

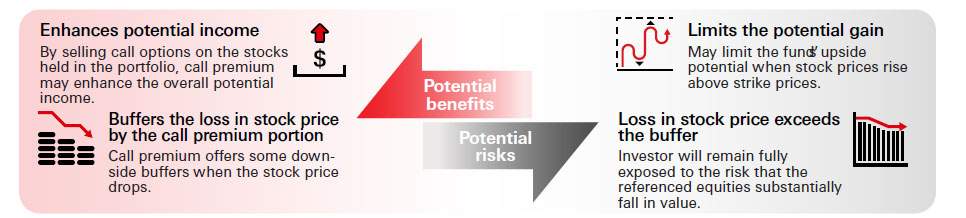

Pros and cons of a covered call strategy

Source: HSBC Global Asset Management. For illustrative purposes only and not guaranteed in any way.

Disclaimer

This document is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management (Hong Kong) Limited (“AMHK”) accepts no liability for any failure to meet such forecast, projection or target. AMHK has based this document on information obtained from sources it reasonably believes to be reliable. However, AMHK does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document has not been reviewed by the Securities and Futures Commission.

Copyright © HSBC Global Asset Management (Hong Kong) Limited 2021. All rights reserved. This document is issued by HSBC Global Asset Management (Hong Kong) Limited.

y

y