Power up your portfolio

Seize the opportunities through multi-asset and active fixed income solutions

Why it’s time to put cash to work

Usually in a high-interest rate environment, investors are rewarded for holding cash. Now, falling interest rates are likely to result in lower prospective returns on cash within portfolios.

|

|

Our Funds

|

Bond funds |

|

|

HSBC Asia High Income Bond Fund |

|

|

HSBC GIF Global Investment Grade Securitised Credit Bond |

|

|

HSBC GIF Global Lower Carbon Bond |

|

|

HSBC GIF Global Short Duration Bond |

|

|

HSBC GIF Strategic Duration and Income Bond |

|

|

Multi-asset funds |

|

|

HSBC GIF US Income Focused |

|

|

HSBC India Multi Income Fund |

|

|

HSBC Post Retirement Multi-Asset Fund |

|

Build your knowledge

Leverage our expertise to understand more about investing in fixed income and multi-asset assets such as bonds, equities and alternatives.

Investment Conversations deck |

Power up your portfolio with multi-asset solutions from HSBC AM |

Introduction to bonds |

Basics of bond prices, bond yields and duration |

Fixed income and multi-asset experts

Markets are always in flux, and 2025 may be a year of profound global change. That’s why it may be beneficial to consider actively managed strategies when powering up your investments.

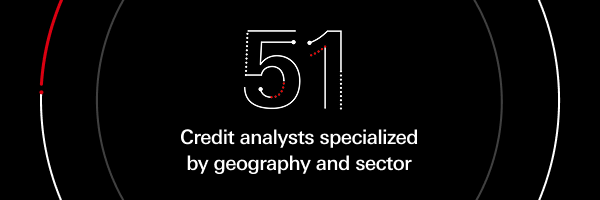

Active fixed income

A recognized, specialized manager.

Global insights, local expertise Supported by global research teams, our approach integrates rigorous global processes with local insights, fostering decision-making that blends investment discipline with collective thinking. |

Research-driven and flexible Our active fundamental approach is research-driven with a strong focus on relative valuation. In emerging and credit markets, we leverage bottom-up credit research and top-down macro analysis to exploit gaps between risk premiums and fundamentals. |

Risk adjusted outcomes We strive to identify, price and integrate risks into our investment process. Intensive research underpins our ability to deliver consistent results. |

Source: HSBC Asset Management as at 30 Sept., 2024.

Active multi-asset

Markets are cyclical, our multi-asset team’s approach is not.

Structured and consistent Our disciplined investment process integrates quantitative and qualitative insights with a clear focus on diversification and risk management. Complemented by a rigorous fulfilment process, it ensures efficient, cost-effective targeted allocations. |

Research-driven Leveraging research and proprietary tools, we analyze factors like value, macro trends and risk to identify opportunities. This approach supports dynamic asset allocation and disciplined portfolio construction for strong risk-adjusted returns. |

Collaborative approach We emphasize a team-based process, fostering collaboration and dialogue. Our multi-asset platform draws on macro and ESG insights and leverages fixed income and equity team expertise for effective fulfilment. |

Source: HSBC Asset Management as at 30 Sept., 2024.

For more information on our range of active fixed income and multi-asset solutions, connect with your HSBC Asset Management Relationship Manager.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance is not a reliable indicator of future performance. Any views and opinions expressed are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. We accept no liability for any failure to meet such forecast, projection or target. This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.