Private Markets View Q4 2025

Strategy Snapshot

Our key perspectives for each Private Markets Strategy

Source: HSBC Asset Management, August’25

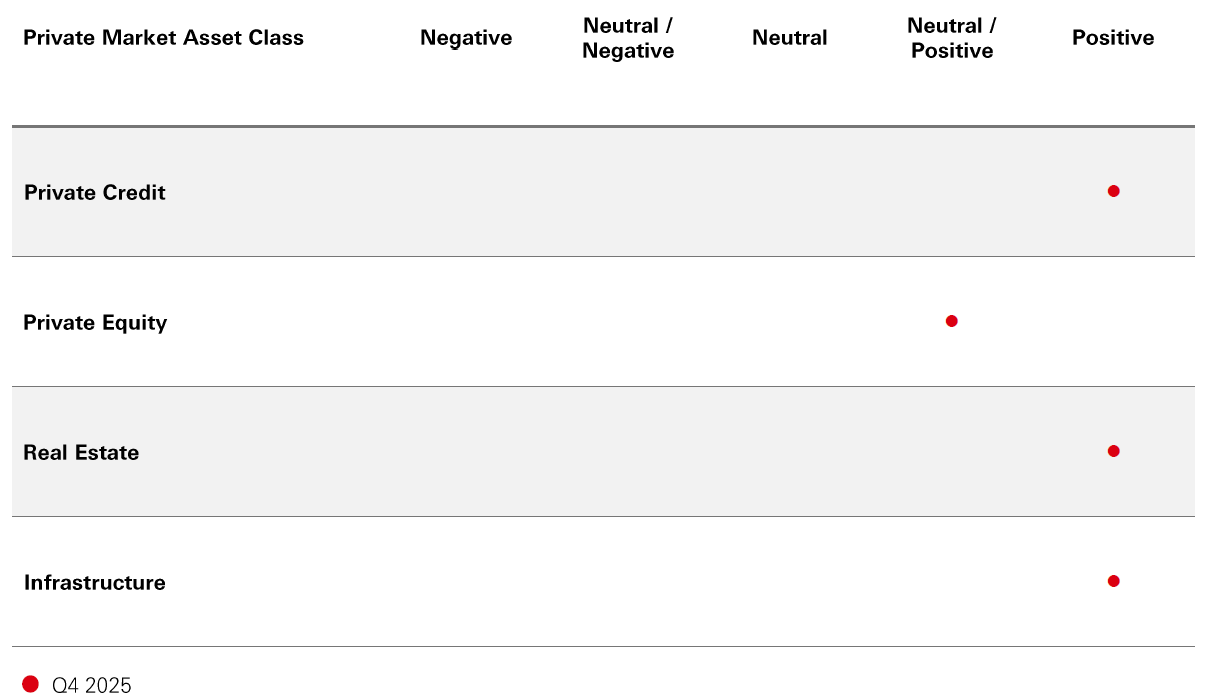

Proposed Strategy Views

In our view, the opportunity set for Private Market strategies remains deep. Within the sub-sector of Private Credit, we continue to hold a ‘Positive’ outlook. Investor demand for Private Credit remains robust due to its stability and yield advantages, with healthy fundraising momentum and strategic flexibility helping to navigate potential challenges, while potential rate cuts in 2025 could further enhance deal activity and returns.

We maintain our stance on Private Equity at ‘Neutral Positive’ . The outlook is cautiously optimistic with markets recovering from earlier challenges, supported by anticipated rate cuts and robust corporate earnings. However, tariff uncertainties and geopolitical risks remain key concerns.

In Real Estate, we continue to hold a ‘Positive’ outlook for the asset class. Despite recent capital value declines, real estate returns are poised for growth driven by higher income returns, with retail and multifamily sectors showing robust potential, while logistics and office sectors face challenges amid shifting market dynamics and demographic trends.

The Trump administration's policies are shaping infrastructure investment trends, with increased interest in European and Asian markets due to stable environments and diversification benefits. Meanwhile, U.S. infrastructure faces challenges from policy shifts affecting renewable energy, tariffs, and inflation. We see signs that this may lead to greater investor interest in European and Asian infrastructure, and continue to maintain a ‘Positive’ view on the asset class.

Source: HSBC Alternatives, as of September 2025.

Our Asset Class Views

Private Credit

Review of Q2

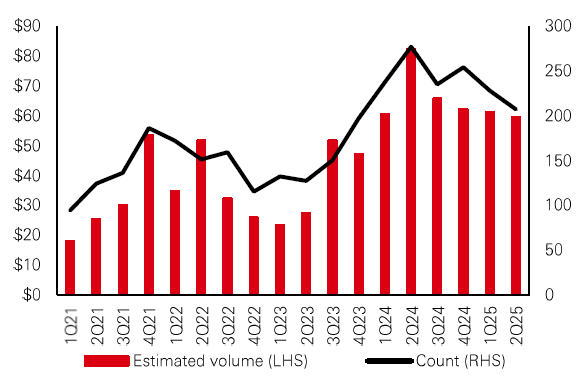

The market has experienced a technical imbalance during the second quarter, with loan demand surpassing supply. This has been compounded by disappointing M&A and buyout activity. The situation was further exacerbated by the Trump administration's tariff announcements on April 2, which triggered a global financial market sell-off, reminiscent of the uncertainty seen during the Covid-19 pandemic. The resulting volatility has significantly curtailed dealmaking activities.

Direct lending activity has been modest in 2025 amid tariff uncertainty and market volatility

Direct Lending deal count and estimated volume (US, USDbn)

Source: HSBC Alternatives, LCD Pitchbook

In terms of deal composition, add-on acquisitions for existing portfolio companies and refinancing activities have been notable. However, many refinancing opportunities have already been capitalised on, leaving fewer options available.

The shortage of deal activity relative to the funds raised for such purposes has intensified competition among private credit lenders for quality deals. This has impacted spreads, particularly for larger loans, prompting some borrower companies to explore the syndicated loan market due to competitive pricing.

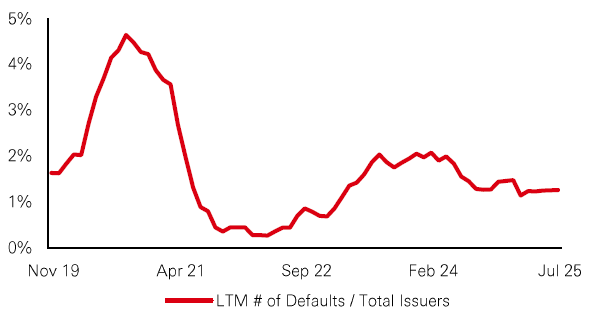

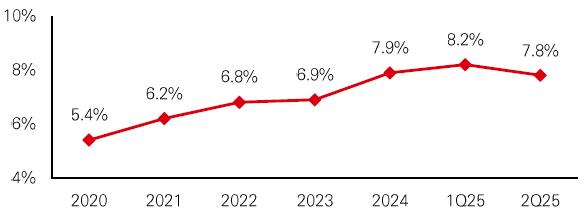

Default rates have remained stable, at similar levels with 2024, and continue to remain low by historical standards.

Default rates remain resilient

Leveraged Loans Index Default Rates

Source: HSBC Alternatives, LCD Pitchbook

12-month outlook

Investor demand for private credit remains robust, including inflows from the wealth channel for open-ended (‘semi-liquid’) products, bolstered by the asset class’s relative stability and yield premium over public markets combined with regular income derived from underlying interest payments. While deployment and origination of transactions remains the industry’s top challenge, fundraising momentum is healthy, with established managers continuing to capture the bulk of inflows.

During periods of stress, sponsors are expected to rely heavily on tools allowing for flexibility— including PIK toggles and extended maturities — to navigate rate volatility and borrower-level headwinds. Although default rates have edged up slightly, they remain low by historical standards. Modest credit deterioration may persist, but proactive equity sponsor support combined with lender flexibility should contain broader fallout.

Potential rate cuts later in 2025 could ease pressure on borrowers and further revive deal activity, positioning experienced lenders for attractive, risk-adjusted returns.

PIK Income declined modestly in 2Q25 but remains above pre-2024 levels

Fitch-Rated BDCs – PIK Income/Interest & Dividend Income

Source: HSBC Alternatives, Fitch Ratings

Source: HSBC Alternatives, LCD, Fitch Ratings, LSTA, S&P Global Ratings as of September 2025.

Our Asset Class Views

Private Equity

Neutral/Positive

Review of Q2

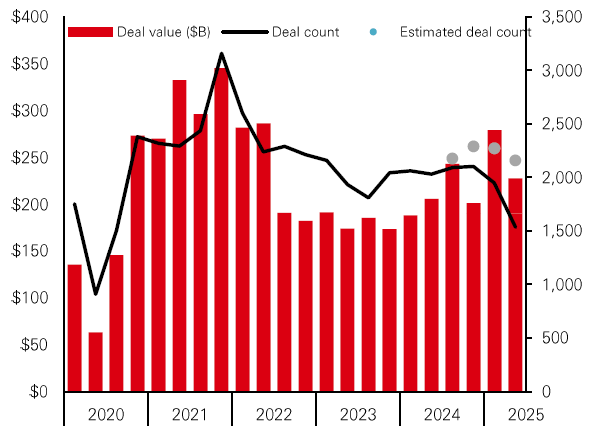

The second quarter of 2025 was marked by ongoing market uncertainty over tariffs and US policy. Amid the challenging environment, US dealmaking fell 18per cent in Q2, however, remains elevated compared to previous quarters and is up 11per cent year-on-year. The proportion of USD1 billion+ deals continues to dominate-GPs appear to be targeting larger, high-quality assets to generate returns.

US PE deal activity by quarter

Capital Invested (LHS), Deal Count (RHS)

Source: HSBC Alternatives, Pitchbook

Activity in high-growth sectors – including AI/technology, healthcare, defence, and the energy transition – will likely remain more resilient to market-wide factors.

US PE exit activity by quarter

Exit Value (LHS), Exit Count (RHS)

Source: HSBC Alternatives, Pitchbook

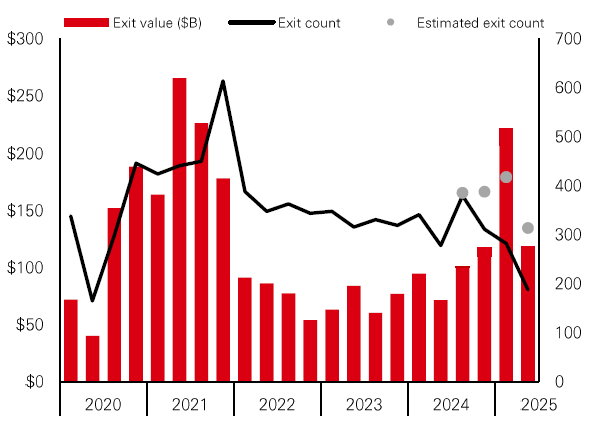

Private equity exit value fell 46per cent and exit count fell 25per cent over Q2 on tariff fears, exacerbating the existing backlog of deals waiting to exit. The ratio of private equity exits to investments has fallen to a new low of 0.32x and distributions remain low by historic standards.

While traditional exit routes-IPOs, M&A and strategic sales slowed in Q2, M&A activity has since picked up after a sluggish few months. GP-led secondaries (continuation vehicles) are becoming an increasingly attractive route for investors to generate partial or full liquidity. Importantly, net asset values are increasing across private equity portfolios, reflecting healthy portfolio company performance.

12-Month Outlook

The outlook heading into Q4 2025 remains cautiously optimistic. After a more challenging start to the year, marked by tariff shocks and an April sell-off, markets have regained their footing. Equity indices are back at record levels, exit activity has picked up and the IPO window is showing signs of sustained reopening, particularly in technology and healthcare. The Federal Reserve has held rates steady at 4.25per cent-4.50per cent, but markets anticipate a gradual cutting cycle beginning this Autumn, offering relief of financing costs.

Tailwinds

- Rate Relief – With the Fed expected to begin cutting rates later this year, financing conditions for buyouts and refinancings should improve materially.

- Exit Rebound – Equity markets at record highs are reopening IPO and trade sale channels, particularly in technology and healthcare portfolios.

- Corporate Earnings – Technology and industrial sectors reporting solid earnings, pointing towards overall market resilience.

Headwinds

- Tariff Uncertainty & Inflation Risks – The US Administration’s policies, including elevated tariffs have introduced inflationary pressures and increased costs for consumer and businesses.

- Policy & Geopolitical Risks – Ongoing political tensions and policy shifts, particularly in major economies like the US and China, continue to contribute to market volatility.

Source: HSBC Alternatives, Pitchbook, as of September 2025.

Our Asset Class Views

Real Estate

Positive

Review of Q2

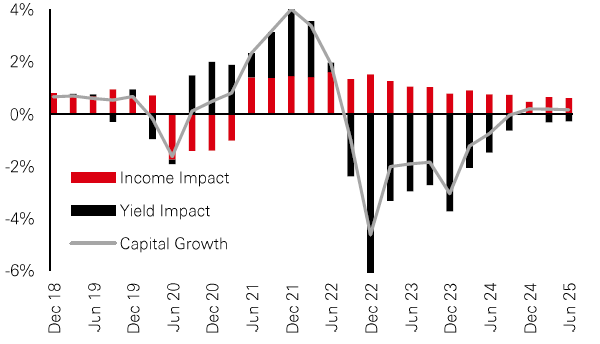

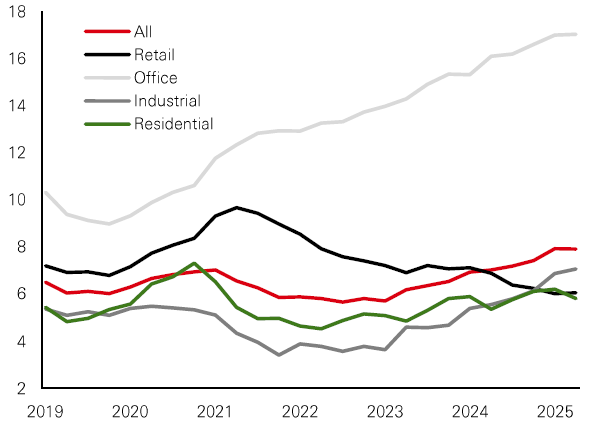

Following a 16per cent decline in global capital values between 2022 and 2024, capital values have edged up by 0.2per cent in both Q1 and Q2 2025 as property yields stabilise and incomes continue to rise. Despite the stabilisation of values at lower levels, investment activity remains subdued because of economic uncertainty and the ongoing tight yield spread. Data from Real Capital Analytics indicates that global investment activity in H1 2025 was 5per cent below H1 2024 and 37per cent below the five-year quarterly average.

A widespread decline in development activity appears to have halted the rise in vacancy rates and this is helping to sustain positive rental growth across most sectors. On the leasing side, demand has held up well for premium space across property types, particularly for office and retail assets, driving healthy prime rental growth. There is a widening vacancy spread between prime and secondary property.

Amongst the traditional property types, the retail sector fundamentals continue to improve (vying with the residential sector to have the lowest vacancy rate), and this is supporting steady rental growth. The surer footing for retail reflects a prolonged period of low supply, particularly pronounced in the US and Europe, combined with a stronger tenant base, as stores vacated by failed retailers during the pandemic have been replaced by more resilient occupants, paying rents at more sustainable levels.

Logistics conditions have softened globally over the last 12-months and vacancy rates continued to rise in Q2 2025. This is being driven by the US where leasing remains subdued, and the recent wave of development is still washing through. In Europe logistics vacancy rates are stabilising and remain historically low. Asia-Pacific fundamentals are mixed with Australia still having very low vacancy rates around Sydney and Melbourne, whilst in Japan a recent surge in development has increased vacancy rates in Tokyo.

Residential sector vacancy rates dipped in Q2 2025 (and are again the lowest of any sector), reflecting stable demand from a diversified tenant base. In the US, vacancy rates remain higher in sunbelt markets than coastal markets due to a wave of supply in 2023-24, though there are signs in H1 2025 that this divergence was starting to narrow as sunbelt development declines and whilst leasing tailwinds remain in place.

Office fundamentals remain notably weaker than other sectors, with particular softness in the US where the national office vacancy rate has risen to approximately 20per cent in Q2 2025, according to C&W. Europe’s vacancy rose slightly in Q2, but prime CBD space remains notably scarce, e.g. the London new-build vacancy rate is just 1.3per cent according to JLL. In Asia-Pacific, whilst office vacancy rates are very low in Tokyo (Grade A is 1.4per cent according to CBRE), they are

Income continues to underpin capital growth

Decomposition of Global Capital Growth (per cent, Q-o-Q)

Source: HSBC Alternatives, MSCI

Significantly higher in Hong Kong, Australia (particularly Melbourne), and Singapore.

12-Month Outlook

The resetting of income returns at higher levels, following recent capital value declines, should underpin attractive direct market real estate returns. Furthermore, the recent decline in development activity across sectors and geographies is expected to support an improvement in income growth via improved occupancy and higher rental growth, particularly for prime quality assets.

The retail sector is well placed to outperform other sectors. Having been out of favour with investors since before the pandemic, retail yields today offer an attractive spread over other property types in most markets. Meanwhile, stable leasing activity and low development pipelines point to positive rental growth, especially for assets with an emphasis on non-discretionary retail.

We remain wary about the near-term outlook for the logistics sector. Property yields remain low relative to other sectors, and the income outlook remains under pressure from weakening market fundamentals. Though vacancy rates may improve in H2 2025 as development slows, the leasing backdrop remains uncertain given the risks around tariff policy.

Although the outlook for offices remains challenging overall, the sharp repricing and tightening prime vacancy rate are prompting some investors to selectively return to the sector. Whilst overall office leasing activity is expected to remain below historic averages, prime offices are expected to outperform the wider office sector in the coming 12-months

Source: HSBC Alternatives, MSCI, Real Capital Analytics, CBRE, as of September 2025.

Our Asset Class Views

Real Estate

12-Month Outlook (continued)

As office utilisation continues to normalise whilst limited development has resulted in competition for the best office stock.

The multifamily apartment sector should remain a solid performer with high occupancy, steady leasing demand and stable rental growth, though this stability is offset by relatively low yields. Stronger income growth is expected in senior housing, particularly in the US, which will continue to benefit from demographic tailwinds associated with an ageing population.

Slowing development could reduce current vacancy rates

Global Vacancy Rate (per cent)

Source: HSBC Alternatives, MSCI, data to Q2 2025

Source: HSBC Alternatives, Bloomberg, Real Capital Analytics as of September 2025.

Our Asset Class Views

Infrastructure

Positive

Review of Q2

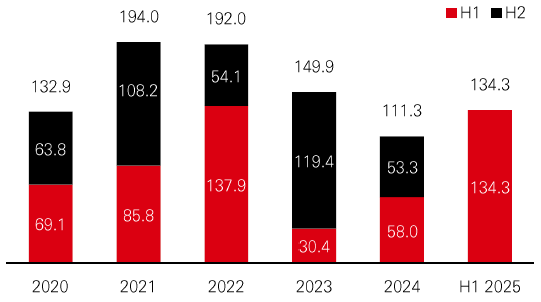

Q2 saw continued steady performance from evergreen infrastructure funds, with annualised returns across the industry in the range of 7-12per cent.

According to Infrastructure Investor, the first half of 2025 was the best fundraising half year for infrastructure since the first half of 2022. The USD 134.3bn of capital that was raised for closed-ended funds comfortably exceeded the total for the whole of 2024. To some extent this is down to the final closes being held for some very large funds: the top three accounted for USD 63.4bn of the total. We consider, however, that it is also illustrative of the attractiveness of infrastructure as a stable asset class in an overall investment universe that faces significant challenges.

Infrastructure Fundraising sees significant uptick

Private Infrastructure Capital Raised (USDbn) in the past 5 years

Source: HSBC Alternatives, Institutional Investor, data to Q2 2025

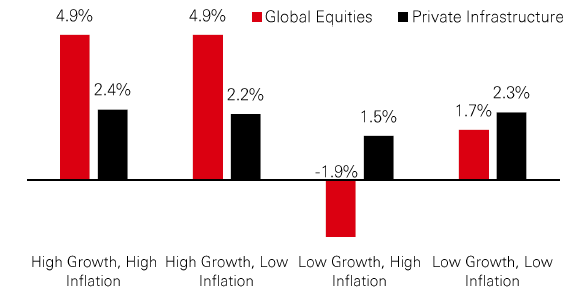

One of the benefits of private infrastructure equity investing is that it can deliver comparable returns to listed equity markets, with significantly lower volatility. This stability of investment returns can also be seen across a variety of inflation and growth scenarios.

Stable Returns continue to be a key feature of Infra1

Average Quarterly Returns Across Market Environments (per cent)

Source: HSBC Alternatives, Pitchbook, data to Q2 2025

12-Month Outlook

The outlook for infrastructure remains dominated by the Trump administration. We see signs that this may lead to greater investor interest in European and Asian infrastructure. The former can be seen as having a more stable policy environment and the latter offers geographical diversification and, in general, less competition for the best assets, which can lead to enhanced returns.

We continue to monitor the policies of the Trump government and their impact on three aspects of infrastructure investing:

- The Big Beautiful Bill Act significantly curtails the tax benefits available to solar and wind energy investments. This is likely to lead to a short-term surge in renewable energy investment activity in the United States followed by a lull when the deadline for eligibility for tax credits expires. Ultimately, however, this sector will resume its growth because onshore wind and solar are price competitive without tax breaks and can be developed more quickly than gas fired power plants. In the energy sector, we favour diversifying investment across North America, western Europe and developed Asia.

- Tariff increases, e.g. for steel and solar panels, can lead to short to medium term disruption to supply chains and delays and cost increases for many construction projects. The effect of tariffs on redirecting trade flows could be adverse in some cases for fixed transport assets such as ports and toll roads, though overall both asset types will be positively correlated to US GDP growth.

- Inflation: a general increase in tariffs could result in an increase in US inflation. That and the prospect of a growing US fiscal deficit may lead to the Federal Reserve keeping interest rates higher for longer. The recent inflationary and interest rate cycle has demonstrated that infrastructure assets tend to be positively correlated with inflation (because their income streams are often index linked) and robust to the interest rate cycle (because they often have long term, fixed rate financing).

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. Past performance does not predict future returns.Diversification does not ensure a profit or protect against a loss. This information shouldn't be considered as a recommendation to invest in the specific sector mentioned.

Source: Preqin, HSBC Alternatives, as of September 2025. 1For the period January 1, 2010 through December 31, 2024. Growth is defined as annual nominal GDP growth based on current USD. Inflation is defined as annual percentage change in CPI, USD denominated. Periods of High Inflation and Growth are quarters when CPI and GDP were above its historical average over the period. Periods of Low Inflation and Growth are defined as quarters where CPI and GDP were below its historical average over the period.

Important Information

Risks of investing in Private Markets

The value of investments and income from them can go down as well as up, meaning you may not get back the amount invested, and you may lose some or all of your investment. Past performance information presented is not indicative of future performance. The return and costs may increase or decrease as a result of currency fluctuations.

- Alternative Risk - There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily realisable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements.

- Liquidity Risk - Investors may be unable to dispose of an investment quickly or at all and at a price that’s closely related to recent similar transactions, if any. There is no guarantee of distributions and secondary market is expected to be established

- Event Risk - A significant event may cause a substantial decline in the market value of all securities

- Long-term Horizon - Investors should expect to be locked-in for the full term of the investment, which is subject to extensions

- No Capital Protection - Investors may lose the entirety of invested capital

- Unpredictable Cashflows - Capital may be called and distributed at short notice

- Economic Conditions - Ability to realize/divest from existing investments depends on market conditions and the regulatory environment

- Risk of Forfeiture - Failure to make call payments could result in forfeiture of commitment, including invested capital, without compensation

- Default Risk - In the event of default investors risk losing their entire remaining interest in the vehicle and may be subject to legal proceedings to recover unfunded commitments

- Reliance on Third-party Management Teams - Underlying investments will be managed by various third-party management teams that will in aggregate determine the eventual returns for the investor, if any

Disclaimer

Important information

For Professional Clients and intermediaries within countries and territories set out below, and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

- The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

- The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

- All data from HSBC Asset Management unless otherwise specified. Any third-party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

- HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D042550_v3.0; Expiry Date: 31.08.2026