Low risk Hong Kong dollar solutions for liquidity management

Over the past year, global money market fund assets have grown by 16 per cent to USD 12.3tn, underscoring their robust demand among both institutional and retail investors.1

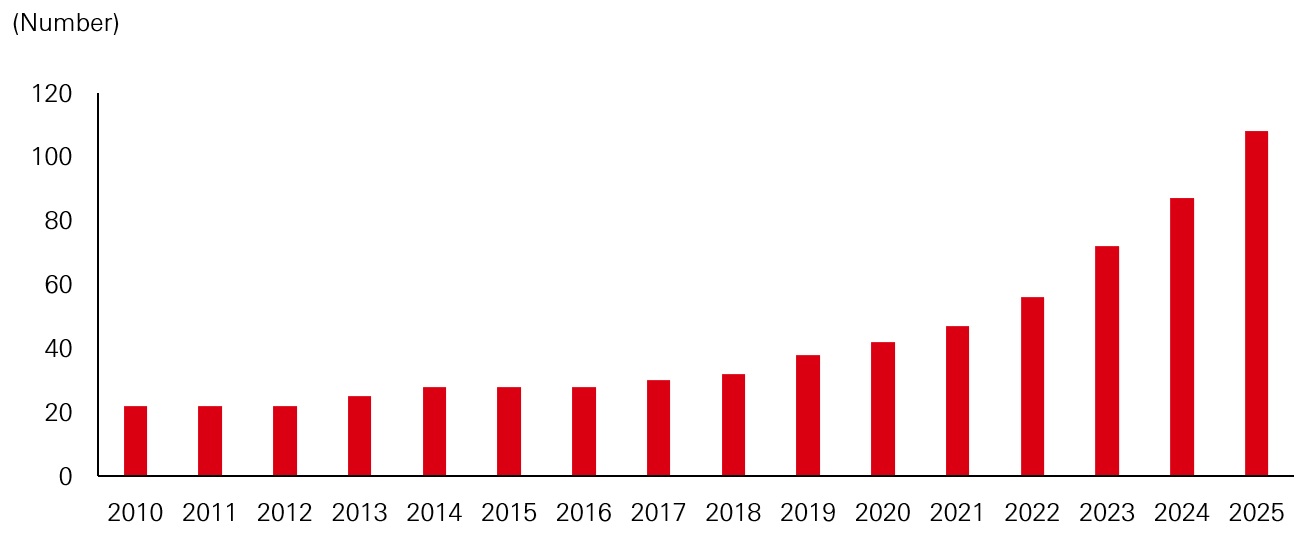

Hong Kong is no exception – the adoption of money market products has accelerated, with asset managers bringing significantly more offerings to the market. The number of money market funds authorised by the Securities and Futures Commission of Hong Kong (SFC) has nearly doubled since 2022, with about 50 new products being launched to meet rising investor demand.2

The number of SFC-authorised money market funds has grown 93 per cent since 2022

Source: Securities and Futures Commission of Hong Kong, as of October 2025.

However, many Hong Kong investors still tend to rely on current accounts and time deposits for short-term liquidity management. But with interest rates now heading lower – although they are not expected to return to the previous near-zero lows – and the gradual evolution of Hong Kong’s mutual fund industry, money market funds are becoming a viable alternative.

Hong Kong dollar money market strategy

HSBC Asset Management manages a Hong Kong dollar money market strategy that aims to preserve capital3 and provide daily liquidity. The strategy’s investment process seeks to manage three main types of risk – namely liquidity, credit, and interest rate risk. The risk-focused strategy adheres to issuer limits, maturity constraints, liquidity ladders, shareholder concentration limits, credit diversification limits, asset type limits and interest rate metrics.

The strategy invests in high quality instruments with a minimum short-term credit rating of A-1 (S&P Global) or P-1 (Moody’s) or its equivalent at the time of purchase.4 By contrast, as the SFC does not specify minimum credit rating requirements, the credit quality can vary significantly among money market funds. Some funds may invest down to the lowest notch of investment grade credit, which corresponds to short-term ratings of A-3 (S&P Global), P-3 (Moody’s) or F3 (Fitch).

Notably, the strategy is among the few money market offerings in Hong Kong with a triple-A rating from a major global credit rating agency, validating its investment and credit processes and ensuring strategy surveillance by a third party.

Investor interest in the strategy has been strong. Since 2023, assets have quadrupled to HKD 21bn.5 The large size has led to an improved access to the primary market, enabling the strategy to buy papers from a diverse pool of global issuers with different deal size requirements, thus helping build a more geographically diversified portfolio, implement duration strategies and optimise income more effectively.

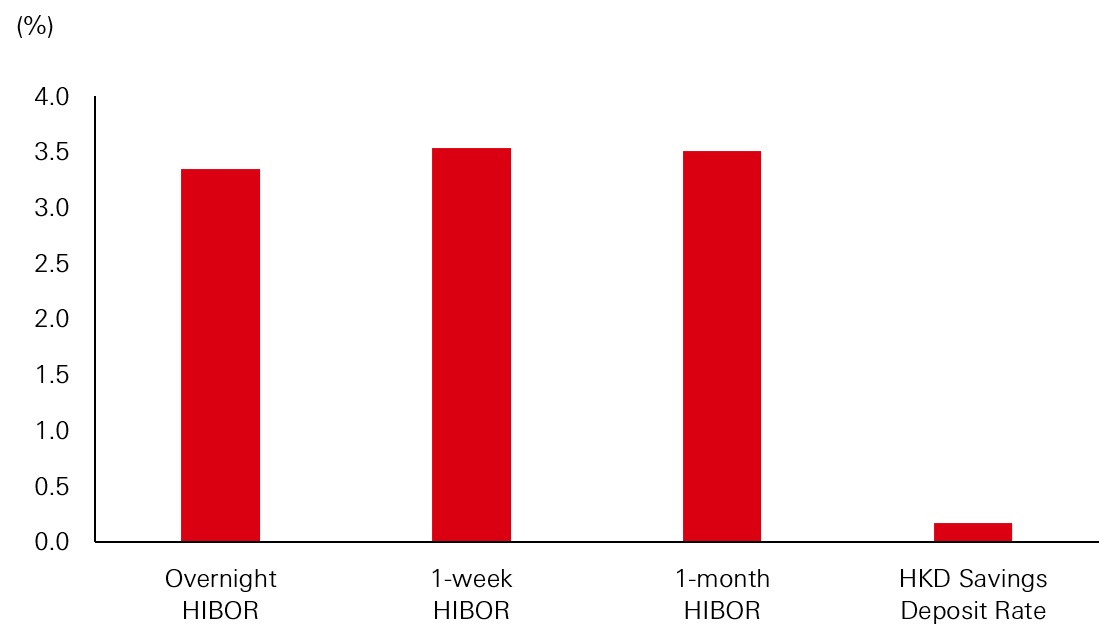

Part of the strategy’s appeal lies in its aim to achieve comparable yields relative to normal money market rates while offering daily liquidity, making it a relatively attractive option for investors who may not be earning much interest on their savings or current accounts – especially in a falling interest rate environment – or investors who forego liquidity in time deposits. The risk-focused strategy also results in greater diversification and removes single issuer credit risk seen in time deposits.

Key reference rates

Using average daily rates in the month of October. HIBOR refers to Hong Kong Inter-bank Offered Rate.

Source: Bloomberg, as of 31 October 2025.

Market outlook

Following the US Federal Reserve’s decision to trim rates in October, the Hong Kong Monetary Authority (HKMA) cut its base rate by 25 basis points to 4.25 per cent from 4.50 per cent, making it the second easing by the central bank since last December.6

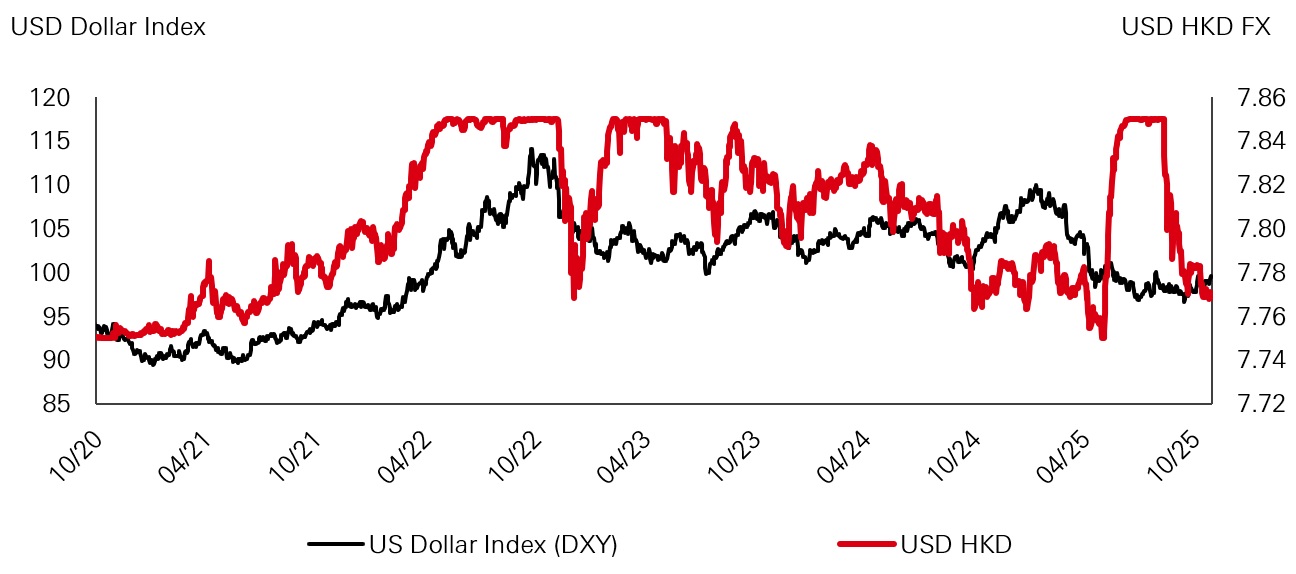

Factors such as a surge in southbound flows via the Stock Connect channels and the reduced strength of the US dollar have been supportive of the Hong Kong dollar. After several interventions by the HKMA defending the top end of the band, HKMA’s aggregate balance, an indicator of the surplus in the banking system, has fallen from HKD 164bn in June to the current HKD 55bn, just HKD 10bn over the pre-May level.6 The USDHKD foreign exchange rate has stabilised at the midpoint of the trading band, and further US Fed cuts means that USD money market rates should fall closer to HKD money market rates, thereby closing the gap to more normal levels.

US dollar has been on a weakening path, adding to Hong Kong dollar strength this year

Source: Bloomberg, HSBC Asset Management, October 2025.

Although the USDHKD foreign exchange rate stabilised, liquidity in the Hong Kong dollar market has continued to tighten due to seasonal demand during the fourth quarter (including calendar year end) and the strong performance of the equity market, which has led to demand from HKD equity settlements. Looking ahead, HKD rates are expected remain volatile in the near term.

Against this backdrop, the HSBC Hong Kong dollar money market strategy can potentially reduce the impact of short-term rate volatility in the market. The strategy invests in a combination of longer dated instruments – potentially benefiting from rates that were locked in at the time of purchase – and a large chunk of overnight to 1-week maturities, helping to smooth out the overnight rate volatility for investors.

Given the near normalisation of the aggregate balance and the narrowing of HKD-USD interest rate differentials, the strategy has shifted back towards targeting its strategic Weighted Average Maturity (WAM) at the higher end of the 40-50 days target range. A longer WAM indicates greater sensitivity to interest rate changes as compared to a shorter WAM.

Liquidity solutions with HSBC Asset Management

HSBC Asset Management has been managing money market funds for over three decades, with USD 178bn in liquidity assets.7 A full range of liquidity solutions is offered, including liquidity funds, segregated mandates, and low duration strategies. The firm manages solutions in 10 currencies, five of which are Asia-Pacific currencies, including Hong Kong dollar, Chinese renminbi, Indian rupee, Singapore dollar, and Australian dollar.

At HSBC Asset Management, liquidity investment philosophy prioritises risk management. The liquidity management approach is prudent and relatively low risk. While investment decisions are taken locally to ensure focus and accountability, portfolio managers in Asia benefit from the expertise and experience of investment professionals worldwide, ensuring a truly global perspective.

The views expressed above were held at the time of preparation and are subject to change without notice.

1. Source: Investment Company Institute, September 2025, data as of 2Q2025.

2. Source: Securities and Futures Commission, as of October 2025.

3. Note: preservation of capital is not guaranteed.

4. Credit ratings given by agencies are subject to limitations and may not accurately reflect the creditworthiness of the security and/or issuer at all times.

5. Source: HSBC Asset Management, as of October 2025.

6. Source: HKMA, October 2025

7. Source: HSBC Asset Management, as of 30 June 2025.

Important information

For professional investors and intermediaries only. This document should not be distributed to or relied upon by retail clients/investors.

This document is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This document does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management (Hong Kong) Limited (“AMHK”) accepts no liability for any failure to meet such forecast, projection or target. AMHK has based this document on information obtained from sources it reasonably believes to be reliable. However, AMHK does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document has not been reviewed by the Securities and Futures Commission. Copyright © HSBC Global Asset Management (Hong Kong) Limited 2025. All rights reserved. This document is issued by HSBC Global Asset Management (Hong Kong) Limited.