Indian equity: Navigating the New India

Key takeaways

- Against a slowing global economy, India’s GDP growth is likely to stay resilient and expand around 6.5-7.0% per annum in the medium term. Given its ongoing structural reforms, infrastructure build-out, growing domestic consumption driven by favorable demographics and tailwinds from unique positioning in a complex global geopolitical landscape, India stands out as a relative outlier among large economies

- Under Trump 2.0, the potential impact of tariffs on India's economy is expected to be minimal, as exports to the US account for only 2.1% of GDP

- Net domestic inflows into Indian equities are robust and reached USD56 billion year-to-date (as of 15 November 2024), far exceeding the USD22 billion recorded for the entire year of 2023 and more than offsetting the foreign outflows experienced year-to-date / October 2024. Divergence of flows has become more pronounced as seen in the domestic ownership of the Indian equity market, which has risen to 25% in September 2024 versus 21% in March 2020, while foreign ownership has fallen to a trough of 16% from 22% over the same period

- Indian equities offers significant diversification benefits to global portfolios with the market becoming less correlated with other major markets as well as less volatile, thus potentially helping achieve better risk adjusted returns

- India is now the world's fifth largest stock market, with a diverse sector composition and stock concentration. Market cap growth drivers such as strong earnings growth and expansion via new listings/IPOs remain intact in the medium-term and should continue to support India equities’ increased representation in key global indices

- Valuations of Indian equities may appear high and seemingly warrant some consolidation in the short term. While one may argue about the valuation premium it deserves, superior earnings growth and higher structural profitability of underlying companies support the premium argument

Source: Bloomberg, NSDL, Macrobond, HSBC Asset Management, November 2024.

This commentary has been produced by HSBC Asset Management to provide a high level overview of the recent economic and financial market environment, and is for information purposes only. The views expressed were held at the time of preparation; are subject to change without notice and may not reflect the views expressed in other HSBC Group communications or strategies. This marketing communication does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. The content has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. You should be aware that the value of any investment can go down as well as up and investors may not get back the amount originally invested. Furthermore, any investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in established markets. Any performance information shown refers to the past and should not be seen as an indication of future returns. You should always consider seeking professional advice when thinking about undertaking any form of investment. This communication has not been reviewed by the Securities and Futures Commission.

India’s GDP outlook: peak goldilocks?

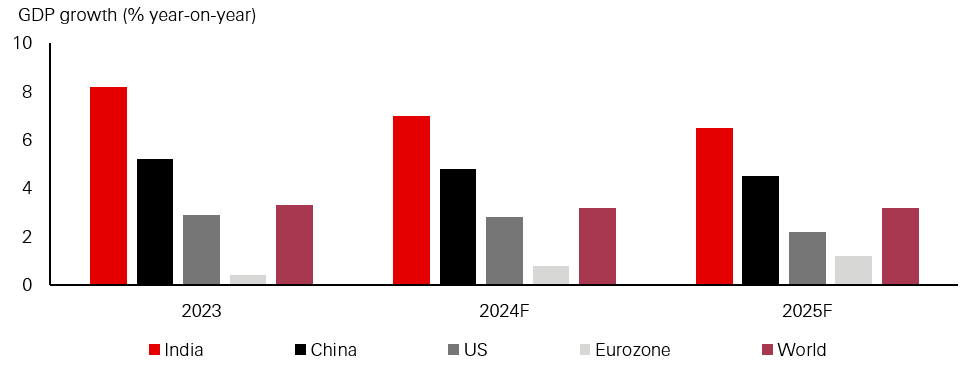

India's GDP growth rate has been consistently robust, far outpacing other major developed economies like the US and even surpassing the pace of China (Fig. 1). In our view, GDP growth is likely to stay at the 6.5-7.0 per cent level, given the ongoing structural reforms, infrastructure build-out, growing domestic consumption driven by favorable demographics and tailwinds from unique positioning in a complex global geopolitical landscape. A rapidly growing middle class and a digitally connected population continue to present vast opportunities for businesses to thrive. While a US/global growth slowdown is expected, India is likely to stay resilient given its domestic demand-orientation and lower share of exports to the US as percentage of its GDP.

Fig. 1: India’s GDP growth vs rest of the world

Source: IMF World Economic Outlook, data as of October 2024

Momentum of structural reforms and policy stability, which we believe form the bedrock of India’s long-term sustainable growth, are continuing given Prime Minister Modi’s re-election in June. The Production Linked Incentive (PLI) scheme, for instance, under the “Make in India” initiative is one of the strategic programmes aimed at promoting domestic manufacturing across various key sectors (i.e. electronics, semiconductors, solar modules, pharmaceutical APIs, defense equipment etc.), which can help to reduce reliance on imports, foster the domestic economy and create jobs. PLI also serves as vital component in transforming India into a competitive manufacturing hub by attracting foreign manufacturers as well as encouraging domestic companies to innovate and enhance their production capabilities, overall positioning India as an appealing alternative for global businesses looking to diversify their supply chains. Another growth driver that increases the appeal of India internationally is the rapid development of its startup landscape – a robust ecosystem that nurtures a culture of innovation and productivity (see more on page 4).

Is there any impact on Indian markets from the US elections?

Trump’s victory in the US presidential elections means that policy uncertainty globally has risen. At present, it’s difficult for investors to gauge the impact of the potential shift in US fiscal, trade policy and immigration. The impact of potential tariffs on India’s economy should be limited, as India’s exports to the US is small, at only 2.1 per centof GDP (in 2023). 1 In fact, India remains one of the least exposed major economies. India’s services exports is significant, with a growing strength in areas including IT services and Global Capability Centers (GCCs), which may have potential implications if there is any tightening of US immigration laws.

There may also be implications for foreign direct investment (FDI) under Trump 2.0 if there is a push for investments to go back to the US. However, this trend could potentially favour India as we could see relocation of some manufacturing to India to take advantage of relatively lower tariffs.

Another factor to consider is the US dollar under a Trump administration and the resulting implications on emerging market currencies such as the INR. In the last month, the INR has seen a depreciation against the USD of 0.38 per cent given the rise of the USD, but the INR has generally outperformed Asian currencies – the Asia dollar index (which tracks the performance of a basket of Asian currencies against the USD), has fallen by 1.9 per cent. Further, in the same period, 10-year US Treasury yields have been volatile, rising by 71bp, while the 10-year India government bond yields have been more stable only rising at 7bp to 6.86 per cent.2 Overall, the INR has been less volatile than other major currencies, though it is noted that currency volatility may increase. With this, it is important to remember that India’s central bank has a record high level of foreign exchange reserves that can help cushion currency volatility. Additionally, structural reforms over the last ten years has brought the INR to a much stronger position today than in the past – with beneficial developments including keeping inflation in check, progressively improving fiscal and current account deficits as well as opening more sectors to FDI thus leading to increased foreign flows.

How do the recent outflows from foreign investors affect Indian equities’ diversification story?

Foreign investors have been net sellers of Indian equities in the last few months. Partially, this can be explained by the improvement in foreign investor sentiment shifting from India towards China, particularly with China’s slew of stimulus announcements since September, on both the fiscal and monetary sides. Additionally, some moderation in high frequency indicators and expectation of softer earnings season triggered the reversal of tactical inflows seen earlier. While near-term foreign flows will be driven by multiple moving factors – such as further stimulus in China, announcement of key polices of the new US administration, relative valuations and the outlook on the Indian Rupee – in the long run, the flows should follow the trajectory of corporate earnings growth. It should be noted that net domestic inflows into Indian equities remain robust, reaching USD 56 billion year-to-date (as of 15 November 2024), far exceeding the USD 22 billion recorded for the entire year of 2023 and more than offsetting the foreign outflows experienced year-to-date / October 2024. Divergence of flows has become more pronounced as seen in the domestic ownership of the Indian equity market, which has risen to 25 per cent in September 2024 versus 20.9 per cent in March 2020, while foreign ownership has fallen to a trough of 16 per cent from 21.9 per cent over the same period.3 Though year-to-date foreign outflows has amounted to USD 1.9 billion, MSCI India (USD terms) has still risen by 11.2 per cent.

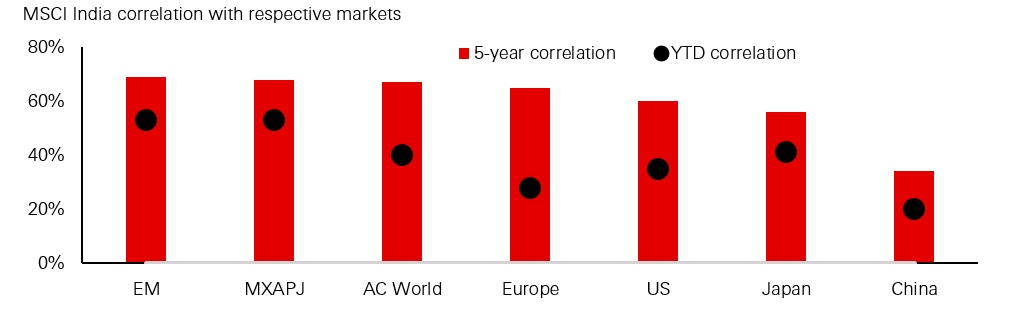

Despite the short-term foreign outflows, the Indian equity market continues to present an opportunity for asset allocators to diversify their portfolios. Importantly, India's economic and financial markets have been experiencing a gradual decoupling from major global markets, such as the US, Europe, and Japan. MSCI India is exhibiting lower correlation year-to-date against major markets as compared to a 5-year period, suggesting that India is becoming less correlated with major markets (Fig. 2).

Fig. 2: India is becoming less correlated with other major markets

Correlation is based on weekly price returns in USD terms. MXAPJ refers to MSCI Asia ex Japan Index. AC World refers to MSCI All Country World.

Source: MSCI, HSBC Asset Management, data as of 16 September 2024.

Asset allocators can leverage this diversification benefit to create a more resilient investment strategy, improving their chances of weathering market fluctuations. India's diminishing correlation with leading markets is particularly appealing in the face of an increasingly interconnected and often unpredictable global economy.

India is now the world’s 5th largest stock market, where does it go from here?

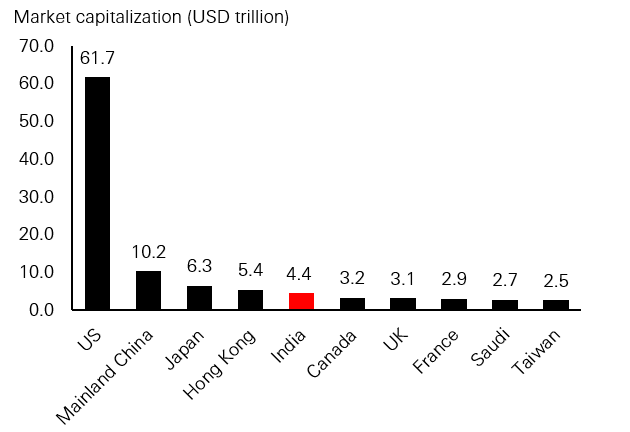

India’s stock market capitalization now stands at USD 4.4 trillion, having tripled by over three times in the last decade. This remarkable achievement means India now has the world’s fifth largest stock market, giving it increased depth, diversity and size. This is an important transformation that greatly improves the investible universe and gives rise to increased investment opportunities across the market cap spectrum and sectors. For instance, there are now 11 “mega-sized” companies – or companies with market capitalization exceeding INR 5 trillion (USD 59 billion) – 10 years ago there were none; there are also now 209 mid-sized companies compared to 50.4 Such an evolution has also translated to MSCI India, a widely tracked benchmark for global investors, increasing the number of constituents from 84 in March 2020 to 151 in September 2024.

Fig. 3: Largest stock exchanges

Source: Bloomberg, 15 November 2024

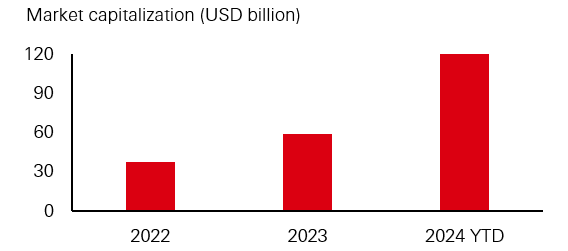

Of note is the surge of new-age businesses such as e-commerce companies and/or venture capital backed tech companies (Fig. 4), illustrating the vibrancy of India’s start-up ecosystem, which is also expected to fuel a steady supply of initial public offerings (IPOs) and present diverse investment opportunities to both domestic and international investors. This ecosystem is characterized by an exciting startup culture, robust access to venture capital, and supportive government initiatives aimed at fostering innovation and economic growth.

Fig. 4: Increasing market cap of venture capital backed tech companies

Source: Bloomberg, HSBC Asset Management, data as of 13 November 2024

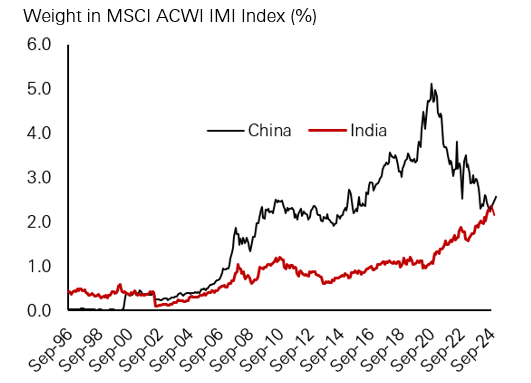

India had even surpassed China briefly in September to become the largest emerging market by weight in the MSCI AC World IMI Index, though the weight has come down given the correction in the market (Fig. 5). Despite this, there is a clear converge between China and India as well as a notable increase in India’s index representation, which have positive implications for global capital allocation particularly as MSCI AC World IMI Index has significant tracking assets of USD 4.6 trillion.

There is a strong likelihood – going by the past trend of rising weight of India in key global indices which is following India’s rising share in world GDP – that India could reach an index weight of around 4-5 per cent in MSCI World ACWI IMI Index. This would be a critical movement for Indian equities as it will reach a weight that would warrant attention from global portfolio managers.

Fig. 5: India’s increasing index representation

Source: MSCI, Morgan Stanley, data as of October 2024

Is the price right for buying into India’s growth story?

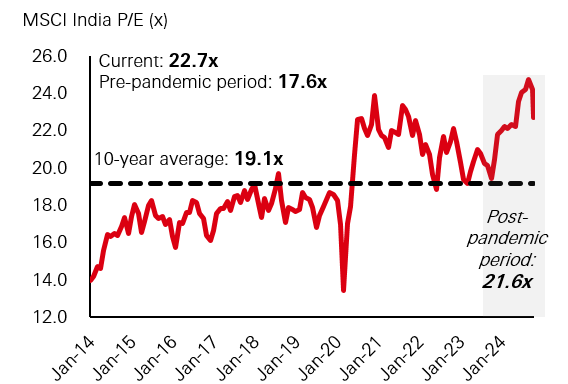

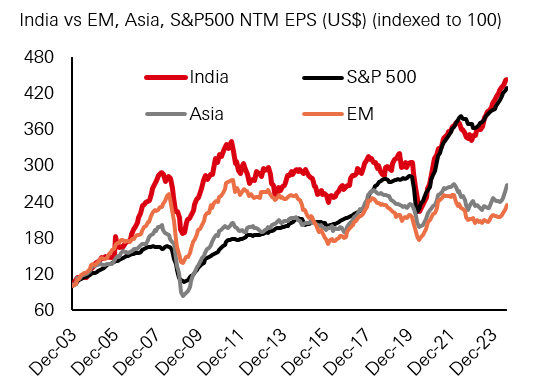

Indian equities are trading at valuations that exceed their long-term averages, with the 12-month forward P/E now standing at 22.7 times (Fig. 6). Valuations may appear high and seemingly warrant some consolidation in the short term but are supported by superior earnings growth in the medium term and a longer runway for growth. The valuation premium is primarily backed by strong underlying earnings growth and return on equity (ROE) profiles compared to other markets. In 2023, for instance, earnings per share (EPS) growth of MSCI India came in at an impressive 20 per cent.3 While the magnitude of earnings growth is expected to ease to 16 per cent in 2024 and 2025,5 the longer-term trend is should remain solid. India’s earnings have grown by 3.4x over the last 20 years, slightly better than the US market and substantially ahead of its Asia and emerging market counterparts (Fig. 7). Having said that, there are areas of the market where valuations and implied growth expectations are excessive and it is prudent to moderate return expectations in the medium-term.

While the 2Q FY2025 (July-Sep 2024) earnings results have seen some weakness, impacted by commodity prices (especially oil) and heavy rainfall in some areas impacting demand, the medium to longer term earnings outlook remains intact. Additionally, the India market already has a foundation that sets it up for high quality growth, backed by reforms, strong demographics, deepening investment cycle and tailwinds from global geopolitics.

Fig. 6: Valuation of Indian equities

Source: MSCI, Goldman Sachs, 15 November 2024. Note: Post pandemic period refers to May 2023 to now, pre-pandemic period refers to May 2014 to Dec 2019

Fig. 7: EPS: India vs EM, Asia and US

Source: Goldman Sachs, August 2024

How is the HSBC Indian Equity strategy positioned?

The HSBC Indian Equity strategy has a reasonable cyclical and growth tilt via sectors like real estate and financials. Real estate is one of the top active weights in our portfolio as demand for residential real estate is currently experiencing an upcycle on the back of favorable demand-supply dynamics; the sector is also witnessing tailwinds from the growing need for new office space to support the GCC expansion in India and the expected interest rate cuts. Healthcare is another active overweight – our positioning here is a play on structural increase in domestic healthcare spend by both the government and the private sector; exposure here is spread over pharmaceutical companies and healthcare service providers like hospitals. We are increasing our positions in consumer staples due to recent shifts in government policy. Additionally, we plan to add more consumer-oriented investments, both discretionary and staples, during market weaknesses, along with select non-bank financial companies (NBFCs). Financials is our largest sector overweight; financials exposure is well diversified between lending and non lending business. Among banks, we prefer major private sector banks and are underweight government-owned banks. The ongoing digitalisation and increased participation of Indian savers continue to support service providers & platforms.

We maintain a positive outlook on India's medium to long-term structural growth, driven by themes such as favorable demographics, rising per capita income, manufacturing diversification through supply chain shifts, and a capital expenditure boom.

Note 1: Source is Macrobond, HSBC Asset Management, November 2024

Note 2: Source is Bloomberg, 18 November 2024.

Note 3: Source is NSDL, Motilal Oswal, November 2024

Note 4: Source is Motilal Oswal, November 2024

Note 5: Source is MSCI, Goldman Sachs, September 2024

Source: HSBC Asset Management, November 2024.

Investment involves risks. Past performance is not indicative of future performance. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. For illustrative purposes only.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. This document provides a high level overview of the recent economic environment. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.