Asia credit - a resurgence rooted in resilience and relative value

Key takeaways

- The Asia credit market has seen solid performance year-to-date and is generally outperforming other major bond markets

- The US rate cutting cycle as well as Asia’s supportive macroeconomic backdrop should sustain Asia credit’s momentum

- While Asia is exposed to a US/global growth slowdown, India, China and parts of ASEAN are likely to stay resilient as these are domestic demand-oriented economies

- Repayment capabilities of Asian dollar issuers are enhanced and credit quality can potentially be improved given the increasing strength of Asian currencies and the renewed interest in Asia local currency bond markets

- While there has been a downward move in global bond yields year-to-date, Asia credit’s yields continue to look attractive. Together with relatively low duration, favourable technical factors, and continued resilience, the case for diversifying into Asia credit remains strong

- The US Fed rate cut is positive for investor sentiment, but we acknowledge the risk that US recession fears can re-emerge on any signs of economic weakness as long as the policy rate remains in restrictive territory. Further market volatility is possible, but we are equipped to navigate market moves and any dips can present opportunities for our Asia bond strategies

Macroeconomic support for Asia credit

Global easing cycle

The US Federal Reserve lowered rates by 50bp on 18th September, marking the first cut in four years and kicking off the US rate cutting cycle, which is expected to contribute to the momentum of Asia credit markets. The choice to cut by 50bp reflects the Federal Open Market Committee’s (FOMC) judgment that the risks to its dual inflation and employment mandate have shifted into better balance, meaning that upside risks to inflation have moderated while downside risk to employment has increased. At the September meeting, the FOMC also published its updated projections, which see a desire to deliver a soft landing for the US economy; the projections see inflation reverting to target, unemployment leveling off to an acceptably low level, growth remaining solid and the policy rate ultimately returning to a more neutral level over time.1 While the move is positive for investor sentiment, we acknowledge the risk that recession fears can re-emerge on any signs of economic weakness as long as the policy rate remains in restrictive territory. Other sources of risk, such as election uncertainty or geopolitical stress can come into play.

The US rate cutting cycle gives room to Asian economies to ease their monetary policies as central banks weigh growth and financial stability amid benign inflation. The rate cuts should also help ease foreign exchange pressures. The US dollar has been weakening against almost all Asian currencies in the last month, which has positive implications for Asian companies; this means that repayment capabilities of Asian dollar issuers are enhanced and credit quality can potentially be improved. Asia credit should benefit from the global easing cycle, especially Asia high yield, as the Fed’s intention to move to a more supportive stance becomes clear.

Positive macro outlook in Asia

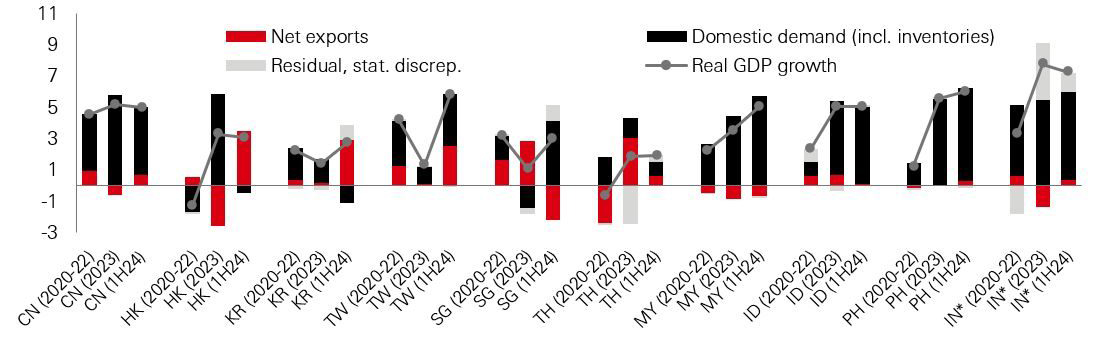

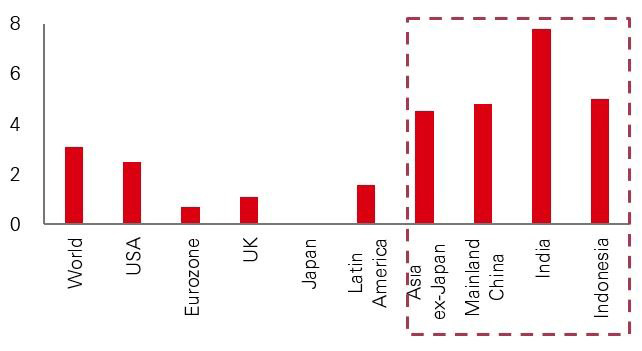

While Asia is exposed to a US/global growth slowdown, India, China and parts of ASEAN are likely to stay resilient as these are domestic demand-oriented economies, i.e. less dependent on external demand.

At the same time, Asia is investing more in itself, with China continuing to be an important partner for Asian countries. From an FDI perspective there is upside for these economies from the “friend shoring” phenomenon, being that Chinese companies might invest in third jurisdictions to mitigate geopolitical risks to supply chains. That being said, countries like Indonesia, Thailand, India and Korea have maintained geographic diversification of foreign capital inflows; Indonesia’s share of total foreign direct investment (FDI) from China, for instance, is 23 per cent while its share coming from ASEAN is 33 per cent.2 Within Asia, India stands out as the least China dependent economy – domestic demand in the country remains resilient amid external uncertainties and structural reforms have been key.

Fig. 1: India, China and parts of ASEAN less dependent on external demand

Contribution to real GDP growth, year-on-year (per cent); ppt

Note*: Calendar year for India. CN=Mainland China, HK=Hong Kong, KR=South Korea, TW=Taiwan, SG=Singapore, TH=Thailand, MY=Malaysia, ID=Indonesia, PH=Philippines, IN=India. Source: CEIC, HSBC Asset Management, August 2024.

Asia credit's resilience

Performance

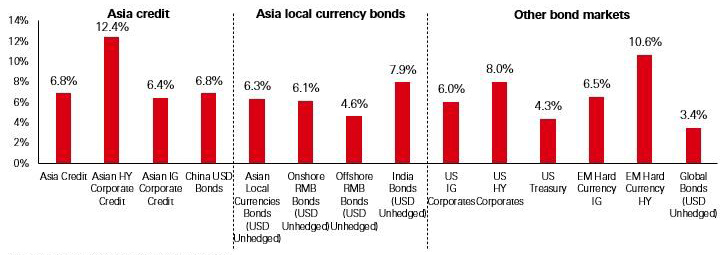

The Asia credit market has seen solid performance year-to-date and is generally outperforming other major bond markets. Asia high yield stands out as one of the best performing bond markets this year. The Asia local currency bond market is also seeing renewed interest, with particularly strong performance in the last three months.

Fig. 2: Asia bond markets' solid performance

Year-to-date performance (as of 19 Sep)

Bloomberg, JPMorgan, Markit, 19 September 2024.

Diversification

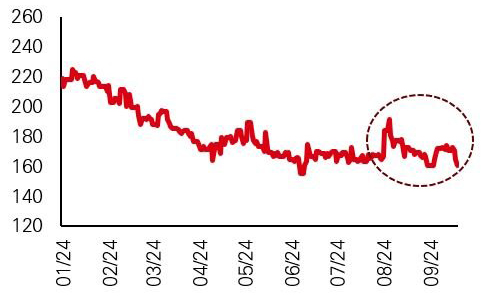

The market turmoil that swept through global markets in July and August perhaps re-emphasized the role that Asia bonds can play as a diversifier for global bond portfolios. During this July/August period, Asia credit spreads widened just modestly, and that move has reversed since (Fig. 3). Asian issuers also benefit from the region’s overall positive macroeconomic outlook, which stands apart from the fading growth momentum of developed economies, such as the US.

Fig. 3: Asia credit spreads

JACI spreads (bp)

Source: JPMorgan Asia Credit Index, 17 September 2024.

Fig. 4: Asia ex Japan GDP growth vs rest of world

2024 forecast GDP growth (per cent)

Source: Bloomberg forecasts, 19 September 2024.

Supply demand dynamics

Asia credit supply continues to be low, with USD130bn of gross supply being forecasted for the year and a negative net financing of USD107bn.3 As seen earlier, the solid performance of Asian local currency markets, the weakening US dollar and increasing strength of Asian currencies are contributing to the repayment capabilities of Asian companies, including dollar issuers. Their access to onshore local currency funding gives them the advantage of multiple sources of liquidity.

Meanwhile, Asia credit continues to be supported by healthy local demand, such as that from Chinese investors. Together this creates a favourable technical dynamic for Asia credit and should help with the resilience of the market.

Duration and yields

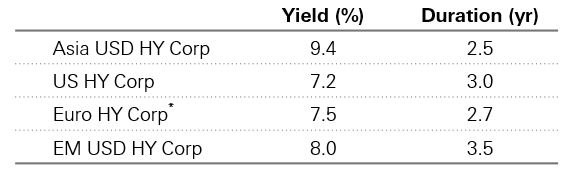

Asia USD bonds’ relatively low duration of only 2.5 years for high yield and 4.0 years for investment grade means that the asset class is less sensitive to spread movements versus comparative markets.

While there has been a downward move in global bond yields year-to-date, Asia credit’s yields continue to look compelling, not just relatively, but also historically in absolute terms, with current yields still above their 5-year historical average (Fig. 5 & 6).

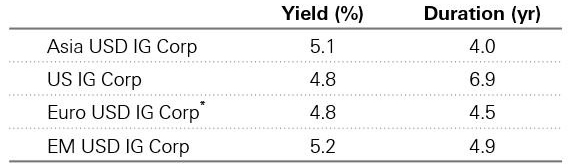

Fig. 5: Investment grade bonds yields and duration

Note*: Euro IG Corp yields listed are USD hedged.

Source: Bloomberg, JPMorgan, 19 September 2024

Fig. 6: High yield bonds yields and duration

Note*: Euro HY Corp yields listed are USD hedged.

Source: Bloomberg, JPMorgan, 19 September 2024

Asia investment grade markets continue to be relatively stable

Credit fundamentals for the Asia investment grade market remain intact, helped by the strong structural makeup of the investment grade universe, which consists of creditworthy business titans, national champions, state owned enterprises and quasi sovereigns.

In our HSBC Asia bond strategies, we see attractive opportunities in Mainland China TMT companies, which have strong balance sheets and cashflows. We prefer selective subordinated bank bonds. We also like many Indian and Indonesian issuers which have the tailwinds of participating in high growth economies.

Improvement in Asia high yield

A more diversified universe

The Asia high yield market's transformation over the last couple of years has led to increased diversification, with a much smaller weight in mainland China property, currently making up about 7.9 per cent of the universe, versus 38 per cent at the end of 2020.4 The universe now has a larger weight in fast growing companies, sectors and regions, including India and Indonesia. Meanwhile, China policymakers have stepped up action to stabilize the property sector, and we believe support will continue until there are clear signs of stabilization.

Moderating default rate

We believe that easy access to funding, strong balance sheets, a resilient economy, and an increasing strength in Asian currencies will enable the vast majority of Asian companies to repay their debts in the coming years.

Nearly all defaults expected for 2024 have already occurred, so that, according to our forecasts, the Asia high yield default rate could settle back to the very low levels as witnessed for many years before the China property crisis.

Investment opportunities

Within Asia high yield, we prefer Macau leisure which continues to recover, and India renewables which are much in demand both as investments and in terms of the service they provide. Indian cyclicals and Indonesian property enjoy the benefits of high growth, and frontier sovereign can provide additional alpha opportunities at current distressed levels. Our remaining exposure to mainland China property concentrates on the highest quality private sector participants.

Asia credit with HSBC Asset Management

Asia's favourable macro dynamics, China's ongoing policy support, and the global easing cycle continue to provide a positive environment for Asia bonds. We believe further volatility is possible in a global market challenged by US growth concerns and political uncertainties, but we are equipped to navigate market moves and any dips can present opportunities for our Asia bond strategies. We continue to emphasize fundamental research at HSBC Asset Management and aim to invest for the optimal balance of risk and reward in the investment opportunities we seek on behalf of our clients.

Source: Bloomberg, HSBC Asset Management, September 2024.

Note 1: Source is US Federal Reserve, 18 September 2024.

Note 2: Source is Citi, Haver, HSBC Asset Management, March 2024

Note 3: Source is JPMorgan, June 2024.

Note 4: Source is JPMorgan, HSBC Asset Management, August 2024.

This document provides a high level overview of the recent economic environment. It is for marketing purposes and does not constitute investment research, investment advice nor a recommendation to any reader of this content to buy or sell investments. This content has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination The views expressed were held at the time of preparation; are subject to change without notice and may not reflect the views expressed in other HSBC Group communications or strategies. You should be aware that the value of any investment can go down as well as up and investors may not get back the amount originally invested. Furthermore, any investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in established markets. Any performance information shown refers to the past and should not be seen as an indication of future returns. You should always consider seeking professional advice when thinking about undertaking any form of investment. This communication has not been reviewed by the Securities and Futures Commission.

Investment involves risks. Past performance does not predict future returns. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. For illustrative purposes only. Diversification does not ensure a profit or protect against loss. The level of yield is not guaranteed and may rise or fall in the future.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.