Breaking down duration: a useful concept for bond investors

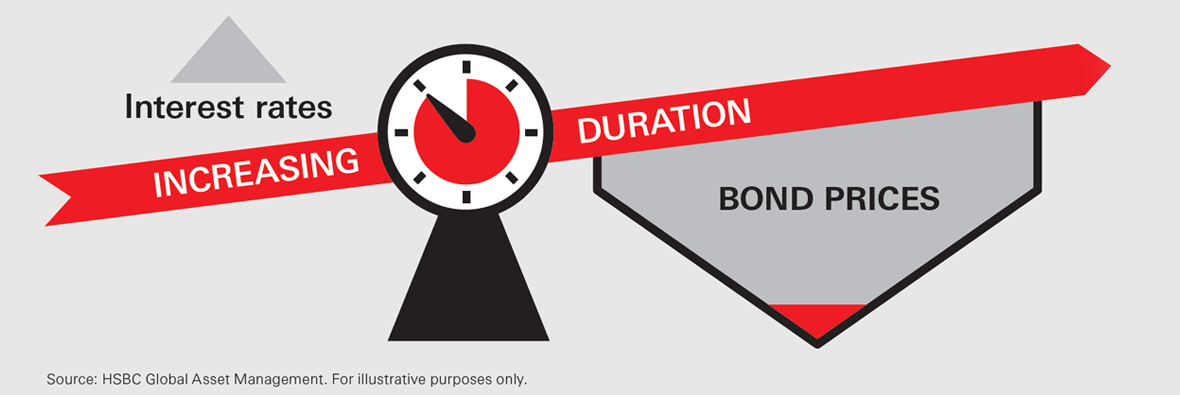

As bond prices and interest rates move in opposite directions, when interest rates rise, bond prices are likely to fall, and in contrast when interest rates decline, bond prices are likely to increase.

What is duration?

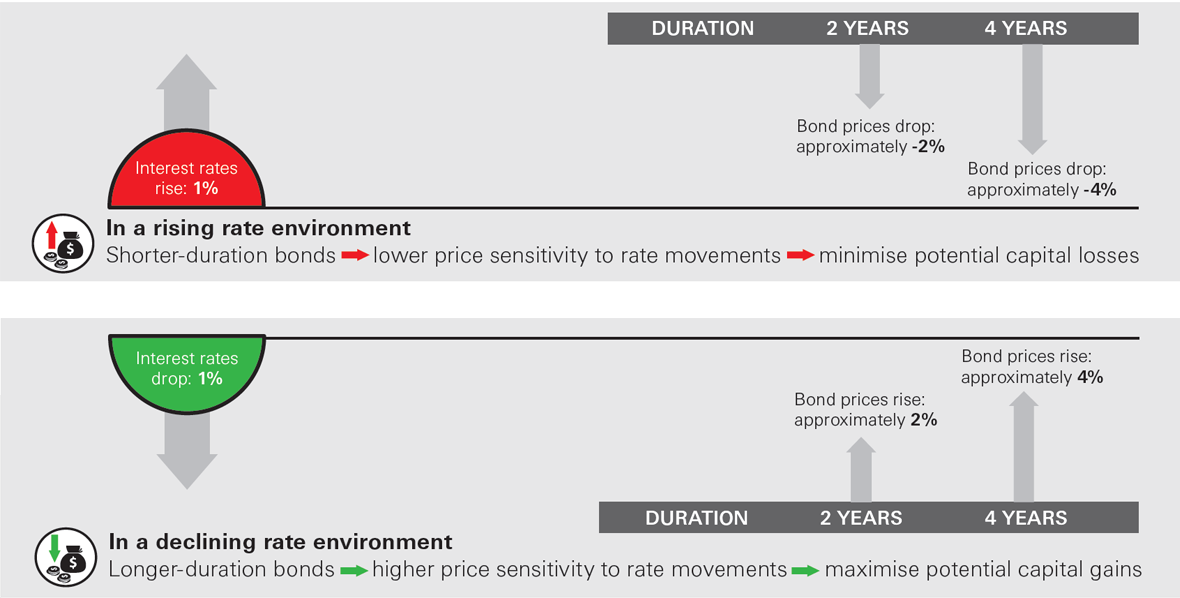

Duration, expressed in the unit of years, is an important and useful concept for bond investors as it measures the sensitivity of bond prices to interest rate movements. The longer a bond’s duration is, the more sensitive the bond’s price is to the interest rate changes.

A useful concept for bond investors

Many people tend to shun away from understanding bond duration because the underlying mathematics could be difficult. Fortunately for investors, to make good use of duration when investing in bonds, calculation is not needed if you understand the concept.

Duration examples

Source: HSBC Asset Management. For illustrative purposes only.

Given its usefulness, duration is a standard data point provided in most bond and bond fund materials.

Disclaimer

This page is prepared for general information purposes only and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive it. Any views and opinions expressed are subject to change without notice. This page does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management (Hong Kong) Limited (“AMHK”) accepts no liability for any failure to meet such forecast, projection or target. AMHK has based this page on information obtained from sources it reasonably believes to be reliable. However, AMHK does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This page has not been reviewed by the Securities and Futures Commission.

Copyright © HSBC Global Asset Management (Hong Kong) Limited 2024. All rights reserved. This page is issued by HSBC Global Asset Management (Hong Kong) Limited.