India bonds: index inclusion

Key takeaways

- On 21 September 2023, JPMorgan announced that it would be including 23 India government bonds with a total notional value of USD 330 billion in its emerging market indices, including EMBI, GBI-EM and CEMBI series

- The inclusion will occur over a period of 10 months from 28 June 2024 through to 31 March 2025 and could likely bring USD 20-22 billion of inflows into the India bond market

- The index weighting of India bonds is expected to reach a maximum weight of 10 per cent in GBI-EM Global Diversified Index

- Following this announcement, we could see a further rally in INR fixed income assets. We see an increasing likelihood of a potential upside for the INR in the coming months, amidst the expectation of broad USD softness and the Reserve Bank of India’s ample FX reserves

- India government bonds can provide global bond portfolios with important diversification benefits given their low correlation of only 0.10 with global government bonds

- India government bonds have meaningfully outperformed both emerging market and global government bonds in the last 5-year and 10-year periods .

India bonds’ inclusion in JPMorgan emerging market indices

What is happening?

- On 21 September 2023, JPMorgan announced that it would be including India government bonds in its emerging market indices, including EMBI, GBI-EM and CEMBI series

- The inclusion will occur over a period of 10 months from 28 June 2024 through to 31 March 2025, at the inclusion rate of about 1 per cent weight per month

What will change?

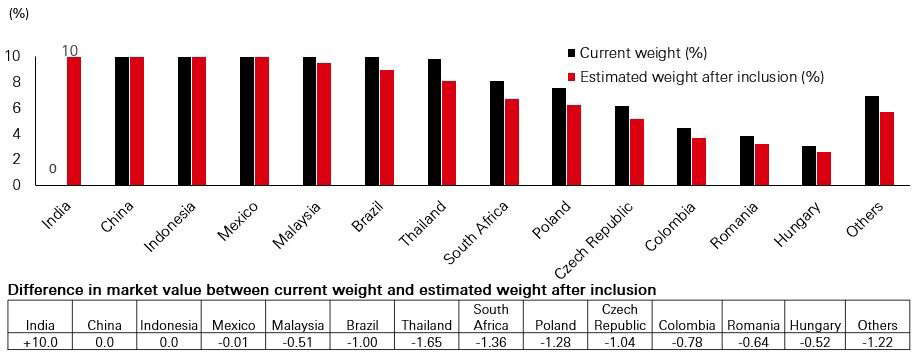

- The index weighting of India bonds is expected to reach a maximum weight of 10 per cent in GBI-EM Global Diversified Index, 8.7 per cent in the GBI-EM Global Index and 14.59 per cent in the GBI-EM Global Diversified IG 15 per cent Cap Index. Other indices will also see changes (see Figure 2)

- Some markets within the emerging market indices will see a reduction in index weight (see Figure 1)

What is eligible to be added?

- Starting on 28 June 2024, 23 Indian government bonds, worth a total notional value of USD 330 billion, will be eligible for index inclusion

- On 28 June 2024, FAR-designated1 Indian government bonds with a maturity date after 31 December 2026 would be assessed for index eligibility, while new eligible FAR-designated Indian government bonds issued during the inclusion period would also be included

Fig. 1: GBI-EM Global Diversified Index - weight projections after the end of India bond inclusion

Source: JPMorgan, 21 September 2023

Fig. 2: Weight projections of JPMorgan emerging market indices after the end of India bond inclusion

Source: JPMorgan, 21 September 2023

Impact of bond inclusion

- We could see a further rally in INR fixed income assets following the announcement by JPMorgan to add India government bonds into its widely tracked emerging market indices

- We have seen recent outperformance of FAR government bonds in the last couple of weeks as investors have been positioning for the inclusion announcement. Nevertheless, there should still be room for a moderate yield decline of government bonds given there is no change in the macro backdrop

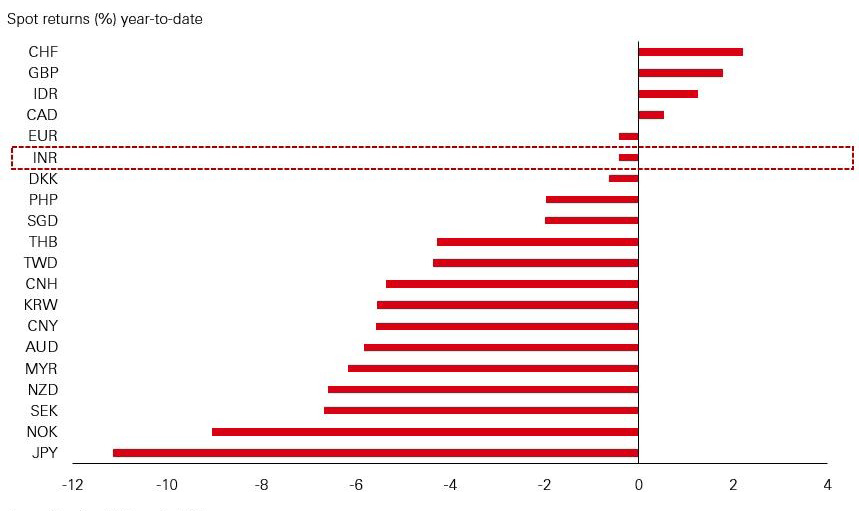

- We see an increasing likelihood of a potential upside for the INR in the coming months, with the expectation of broad USD softness and the central bank’s ample FX reserves, which is currently at USD 594 billion

- The INR should also have better support with the positive market sentiment arising from the index inclusion announcement

- INR internationalization should get a boost from index inclusion

- Over the longer term, we expect India bonds’ yield advantage to drive larger global allocations. India’s 10-year government bonds yield 7.2 per cent, while its US and China counterparts yield 4.5 per cent and 2.7 per cent respectively2

- Despite it being a large and liquid market, India bonds have not previously been added to any major global or emerging market indices. JPMorgan’s announcement marks a first. The inclusion period could likely bring USD 20-22 billion of inflows into the India bond market

- India bonds are also being considered for inclusion in other major indices, including in FTSE Emerging Markets Government Bond Index, where they are currently placed on the watch list

- We believe index inclusion is the right direction for the India bond market and yet another testament to the value the asset class brings to a global portfolio

Fig. 3: The Indian Rupee has performed decently against other G10 and Asian currencies

Source: JPMorgan, 21 September 2023

Diversification benefits of India bonds

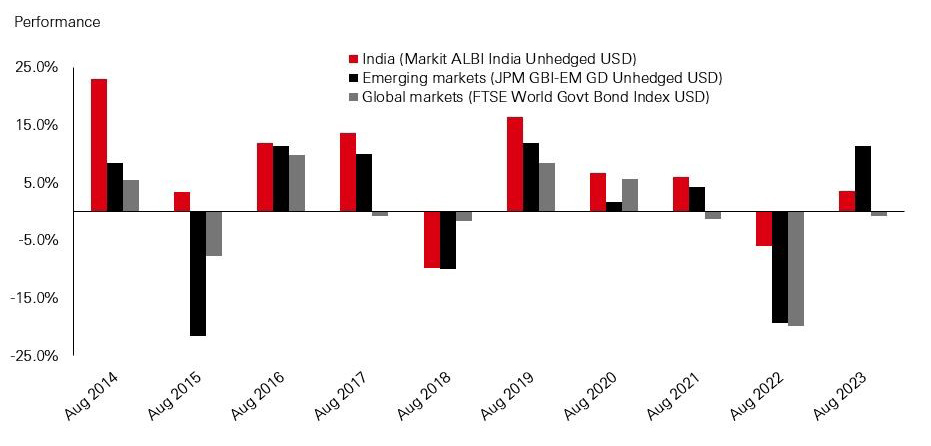

- India government bonds, as measured by the Markit ALBI India Unhedged USD Index, have largely outperformed both emerging market government bonds (JPM GBI-EM Global Diversified Unhedged USD) as well as global government bonds (FTSE WGBI USD)

- Correlation between India bonds and global bonds over the last 5 years has been low at only 0.15 and even lower over the last 10 years at only 0.10, strengthening the case for India bonds as a diversifier for global portfolios3

- Correlation between India bonds and emerging market bonds over the last 10 years is 0.293

Fig. 4: India government bonds have largely outperformed both emerging market and global government bonds

JPM GBI-EM GD Unhedged USD refers to JPM GBI-EM Global Diversified Unhedged USD Index. Source: Markit, JPMorgan, FTSE, 21 September 2023

Note 1: FAR refers to Fully Accessible Route, introduced in 2020, whereby Foreign Portfolio Investor (FPI) limits are not imposed on certain government securities.

Note 2: Source is Bloomberg as of 21 September 2023.

Note 3: Source is Markit,, JPMorgan, FTSE, 31 August 2023

Source: HSBC Asset Management, JPMorgan, Bloomberg, September 2023.

The information contained in this publication is not intended as investment advice or recommendation. Non contractual document. This commentary provides a high level overview of the recent economic environment, and is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. The performance figures displayed in the document relate to the past and past performance should not be seen as an indication of future returns. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Investment involves risks. Past performance is not indicative of future performance. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. For illustrative purposes only.

Important information

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries in which they trade. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity.

We accept no responsibility for the accuracy and/or completeness of any third party information obtained from sources we believe to be reliable but which have not been independently verified.

Investment involves risk. Past performance is not indicative of future performance. Please refer to the offering document for further details including the risk factors. This document has not been reviewed by the Securities and Futures Commission.

HSBC Asset Management is the brand name for the asset management business of HSBC Group. The above communication is distributed in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited.

This document should not be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is purely for marketing purposes. This document is not a contractually binding document nor are we required to provide this to you by any legislative provision.

Copyright © HSBC Global Asset Management (Hong Kong) Limited 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management (Hong Kong) Limited.